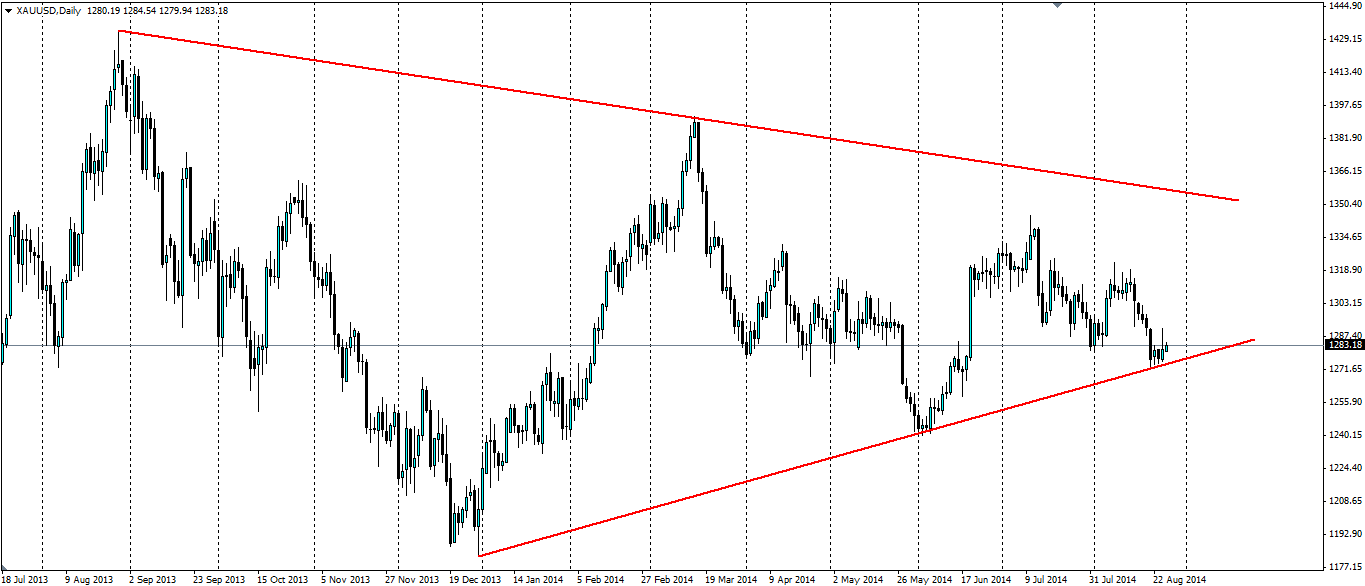

Gold has found itself along the bottom line of a rather large triangle and bullish gold traders will be salivating over the prospect of a bounce towards the upper line.

Gold has made some big movements over the past year and the triangle that has formed on the daily chart is a staggering $250 wide. In that time we have seen the US Fed begin tapering of the enormous Quantitative Easing programme and Russia annex part of Ukraine and subsequently a war break out between Ukraine and Russian backed rebels. These two events are completely separate but underline what drives gold markets.

The first, tapering, sent the gold markets spiralling downwards because it represents the first step towards higher exchange rates, which increase the opportunity cost of holding gold as a store of wealth. More recently, positive jobs data, such as Non-farm Payroll and Unemployment Claims data are adding to the downward movements of gold because the Fed has placed an emphasis on the recovery of labour markets when deciding the timing of interest rate increases. Once the timing is announced, gold will take a hit and the bears will have a field day.

The second major even impacting gold markets has been the situation in Ukraine. Or to put it more broadly: global risks. Gold acts as a safety asset in times of turmoil and the tensions in Ukraine is what drove gold higher at the beginning of the year. The issues in Ukraine have not been resolved and there are problems in Iraq and Syria that could easily send investors back into gold markets at any stage.

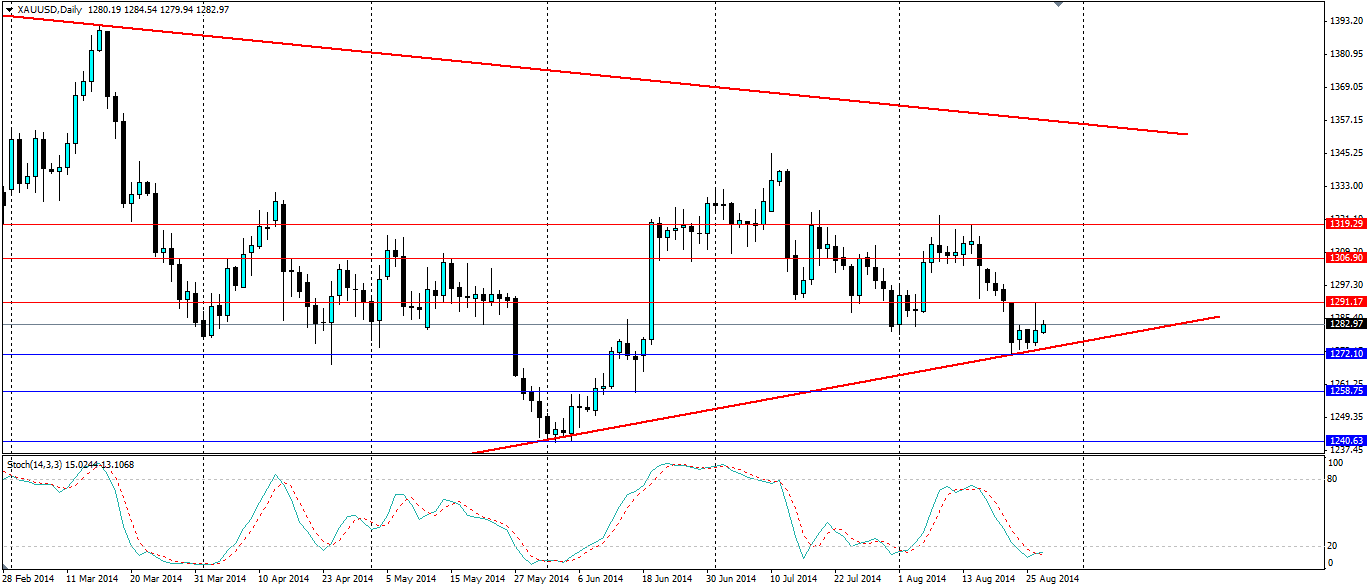

An increase in global tensions could be the catalyst for a breakdown of current resistance that is preventing the price from pulling back from the trend line. There is heavy resistance at the current level around 1283.00 with a big rejecting back down after the price pushed through it yesterday. Further resistance can be found at 1291.17, 1306.90 and 1319.29. The support found on the trend line is likely to be stronger given the number of times it has been tested already.

The Stochastic Oscillator has just crossed over %D line, however, is still showing oversold conditions. The cross over itself is a decent enough buy signal, however, a rise out of the oversold level may be a more robust trigger as this could attract the bulls and a drive higher could result.

Gold is currently on the bottom edge of a large triangle and indicators point to a possible bounce off the trend line. Any escalation in global tensions will pile on the bullish sentiment.