OIL & GAS: USA 1, OPEC 0

OPEC doesn’t stand a chance.

Since most OPEC nations can pump all the oil and gas they need using first- or second-generation technology, they fail to understand the role of technology in bringing down oil prices. The point, when investing in energy companies, is not to ask merely, “Is the price of oil up or down?” When investing, we are seeking firms that can grow their revenues and their earnings, thus increasing their intrinsic value, through good times and bad. So the more important question to answer is “At what point can company A or country X make a reasonable return so that its earnings grow at whatever the current price of oil is?”

Answering that question for individual companies like those in America, Canada, Australia and much of Europe and the rest of the world involves determining the price the company receives for its efforts, and beyond that, what its costs are to service its debt, pay its employees, upgrade equipment, etc. For these independent companies, once they have satisfied their creditors and employees, the rest is effectively divided among its shareholders via dividends, buybacks or an increasing stock price.

For perspective on this flexibility, I recently saw a report from the state of North Dakota (now the biggest top oil-producing state) that said the average cost to produce a barrel of oil there is about $38.50. So companies there, on average, can make 10% return at just $42 a barrel.

But for OPEC nations, which typically have no private companies in the energy business but rather just one state-owned monolith, the answer is very different. These behemoths exist to provide revenue for the massive welfare states the rulers of these nations have created, most often as a way to keep their grip on power, pay the military and police to enforce their rules, lavish largess upon their cronies, and provide food, fuel and other subsidies to their restive subjects in order to keep them in line.

What this means is that OPEC nations might be able to “pump” oil at a lower price but the price they need to stay in power far exceeds what independent oil and gas companies need to pay their bills and keep their shareholders happy. Add to this OPEC / Saudi burden the fact that every year U.S. technology improves and lowers our cost of finding and producing oil and gas and adds substantially to our reserve position. This is a tsunami OPEC cannot hold back.

As investors, we need to stop obsessing over the price of crude and determine instead the price at which our independent oil companies can produce oil, make a profit for their shareholders, and still cost less than the “total” cost OPEC nations need in order to hold their anachronistic cartel (and often their anachronistic regimes) together.

From a USA-centric geopolitical standpoint, cheap oil and gas is a Very Good Thing! America doesn’t have a national oil company on which the government depends for massive welfare programs or make-work jobs to keep people from rioting in the streets.

If oil and gas decline to the point where some of our companies can’t make money, they shut down their operations, sell their leases at fire sale prices and, worst case, declare bankruptcy. This will not make their shareholders or their workers happy, but the worst macro effect is that many good workers will become unemployed. In terms of production, however, the remaining hundreds of oil and gas companies will simply pick up the slack. That isn’t the case with OPEC producers.

In the depths of the real-estate-bubble-cheap-credit-Wall-Street-banks-induced recession of 2008, I wrote that American workers manufacture more than 20% of all factory goods sold worldwide. America is still the world leader in “making things.” Which nation on earth produces more food and farm equipment than any other? Which produces the most chemicals and pharmaceuticals? How are we doing in shipbuilding, skyscrapers, and big-ticket items like airplanes and power generation equipment? How about mining and energy extraction equipment? Or telecommunications equipment, semiconductors, metals, or plastics?

The US is the world’s biggest manufacturer for good reason: we reward entrepreneurs and offer the greatest likelihood of a stable nation with the least likelihood of asset confiscation. Companies pay more for American labor but what they get are people who are more productive than most anywhere else in the world.

Remember, too, it costs big bucks to ship big products over long distances. Why produce wind turbine blades in China if you’re going to use them in Texas? Whatever you may have saved in labor, you’ll pay in transportation costs. The heavier the item, or the more perishable, the smarter you are to manufacture it where 300 million people who need actually live.

