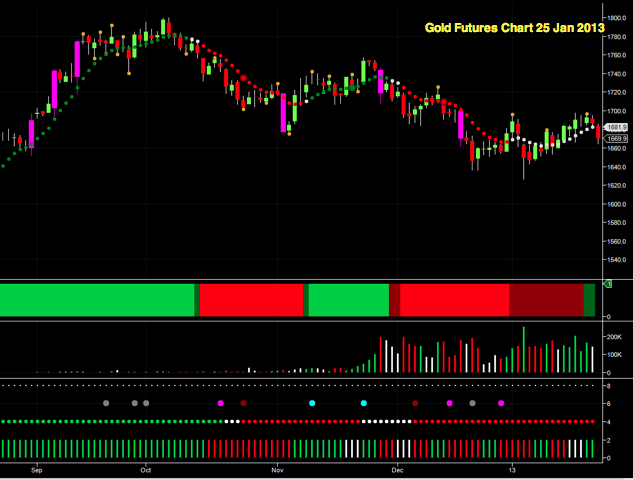

The gold price continues to tease and exasperate gold bugs as each attempt to recover and move beyond the $1700 per ounce price point is promptly extinguished with a sharp reversal, which was once again the case in Friday’s trading session.

From a technical perspective, and as stressed in previous gold market analysis, the $1700 per ounce price point is now taking on increased significance, particularly following the posting of an isolated pivot high on 22nd January which saw gold touch an intra day high of $1695.90.

This aligns almost exactly with the isolated pivot high of 2nd January at $1695.40. These price points were further reinforced this past week at failures at this level virtually every day and confirming the weakness in gold which we saw Friday, as the February GC contract closed at $1669.90.

From a fundamental perspective, this lack of interest is partly due to the current move back into equities and indeed many commentators are now questioning whether it may be time to sell gold and move into gold mining stocks instead. Whilst gold stocks underperformed in 2012 against other sectors, 2013 may well be the year for them to shine whilst the physical asset becomes less attractive.

The question now, of course, is where next for the gold price and, given the above fundamental and technical pictures, we may well see further weakness in the short term, possibly to test the interim platform of support in the $1640 per ounce region. From there we may even see a deeper move back down to $1620 per ounce where gold will find sustained price congestion as well as a solid platform of potential support.

Indeed, this area may hold good, as has happened in the past, and was a key feature of the recovery on the 4th January which triggered the recent short term move higher.

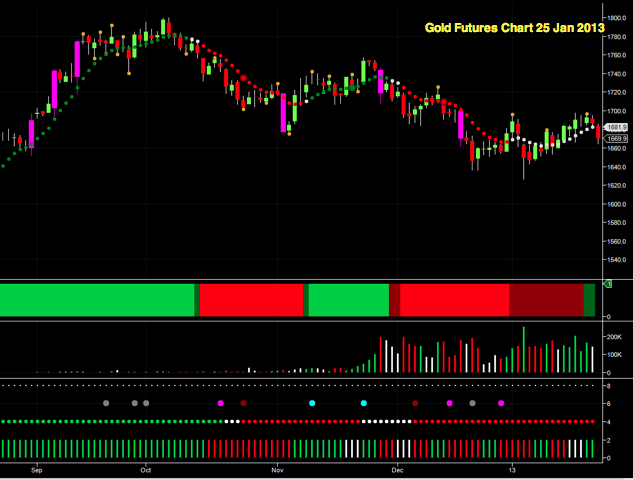

From a technical perspective, and as stressed in previous gold market analysis, the $1700 per ounce price point is now taking on increased significance, particularly following the posting of an isolated pivot high on 22nd January which saw gold touch an intra day high of $1695.90.

This aligns almost exactly with the isolated pivot high of 2nd January at $1695.40. These price points were further reinforced this past week at failures at this level virtually every day and confirming the weakness in gold which we saw Friday, as the February GC contract closed at $1669.90.

From a fundamental perspective, this lack of interest is partly due to the current move back into equities and indeed many commentators are now questioning whether it may be time to sell gold and move into gold mining stocks instead. Whilst gold stocks underperformed in 2012 against other sectors, 2013 may well be the year for them to shine whilst the physical asset becomes less attractive.

The question now, of course, is where next for the gold price and, given the above fundamental and technical pictures, we may well see further weakness in the short term, possibly to test the interim platform of support in the $1640 per ounce region. From there we may even see a deeper move back down to $1620 per ounce where gold will find sustained price congestion as well as a solid platform of potential support.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Indeed, this area may hold good, as has happened in the past, and was a key feature of the recovery on the 4th January which triggered the recent short term move higher.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.