Primary-Term Uptrend

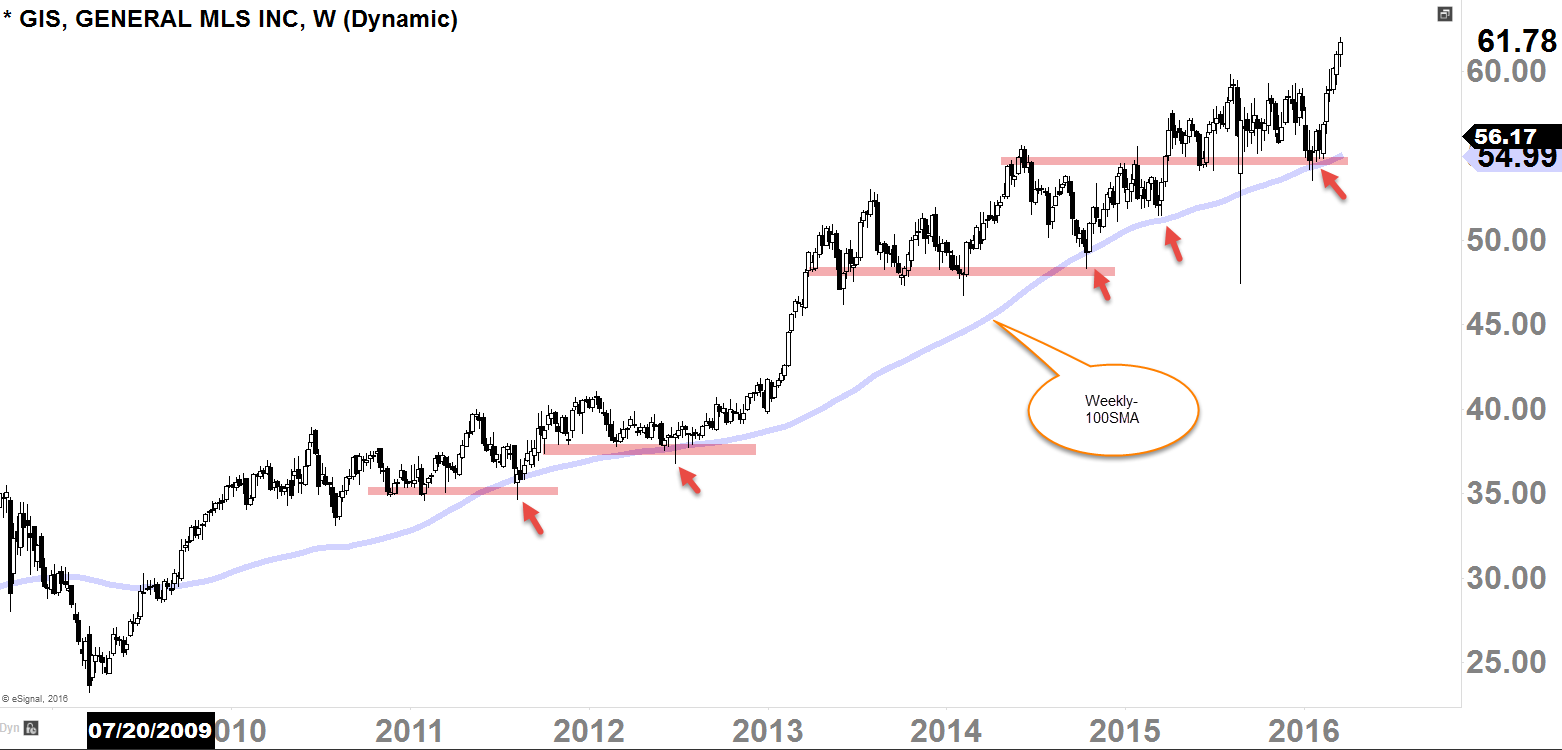

Weekly-100SMA (Simple Moving Average) is a predominant supporter of the bulls as you can see in the chart below.

Since 2010 it has been acting/providing as strong support-levels protecting the buyers; this is how you understand the probability of the potential outcome. As long as the primary-term uptrend is perceived as 'valid', the trend is assumed to be in effect until it gives us a clear signal that it has been 'reversed.'

Despite the fact that the overall market has been very shaky last several month, General Mills (NYSE:GIS) truly stood it's ground and held up above the weekly-100SMA support level.