In addition to U.S. manufacturers benefiting from cheaper energy, U.S. service firms and U.S. consumers benefit, too. Is there a more mobile nation anywhere on earth? Service firms like Amazon (NASDAQ:AMZN) ship roughly 1.7 gazillion items per day. United Parcel Service Inc (NYSE:UPS) and FedEx (NYSE:FDX) aren’t the only beneficiaries. Cheap gasoline lets Americans travel freely hither and yon and keeps salespeople on the road and families not thinking twice about driving to the mall or to McDonald's (NYSE:MCD) On the other hand…

The very nations that have proven to be our most consistent and intractable adversaries depend hugely on oil and gas revenue!

I will be the first to say that I did not expect to see the flash crash we endured in energy on Black (for oil) November 28. But I believe that knee-jerk reaction was overdone and certainly not worth selling into at this point. It isn’t as if OPEC said, “We’re going to open the spigots to drive the U.S. shale operators into bankruptcy.” All they said was, “We’re going to maintain current production.”

Well, guess what? At the status quo “current production” levels, the world is slightly out of balance with demand about 3% less than supply. This means oil & gas companies will have to tighten their belts and become more efficient. All will review their current exploration schedule and likely cut back in the short term. It may not be a fun time for the drillers that depend upon new exploration or the service firms that service these new rigs and platforms. But drive U.S. firms to their knees? Not going to happen. Oil and gas would have to fall below $40 and stay there for that to happen.

Natural gas already plunged to the bottom and U.S. natural gas producers are still standing. What makes anyone believe it will be any different for the oil companies?

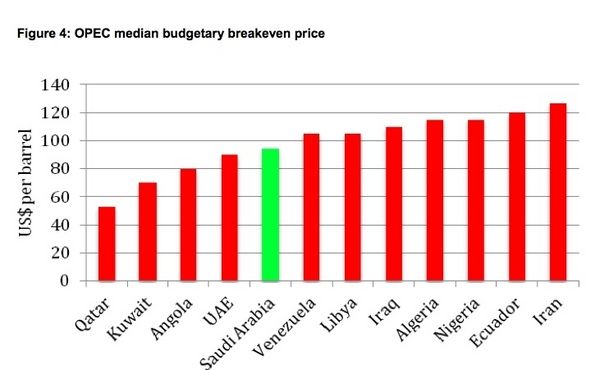

As this chart makes abundantly clear, however, the same cannot be said for the aforementioned adversaries:

Source: Matthew Hulbert, European Energy Review (as of 2012)

This single chart tells the geopolitical story in a nutshell. I believe it is the single most important chart we need to refer to in order to answer the questions, “How low can oil go?” and “Who will blink first?” I conclude that OPEC has played their hand very poorly and made inaccurate assumptions regarding all-in costs, national interests, and the role of technology in lowering extraction costs.

Too many investment analysts look solely at the “economic” side of the oil business. This leads them to conclude that Saudi Arabia and its Mideast neighbors enjoy a compelling cost advantage over U.S. and European producers. They note that Saudi crude is the cheapest to extract in the world. Including CapEx, Saudi Arabia can get oil out of the ground at somewhere between $5 and $7 a barrel. Iraq can do it for a couple of dollars more and the UAE can produce for around $10 a barrel. All true as far as it goes.

But geopolitics will always trump economics. OPEC nations must get x dollars over the cost of production. They have massive imbedded programs of subsidized energy, free higher education (without providing the jobs which those graduates expected,) no taxes and lots of free goodies. They dare not now dismantle these for fear of rioting in the streets, massive recruitment by terrorist groups, and losing their thrones. Qatar and Kuwait can break-even or make a profit at current prices, but the rest cannot. (Mexico, Norway and many U.S. and European multinationals are profitable here as well, with Canadian firms all over the board — light crude producers with no CapEx to pay off are fine at $40; oil sands producers need about $80 over a full year.)

To maintain their tenuous grip on power once they run through their reserve dollars, with 90% of the Saudi budget reliant on oil sales, the rulers of Saudi Arabia actually need more than $90 per barrel of oil, not the $5 - $7 it costs to pump the oil itself! Venezuela, Libya, Iraq, Algeria, Nigeria, and Ecuador all need between $100 and $120 a barrel (as does Russia) while Iran needs oil at $120.

OPEC is whistling past their own graveyard. Their level of naïveté dooms them. Here is Venezuela’s foreign minister Rafael Ramirez at the conclusion of the OPEC meeting:

“Shale oil is a disaster as a method of production, the fracking. But also it is too expensive. And there we are going to see what will happen with production.”

Believe your own propaganda if you like, Mr. Ramirez, but the cost of shale energy declines every quarter. The political cost of not facing reality for you rises every day.

What to Buy and What to Keep

We bought energy stocks as they were declining. With the silly certainty of hindsight, we clearly bought too soon. So what to do now? The discipline we have imposed upon ourselves is to never allow any one sector to comprise more than 15% of any client’s portfolio. This forces us to select the best sectors, to diversify by geography and capitalization, and to select mutual funds and ETFs that invest broadly across all sectors.

This self-imposed discipline means that we cannot now buy additional shares, salivate as I might at what I consider delightful entry points, unless we sell something else. Rather than panic at today’s cyclical lows, we will hold virtually everything we own and have suggested for your research and due diligence.

The only thing we are doing today is exchanging a minority percentage of the firms that are more vulnerable in the short term to declining or stagnant earnings, like some drillers and service firms, for the big integrated oil companies. The big integrated oils don’t have to drill new wells like Seadrill (NYSE:SDRL) or Transocean (NYSE:RIG), or sell servicing equipment and supplies, like Carbo Ceramics (NYSE:CRR) does. There’s a reason the big guys consistently choose to outsource these functions; if push comes to shove, they simply maintain the equipment they have in place and pump whatever amount of oil and gas they are willing to sell at current prices until the clouds have passed. There is no existential threat to their existence, only a period of depressed earnings.

If you are well under your own threshold of energy sector ownership, you may not want to make any changes at all. Given that we are bumping against the 15% limit for our family portfolios and some clients, we will be doing some selective exchanges, taking tax losses on some issues while positioning in the bigger, more flexible firms at much lower prices than we could buy them for last month or last week.

The reason we are making only incremental change is we aren’t talking about dot.com.bomb type stocks a la 2000. Even the drillers and niche product providers that may take a quarter or two ding to their earnings are still companies that will survive and sustain roughly their current pricing in a constrained oil price market. And they will once again thrive in a more normal oil price market. Plus, to panic sell today means that we would miss the result of any geopolitical event that moves oil up rapidly.

Will Iraq self-devolve into civil war? Will Venezuela have to stop exporting to subsidize the home market to prevent a collapse of the government? Will Iran see more sanctions on its oil export capability? Will OPEC blink? Or will investors simply deem 5% yields and PEs of 6 and 7 to represent likely future value? No one knows. But it is the nature of supply and demand to seek homeostasis. The price of oil has fluctuated between $20 and $120 since 2000. Yet, through it all, while a few wildcatters failed, the best of the oil companies hung in there and emerged stronger from every pullback.

We will be judicious in our exchanges. By owning energy firms, we own the companies that literally lubricate the global economy -- and most are under 10 x earnings. We have to stay within our 10-15% allocation, which means *we* (but not necessarily you) will have to sell a little RIG, SDRL and CRR to buy some of the 4 below that are now in our buy range.

We will keep our iShares U.S. Energy ETF (NYSE:IYE) and Energy Select Sector ETF (ARCA:XLE). As market cap weighted ETFs, their top holdings, Exxon (NYSE:XOM), Chevron (NYSE:CVX), Schlumberger (NYSE:SLB), Conoco (NYSE:COP) and Occidental Pete NYSE:OXY) comprise roughly half the portfolios. We’ll keep our Market Vectors Oil Services (ARCA:OIH), 2 of the 3 largest components of which are SLB and National Oilwell Varco (NYSE:NOV). With prices this low, SLB, NOV and others of their size and quality may well be looking to upgrade their offerings by buying firms that can’t go on as independents.

