Global economic growth is projected to slow to a ten-year low, according to the latest report by the Organization for Economic Cooperation and Development (OECD).

According to OECD, global growth is set to expand at a pace of 2.9% this year. This marks the smallest increase since 2009. The OECD attributed the slowdown to various headwinds, particularly the US-China trade wars and a potential no-deal Brexit.

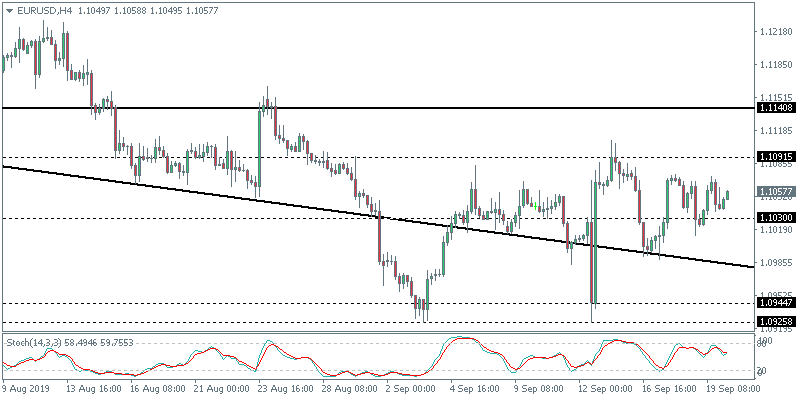

Euro Trades Muted, Lack of Fundamental Drivers

The euro mimicked price action in the U.S. dollar which has remained rather flat. The common currency, however, was easing back on Thursday following brief highs during the intraday sessions. A lack of fundamentals from the eurozone following the ECB meeting is keeping investors on the sidelines.

EURUSD Back to Support

The currency pair gave up the intraday gains as the support level of 1.1030 is being tested. Price action has been consolidating around this level over the past few weeks. But lack of any major moves has kept price action subdued. The EURUSD remains caught within the range of the 1.1091 – 1.1030 region.

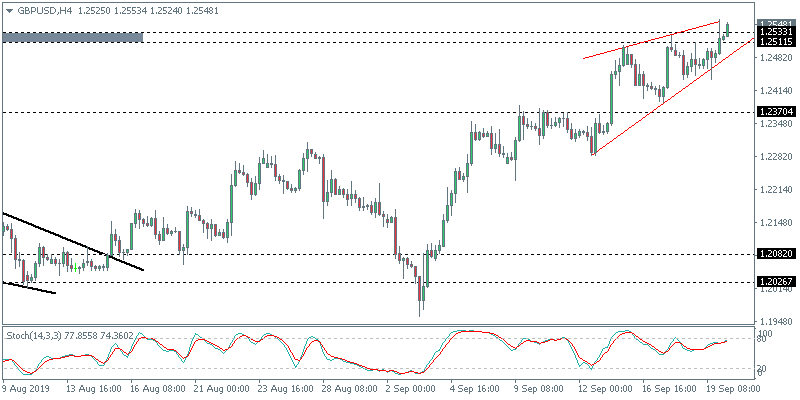

BoE Holds Rates Steady as Expected

The Bank of England’s monetary policy was seen to be in line with expectations. The central bank left interest rates and its asset purchase program unchanged. The decision to leave rates steady comes with a unanimous vote. The recent pullback in inflation is also seen giving officials some breathing space in the backdrop of the Brexit deadline.

GBPUSD Holds Near the Resistance Level

Sterling was rather unmoved following the release of the BoE’s interest rate decision. Price action pulled back from the initial test of resistance at 1.2511. But the currency pair is seen hovering close to this level. In the process, an ascending wedge pattern is taking shape. A breakout from this level could trigger a move lower. The support at 1.2370 could be the downside target.

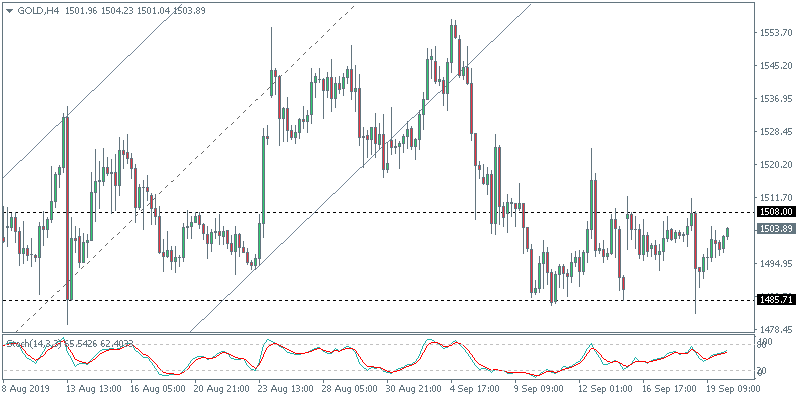

Gold Muted as Risk Aversion Declines

The precious metal was trading modestly lower on Thursday following the easing risk aversion sentiment. The Fed rate cut also failed to move the precious metal higher. This came as the Fed maintained a less than dovish outlook on monetary policy. Meanwhile, the BoJ, which also signaled that it could act as early as October, failed to move the precious metal higher on the day.

XAUUSD Remains Rangebound, For Now

The precious metal remains trading within the established corridor of 1508 and 1485. If gold prices settle within this range today, it would mark almost two weeks of flat trading. The bias remains mixed for the moment. The upside gains are a bit limited. A lower high could possibly confirm that a correction is due. While a breakout to the downside will trigger a move to the 1431– 1428 region.