G-III Apparel Group (NASDAQ:GIII), Ltd. GIII appears strong on the back of its robust business strategies including digital expansion and brand strength. Markedly, the company is steadily witnessing robust results on the websites of DKNY and Karl Lagerfeld Paris. Management also remains optimistic about its portfolio of brands including the five powerful names, DKNY, Donna Karan, Calvin Klein, Tommy Hilfiger and Karl Lagerfeld. In addition, the company completed streamlining its retail division and the new retail model is poised to achieve profitability

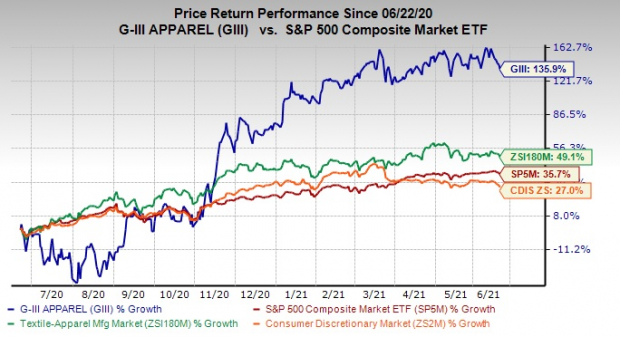

Encouragingly, this presently Zacks Rank #2 (Buy) stock is seeing strength, having surged 135.9% and also surpassed its industry’s rally of 49.1% in a year’s time. Also, the New York-based company has outpaced the broader Consumer Discretionary sector’s 27% rise and the S&P 500 Index’s 35.7% growth in the same time frame. This outperformance is also led by sturdy first-quarter fiscal 2022 results followed by an upbeat outlook.

Moreover, analysts are optimistic about this stock as it is seeing higher earnings estimate revisions. The Zacks Consensus Estimate for fiscal 2022 earnings stands at $2.70 and the same for fiscal 2023 is pegged at $3.06, indicating growth of 15.4% and 9.3%, respectively, over the past 30 days. Also, the consensus mark for second-quarter fiscal 2022 earnings of 11 cents has increased about 83% in the same time period.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Let’s Find Out More

We note that G-III Apparel is focused on growing its digital business with expansion in the distribution channel. During the first quarter of fiscal 2022, sales of the product through e-commerce were praiseworthy. Moreover, the company’s own sites for DKNY and Karl Lagerfeld Paris combined comparable sales rose nearly 40% year over year. Its business in China saw another quarter of significant growth with momentum in e-commerce. Hence, management is on track to drive growth across the digital landscape via investments in internal talent, e-commerce sites, improved logistics capabilities and loyalty program.

In addition, G-III Apparel undertakes several strategies including acquisitions and licensing of well-known brands to expand its product portfolio and fuel growth. Also, its International business remains a key driver for the company. Apart from these, GIII-Apparel is pursuing brand enhancement across channels with new launches, improved marketing strategies and a broader consumer reach.

Now speaking of brand strength, the company’s solid brands including DKNY, Donna Karan, Calvin Klein, Tommy Hilfiger and Karl Lagerfeld have an annual net wholesale sales potential of $4 billion. Moreover, G-III Apparel sees opportunities to grow athleisure for brands including Calvin Klein, Tommy Hilfiger, DKNY and Karl Lagerfeld Paris. The company’s casual offerings are also consistently driving its sportswear category. Also, the footwear and handbag businesses continued to remain strong. It had also launched the Karl Lagerfeld Paris women's brand across 75 new doors at Macy's (NYSE:M) M.

Quarterly Performance & Outlook

During the first quarter of fiscal 2022, both the company’s top and the bottom line beat the Zacks Consensus Estimate and also improved year over year. Management stated that sales for the broader lifestyle apparel including sportswear, wear-to-work attire and dresses have been impressive for a while now. Besides, the company’s overall business in North America is appreciative.

For second-quarter fiscal 2022, G-III Apparel forecasts net sales of about $460 million, indicating growth from $297 million delivered in the same quarter a year ago. Further, earnings per share are likely to come in the bracket of 3-13 cents versus a net loss of 31 cents seen in the year-earlier quarter. Additionally, the company envisions earnings in the range of $2.60-$2.70 per share for fiscal 2022, implying significant growth from 48 cents delivered last fiscal. Further, the China business is anticipated to be up 50% for the same fiscal year.

Wrapping up, G-III Apparel is likely to continue its momentum, given the aforementioned strategies and sound fundamentals. Well, a Momentum Score of A with expected long-term earnings growth of 11.6% further speaks volumes for the company.

Don’t Miss These Solid Bets Too

Crocs (NASDAQ:CROX) CROX has a long-term earnings growth rate of 15% and a Zacks Rank #1 (Strong Buy), currently. You can see the complete list of today’s Zacks #1 Rank stocks here.

Gildan Activewear (NYSE:GIL) GIL, presently a Zacks #1 Ranked stock, has a long-term earnings growth rate of 28.6%.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Macys, Inc. (M): Free Stock Analysis Report

Crocs, Inc. (CROX): Free Stock Analysis Report

GIII Apparel Group, LTD. (GIII): Free Stock Analysis Report

Gildan Activewear, Inc. (GIL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research