Gold: Investors Are Booking Profits On Brexit-Driven Gains

- Two rating agencies on Monday downgraded their ratings for the UK government debt. Standard & Poor's had rated the UK at its highest rating of AAA, but on Monday afternoon after financial markets had closed it downgraded the rating by two notches to AA. Only a few hours later a second rating agency, Fitch, downgraded the UK from AA+ to AA. The third major rating agency, Moody's, had already downgraded its rating on UK government debt on Friday, from Aa1 with a stable rating to Aa1 with a negative rating.

- European Central Bank President Mario Draghi said central banks around the world should align their monetary policies to help prevent "destabilising spillovers" between economies growing at different paces.

- Draghi did not make any reference to Britain's vote to leave the European Union last week, which has rocked global markets and put a question mark over the future on the EU. Instead, he focused on the adverse effects of diverging monetary policies among different countries, citing large fluctuations in exchange rates and swings in the flow of capital, particularly in emerging economies.

- Draghi also called for alignment among other areas of economic policy, saying the implementation of a pledge by the world's 20 largest economies to boost global growth had been "disappointing".

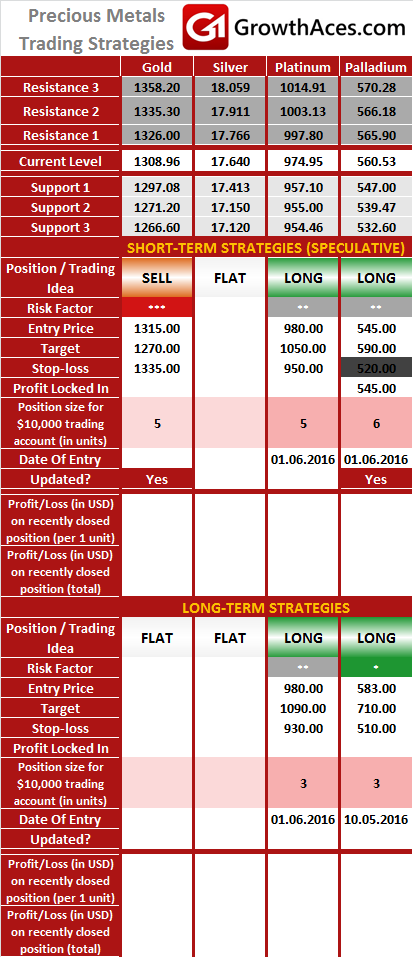

- Gold fell on Tuesday as investors booked profits, two days after the yellow metal rallied to its highest since March 2014 thanks to safe-haven demand. Losses in the wider markets reversed on Tuesday, with European shares up after a three-day fall on hopes of a more co-ordinated central bank response to financial market losses.

- We think gold is likely to fall below USD 1,300 an ounce in the coming days. But we will be looking to get long again near 1,250 for long-term gains to 1,375-1,400.

USD/CAD: Loonie Rebounds On Rising Oil Prices

- Britain's vote to leave the European Union sent global stocks and currencies spiraling down, but commodity currencies losses were relatively limited. The USD/CAD is back below 1.3000 today and the fall is driven by rising oil prices.

- A looming strike at several Norwegian oil and gas fields threatened to cut output in western Europe's biggest producer, helped support oil prices today. A strike in Norway, which could start this Saturday, would add to a number of production outages in oil producing countries including Nigeria and Libya in recent weeks.

- We keep our USD/CAD short unchanged.

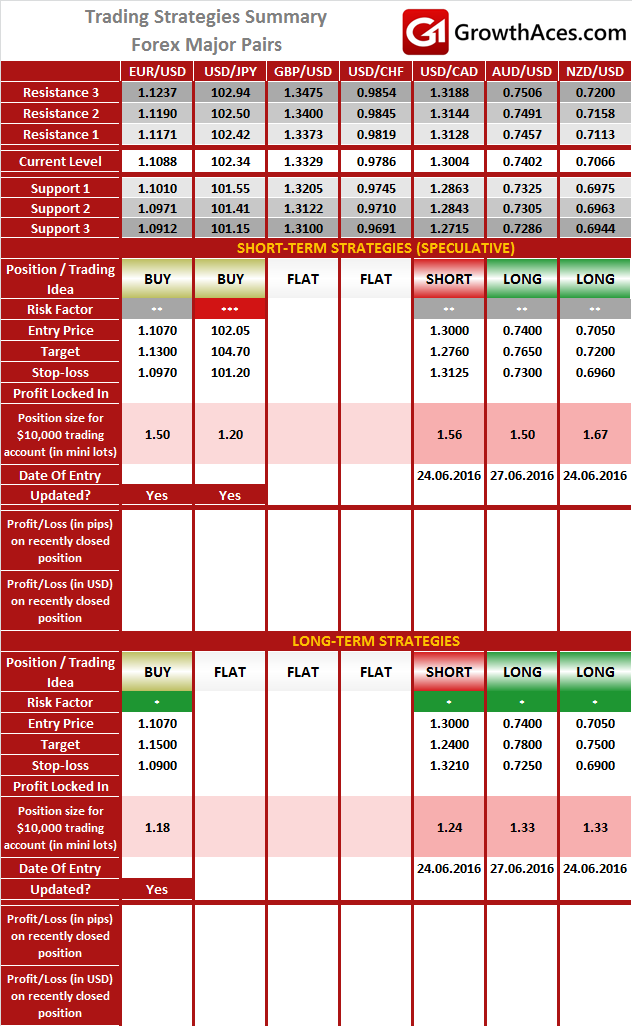

FOREX - MAJOR PAIRS:

