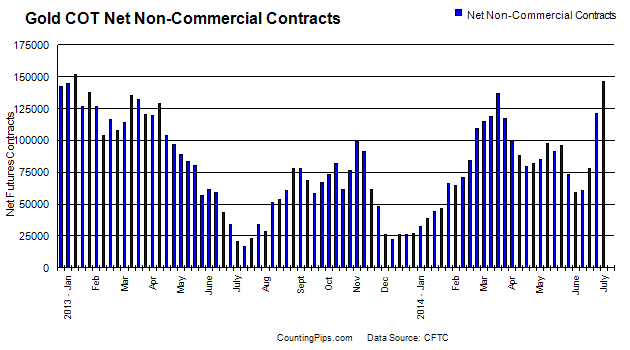

Speculator Positions at highest level since January 2013

Gold: Gold market futures speculators continued to raise their overall bullish bets in the gold futures market for a fourth consecutive week last week and pushed bullish bets to the highest level in over a year, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

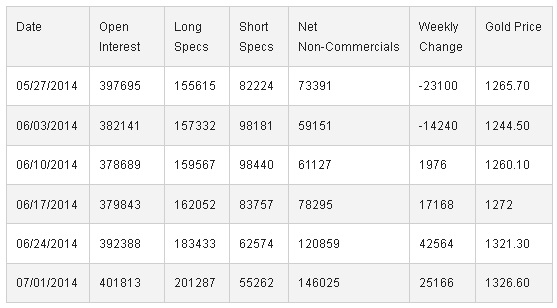

The non-commercial futures contracts of Comex gold futures, traded by large speculators and hedge funds, totaled a net position of +146,025 contracts in the data reported through July 1st. This was a weekly change of +25,166 contracts from the previous week’s total of +120,859 net contracts that was registered on June 24th.

The rise in the net bullish speculator positions (+25,166) last week was due to a strong increase in bullish positions by 17,854 contracts while the bearish positions or the number of traders betting on a decline in gold futures fell by 7,312 contracts.

The overall bullish standing is now at the highest level since January 22, 2013 when net bullish positions equaled 151,897 contracts.

Over the weekly same reporting time-frame, from Tuesday June 24th to Tuesday July 1st, the gold price advanced for a fourth week from approximately $1,321.30 to $1,326.60 per ounce, according to gold futures price data from investing.com.

Last 6 Weeks of Large Trader Non-Commercial Positions

Disclaimer: The weekly commitment of traders report summarizes the total trader positions for open contracts in the futures trading markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).