Technology is the strongest equity sector to date in 2023, but how you define tech matters for evaluating performance, risk and other factors. That’s tougher than it sounds because there are more than 90 ETFs in this space, according to ETFdb.com.

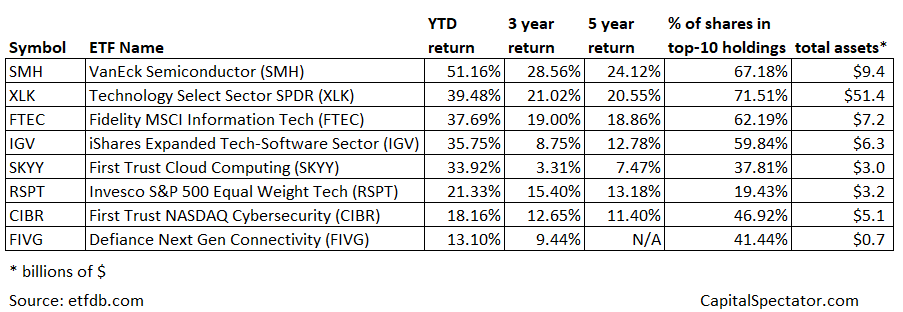

For some perspective on the choices available and how results vary, CapitalSpectator.com zooms in on ten of the largest ETFs in the tech sector. The data source is ETFdb.com — you can find the full list here. As a first look, here’s a subset of funds selected from the 25-largest (based on assets under management). The table below attempts to minimize overlap by listing one fund for any given focus within tech. For example, there’s only one semiconductor industry ETF listed.

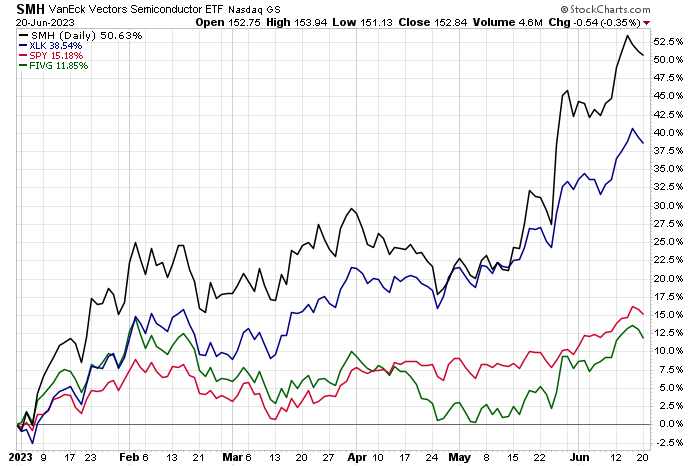

The main takeaway: tech ETFs vary on multiple dimensions, including performance, holdings, and risk. For example, the table above sorts funds by year-to-date return, which ranges from the top-performing VanEck Semiconductor ETF (NASDAQ:SMH) — up more than 50% so far in 2023 — to the relatively modest 13% year-to-gain for Defiance 5G Next Gen Connectivity ETF (NYSE:FIVG). Note, too, that the degree of concentration in the top-10 holdings varies substantially, from more than 70% for XLK to under 20% for the equal-weighted tech fund RSPT.

The benchmark for these funds is arguably Technology Select Sector Fund (NYSE:XLK), which is ahead by more than 39% this year. That compares with a 15% gain for US equities overall via SPDR® S&P 500 (NYSE:SPY).

As the variety of results in the funds above suggest, the decision on how (or if) to select industries within the broader tech space can have far-reaching consequences for investment returns and risk.

There’s also the macro factor to consider at the moment, namely: bubble risk. Debate rages on whether the current run for tech is highly speculative. It’s easy to find believers who think that artificial intelligence (AI), which is fueling this year’s tech rally, is the next big thing.

“Recent developments in generative AI herald a sea change,” analysts at Bank of America wrote earlier this month.

But Jason Pride, chief of investment strategy and research at Glenmede, a Philadelphia-based wealth management firm, is wary.

“I haven’t seen a technology cycle yet in my career in which the initial run-up isn’t more filled with hype and hope than the longer-term prospects.”