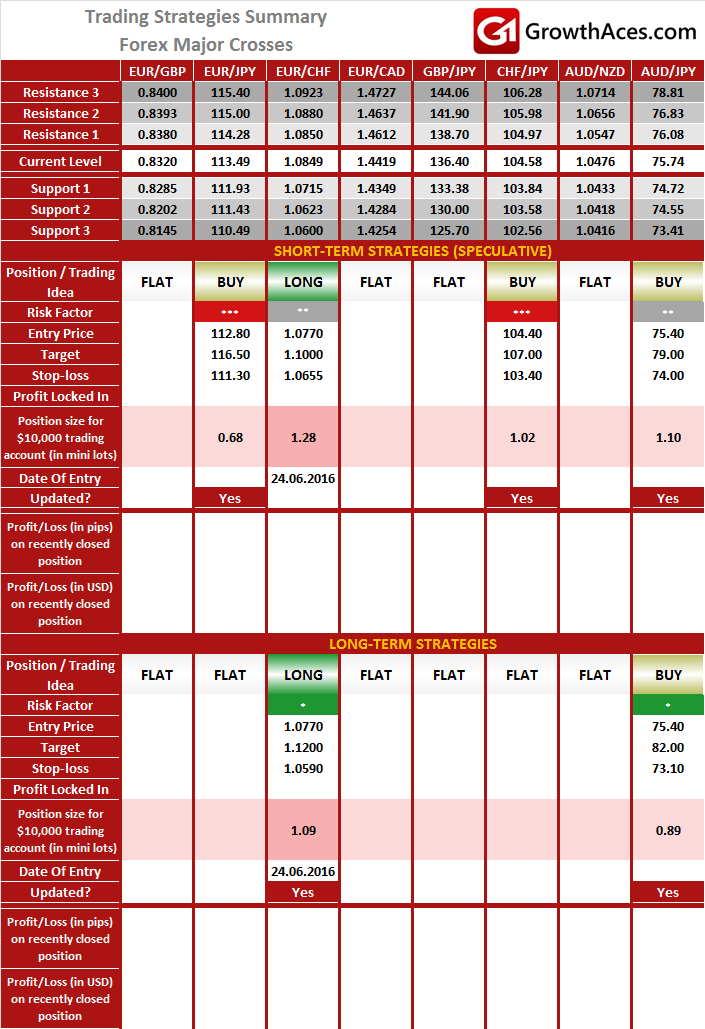

FOREX - MAJOR CROSSES:

PRECIOUS METALS:

It is usually reasonable to divide your portfolio into two parts: the core investment part and the satellite speculative part. The core part is the one you would want to make profit with in the long term thanks to the long-term trend in price changes. Such an approach is a clear investment as you are bound to keep your position opened for a considerable amount of time in order to realize the profit. The speculative part is quite the contrary. You would open a speculative position with short-term gains in your mind and with the awareness that even though potentially more profitable than investments, speculation is also way more risky. In typical circumstances investments should account for 60-90% of your portfolio, the rest being speculative positions. This way, you may enjoy a possibly higher rate of return than in the case of putting all of your money into investment positions and at the same time you may not have to be afraid of severe losses in the short-term.

How to read these tables?

1. Support/Resistance - three closest important support/resistance levels

2. Position/Trading Idea:

BUY/SELL - It means we are looking to open LONG/SHORT position at the Entry Price. If the order is filled we will set the suggested Target and Stop-loss level.

LONG/SHORT - It means we have already taken this position at the Entry Price and expect the rate to go up/down to the Target level.

3. Stop-Loss/Profit Locked In - Sometimes we move the stop-loss level above (in case of LONG) or below (in case of SHORT) the Entry price. This means that we have locked in profit on this position.

4. Risk Factor - green "*" means high level of confidence (low level of uncertainty), grey "**" means medium level of confidence, red "***" means low level of confidence (high level of uncertainty)

5. Position Size (forex)- position size suggested for a USD 10,000 trading account in mini lots. You can calculate your position size as follows: (your account size in USD / USD 10,000) * (our position size). You should always round the result down. For example, if the result was 2.671, your position size should be 2 mini lots. This would be a great tool for your risk management!

Position size (precious metals) - position size suggested for a USD 10,000 trading account in units. You can calculate your position size as follows: (your account size in USD / USD 10,000) * (our position size).

6. Profit/Loss on recently closed position (forex) - is the amount of pips we have earned/lost on recently closed position. The amount in USD is calculated on the assumption of suggested position size for USD 10,000 trading account.

Profit/Loss on recently closed position (precious metals) - is profit/loss we have earned/lost per unit on recently closed position. The amount in USD is calculated on the assumption of suggested position size for USD 10,000 trading account.

Source: Growth Aces - Forex And Precious Metals Trading Signals