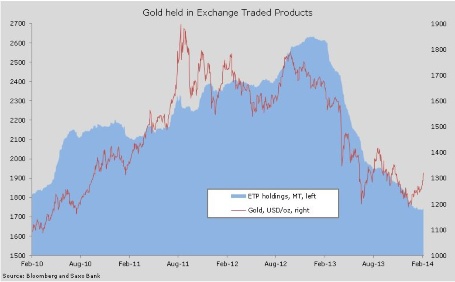

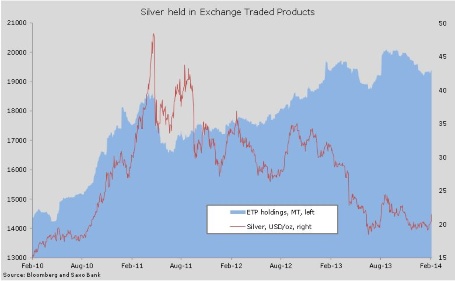

The rally in gold since the start of the year shifted up a gear last week when some key technical levels were broken. This resulted in the price reaching a three-month high and it lifted total holdings in exchange traded products for gold by 3.2 tons, the biggest weekly increase since December 2012. Holdings in silver, which rallied more than 7 percent last week, jumped by 104.2 tons.

With two weeks gone, February could be on track to show the first monthly increase in ETP holdings since December 2012 as many investors who left the market last year may be tempted to get involved once again. The fact that we have not seen a bigger jump yet in ETP holdings despite the near 10 percent rally so far this year has much to do with the sharp sell-off witnessed last year.

Many new investors, both private and institutional, had been getting involved with gold during the final stage of the bull market and the sell-off last year triggered an exodus and return to bonds and stocks. For many of these investors to return there has to be a compelling long-term supporting case for gold and with the recent emerging-market turmoil, weaker US economic data and continued uncertainty about the health of the Chinese economy some may just have found enough reasons to get back in although so far only on a limited scale.