It’s easy to despair over the outsize role of finance in the modern world and but a short step to the cynical question: What good is finance anyway? In his sweeping book Money Changes Everything: How Finance Made Civilization Possible (Princeton University Press, 2016) William N. Goetzmann demonstrates that although finance has often created serious problems (in part because it is “a potentially destabilizing force”), it also led to “some of civilization’s most important achievements: writing, the mathematics of probability, mechanisms for savings and investment, and the harmonization of global relations.” (pp. 8, 519)

Goetzmann, a professor of finance and management studies at the Yale School of Management, takes the reader on a fascinating intellectual adventure in time and space, from the Uruk tablets (c. 3100 BCE) to sovereign wealth funds, from China to Europe, Inc. Throughout, he points to the feedback loops between civilization and finance. For instance, he quotes the fourth-century Pythagorean philosopher Archytas: “The discovery of calculation (logismos) ended civil conflict and increased concord. For when there is calculation there is no unfair advantage, and there is equality, for it is by calculation that we come to agreement in our transactions.” Goetzmann comments: “Who might have guessed that the roots of democracy lay in financial literacy?” (pp. 94-95)

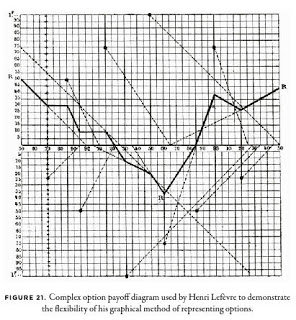

He shows how Fibonacci, in his Liber Abaci, compared the present value of two cash flow streams to devise the method of “net present value,” “the most important tool in modern finance.” (p. 243) He discusses the analysis of option prices by Henri Lefèvre (1827-1885?) and includes one of Lefèvre’s payoff diagrams that shows how to deconstruct an option position.

This book is packed with information. We learn, for instance, that Christopher Columbus’s “contract with the Spanish crown was extraordinarily complex: he received not only political favors but also 10% of future revenues from transatlantic trade. He also negotiated an option to invest up to 1/8 share of any commercial enterprise organized to exploit his discoveries.” (p. 10)

There is no way I can do justice to this book in a brief post. Let me say simply that everyone who is curious about the history of finance will be richly rewarded by reading this book. And by keeping it ready to hand for future reference.