It could take many months — or even years — for the precious metals to form a bottom

I am on record as stating my opinion that the current down thrust in Gold, Silver and Platinum is likely to be the final leg down in their respective bear trends. If you inappropriately still own precious metals from higher prices, please do not take comfort from my belief we are headed for a low.

There is a huge difference between the end of a bear market and a bottom. Even if the precious metals find a final low, you could grow old and die before the next bull trend bails you out.

Let’s look at history.

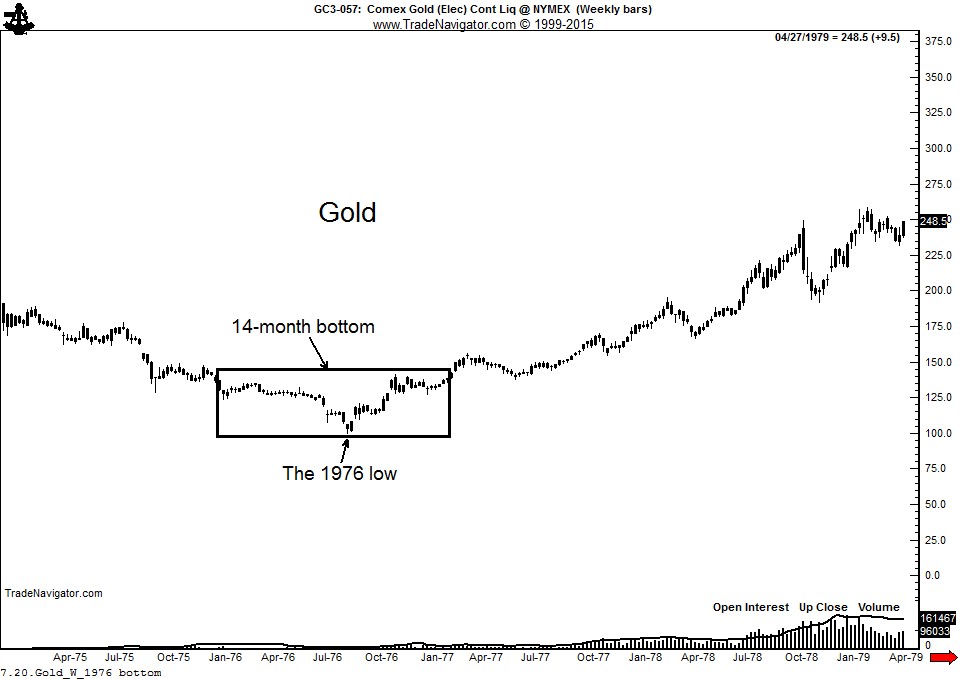

The bottom in Gold following the 1974-1976 bear trend required 14 months to play out. There was no reason to be a bottom picker during this bear trend.

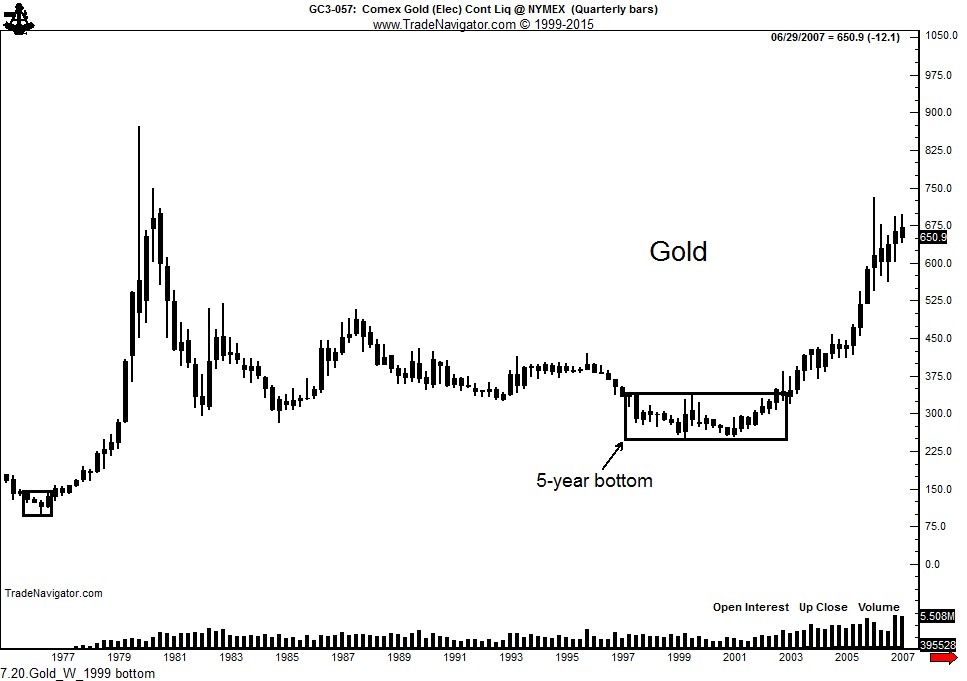

The bottom in Gold following the 1980-1999 bear trend required more than five years to play out. There was no urgency to pick the bottom of this 19-year bear trend.

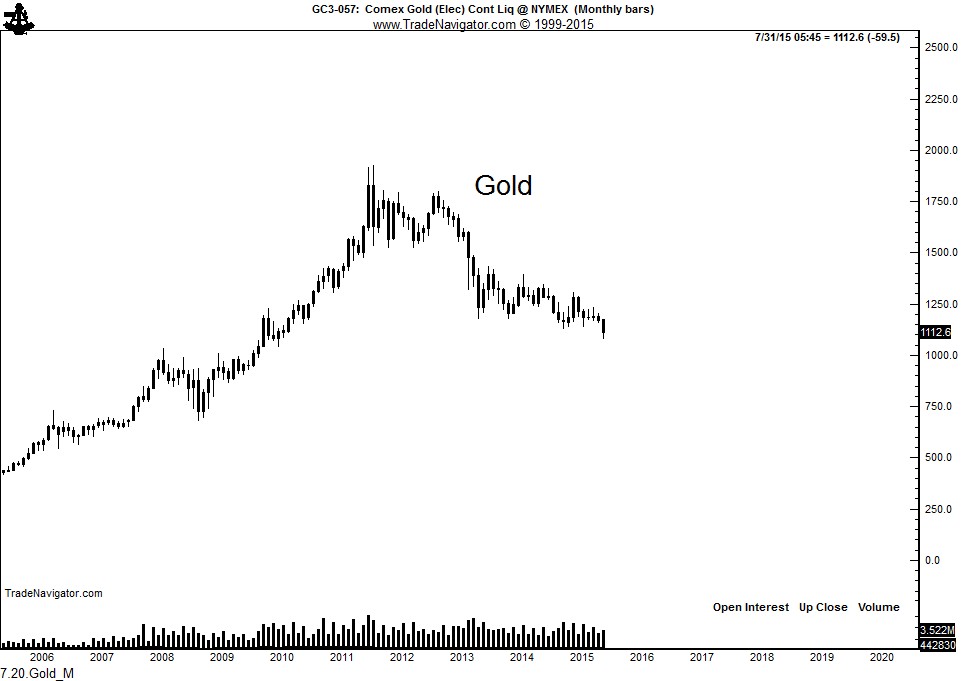

Bottoms require time, especially in raw material commodities. SELDOM do raw materials create “V”-extended lows. Take a look at the current Gold chart. What possible reason is there to become a Gold bull even if a low might be near? Answer — ABSOLUTELY NO REASON!

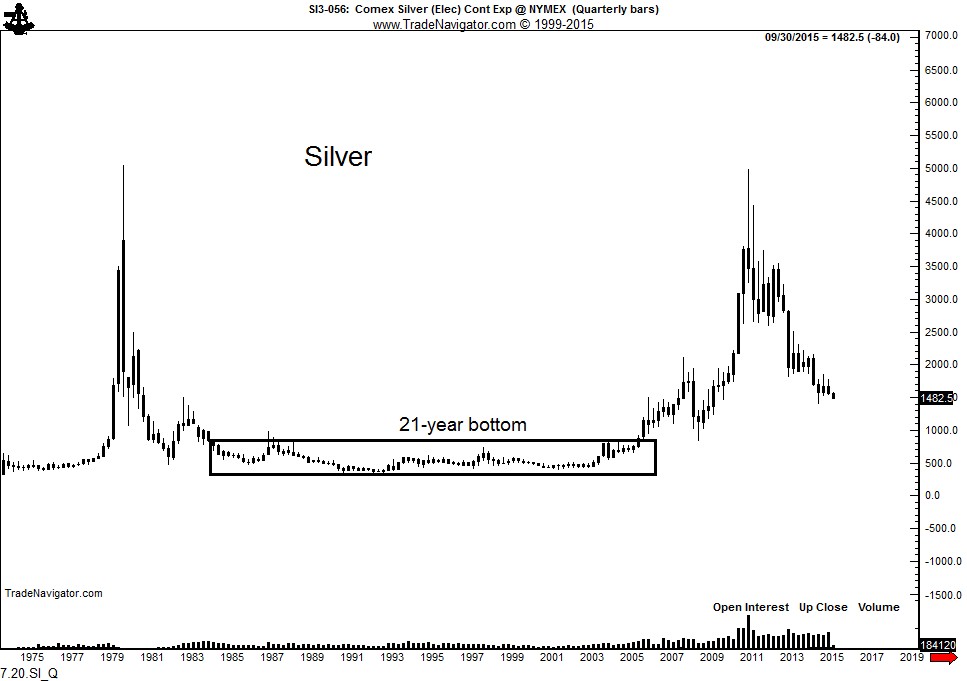

Based on history, there is even less urgency to be an owner of Silver. It required 20 years for Silver to bottom after the 1979/1980 bull market, finally completing its bottom in 2005. I remember this well — I became a major bull in Silver in late 2005 based on classical charting principles.

When I think about Gold and Silver entering the final stages of their bear trends, my frame of reference is short covering, not trying to pick a bottom as a buyer. Even if the precious metal markets are in their final down thrust, it could be many months or even years before it is time to seriously become a bull again.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.