Of the firms now in our buy range to exchange into, we include Ecopetrol (NYSE:EC) and top quality Helmerich & Payne (NYSE:HP). In addition, we can buy Suncor (NYSE:SU), Canada’s biggest energy company and BP (NYSE:BP). Of the big integrated oils, BP looks best to me right now. Here’s a brief vignette on what most attracts me to the above companies:

- EC has no debt. None. We don’t have to worry about them not being able to service their debt. At its current price, it’s off 50% for the year, sells at a PE of 7.6, a PB of 1.2, and a Graham # of 0.64. Like many foreign firms, it only pays annually, but its last dividend provided a yield of 11%. The only negative is one I believe is way overblown. The FARC as well as an indigenous tribe have objected to EC’s pipelines crossing “their” territory. They have expressed their indignation by blowing up the pipeline. EC just rebuilds it (with government help). I was in Colombia last year and, even then, the FARC’s antics were wearing thin. If the government stops playing pat-a-cake with them and sends in the troops, I think EC will soar.

- As Tina Turner might sing, HP is “Simply the Best.” When contract drillers grow up, they want to be HP. It sells at a PE of 10.6, a PB of 1.5, and has a Graham # of 0.85. (As a reminder, the Graham # is, in homage to Ben Graham, a measure of intrinsic valuation. A number less than 1 gets my attention…) HP pays just under 4%, but has a history of increasing the dividend regularly, like other dividend aristocrats. I hate that we bought too early on some bargain prices that became even bigger bargains, but I appreciate that we can now switch to companies we can truly put away for years.

- SU is getting dinged because it has a large position in the expensive-to-process Canadian oil sands. True, but it also has refining, midstream and downstream operations that are still humming just fine. What many investors don’t realize is that lots of oil companies are also in the chemicals business and cheaper feedstocks are better for that business. SU sells for a PE of 17 and a PB of 1.25, higher than my other quality firms. And its Graham number is a skosh higher, too, at 1.02. It is Canada’s Big Oil, though (followed closely by another favorite of ours, Imperial Oil—IMO). As such, I believe it will rebound more quickly than most others.

BP, XOM, CVX, Total SA (NYSE:TOT), Royal Dutch Shell A (MX:RDSA), OXY and COP… These have historically been the companies that have resisted oil price declines best (as will the capitalization-weighted ETFs like IYE and XLE that are heavy with these Big Oils.)

There’s a reason. Drillers have to rent their rigs and platforms to make money. Equipment manufacturers have to sell equipment to make money. But the biggest firms are diversified enough to make their profits on chemicals, plastics, retail gas stations, propane, etc. when they need to tide themselves over a rough patch. It doesn’t make them immune; it does make them more resilient.

Of this group, I select BP as our Big Oil of choice. It has lots of cash (roughly double what it would pay out if every real and spurious / fraudulent claim was paid for as with the Deepwater Horizon accident). It sells at a PE of 16, a PB of 0.99, and a Graham # of 0.97.

T Boone Pickens, who has made a dime or two in the oil business consistently for the past half-century, just predicted oil will be at $100 within 12-18 months. I don’t predicate any of our holds or buys on the return of $100 oil -- but neither would I mind if Mr. Pickens is right once again!

The Fine Print: As Registered Investment Advisors, we believe it is our responsibility to advise that we do not know your personal financial situation, so the information contained in this communiqué represents the opinions of the staff of Stanford Wealth Management, and should not be construed as personalized investment advice.

Past performance is no guarantee of future results, rather an obvious statement but clearly too often unheeded judging by the number of investors who buy the current #1 mutual fund one year only to watch it plummet the following year.

We encourage you to do your own due diligence on issues we discuss to see if they might be of value in your own investing. We take our responsibility to offer intelligent commentary seriously, but it should not be assumed that investing in any securities we are investing in will always be profitable. We do our best to get it right, and we "eat our own cooking," but we could be wrong, hence our full disclosure as to whether we own or are buying the investments we write about.