As long as we stay above the weekly-100SMA, I would have to assume that the primary-term uptrend will continue (along with it's minor to intermediate-term ups and downs).

Minor-Term "Overbought"

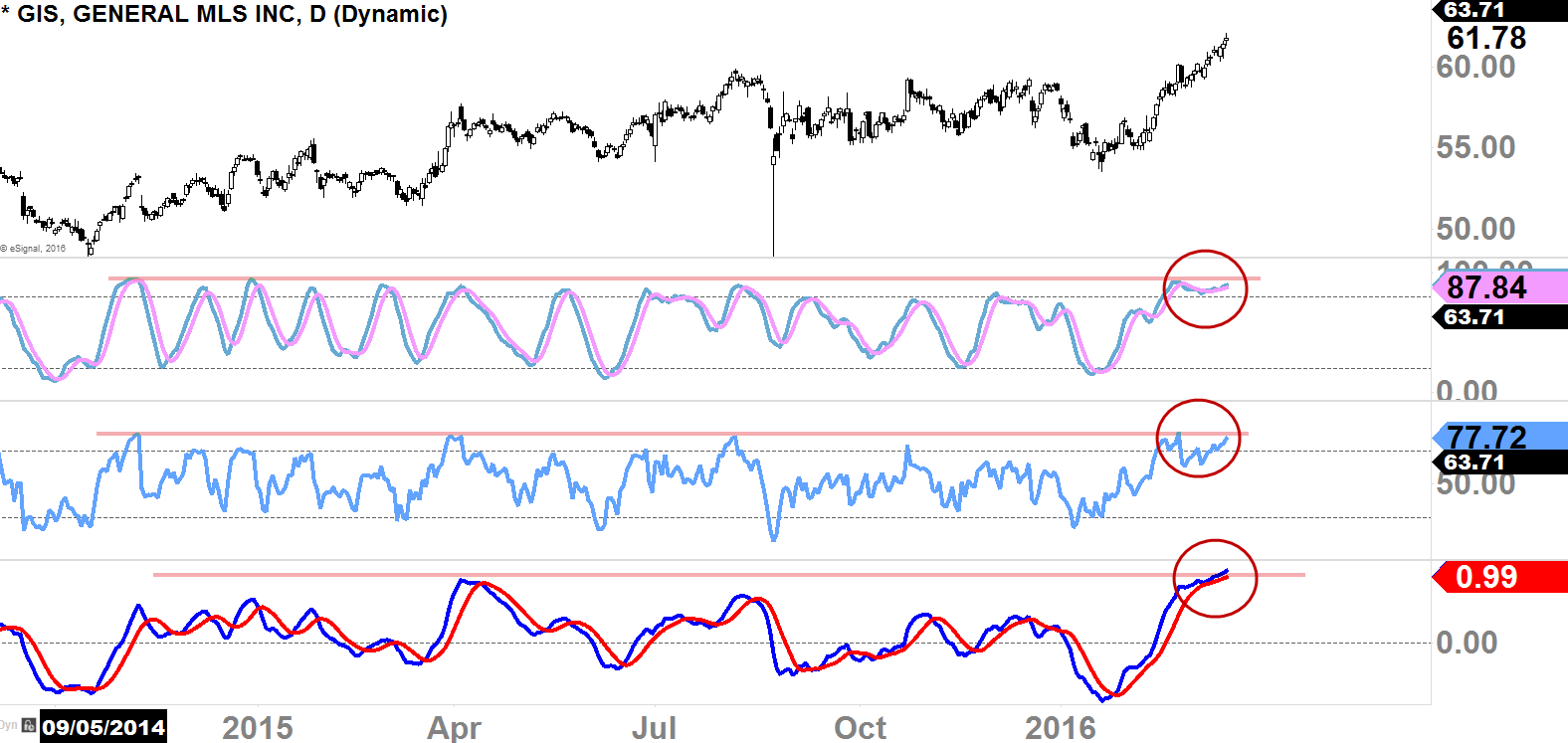

Though long-term picture looks solid for General Mills (GIS), minor-term sentiment is bit 'overbought' as you can see as the Oscillators insinuate possible pullback or sideways movement that could be in the horizon.

If we see rather sharp decline in the next 1-2 weeks, $58-$59 is the level to watch for possible level of support. Also keep in mind that the Earnings Report is next Wednesday after market close.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI