- GBP/USD could be impacted significantly by UK CPI data this week

- Iran-Israel tensions at forefront

- GBP/USD outlook bearish as US dollar likely to remain supported on dips

The GBP/USD pair bounced off its lows on data showing strong wage growth, which may potentially delay the first Bank of England rate cut. Other GBP crosses did even better as the odds of a June rate cut fell. However, despite its slight recovery, the GBP/USD stayed below the broken 1.25 handle, with traders continuing to largely favor the US dollar in what has been a risk-off environment amid the escalation of the of the geopolitical risks in the Middle East.

The GBP/USD will remain in sharp focus as we head to the middle part of the week, owing to the release of more important macro data from the UK: CPI, which could set the near-term direction for the pound. We also have a few US data releases this week (see below) and a speech by Powell today, but the key data is the Core PCE index next week, which means there is plenty of time for the dollar to find fresh support.

GBP/USD finds mild support on UK wages data

The greenback was already supported by strong activity data and sticky inflation figures we saw last week, plus other external factors such as elevated geopolitical risks and a dovish-leaning ECB, which hurt the euro. Thus, compared to other GBP crosses, the GBP/USD only managed to find mild support from this morning’s wages data from the UK.

The ONS reported that wages grew by 6% in the three months to March compared to a year earlier, only slightly down from the 6.1% reading in the previous month, while including bonuses, average earnings remained unchanged at 5.6%. Additionally, jobless claims rose by less than expected (10.9K vs. 17.2K eyed). However, the unemployment rate unexpectedly jumped to 4.2% from 3.9% last, suggesting the jobs market is cooling.

US dollar is likely to remain supported on dips

The US dollar will also remain in focus with attention turning to a speech by Federal Reserve chairman Jerome Powell, who is scheduled to speak later today and may provide clues about the path for interest rates in the US. The Dollar Index has risen to a 5-month high.

We had more forecast-beating US data supporting the greenback on Monday, as retail sales rose by more than expected to 0.7% month-on-month. The sales data underscores the surprising resilience of the US consumer and undermines the Fed’s ability to cut rates. The retail sales data came after US CPI rose last week for a third straight month.

But right now, it is mostly haven flows amid ongoing Middle Eastern concerns that is driving the markets, and keeping the dollar higher. With the Fed likely to keep interest rates high for longer and Middle East tensions unlikely to ease materially, this is likely to keep risk appetite low, and the dollar supported. Thus, the GBP/USD could remain under pressure for a while yet, especially if the UK’s CPI turns out to be weaker than expected on Wednesday.

Economic calendar highlights for the GBP/USD

As the likes of the ECB and BoE get closer to cutting interest rates, possibly in June, the Fed’s timeline has lengthened, which has been the main reason behind the GBP/USD decline. This narrative may get even more relevant should the upcoming data from the UK disappoint expectations, or if US data shows further resilience.

This week, though, the primary concern for the GBP/USD and broader markets arises from geopolitical tensions involving Iran, Israel, and their allies. On a macro level, GBP/USD traders will also need to keep a close eye on the economic data calendar and factor in market-moving UK releases, including CPI on Wednesday and retail sales on Friday. From the US, attention will be on Powell and industrial production on Tuesday, followed by the Philly Fed Index and Existing Home Sales on Thursday.

Here are the key data highlights to watch in the week ahead:

|

Date |

Time |

Currency |

Data |

Forecast |

Previous |

|

Tue Apr 16 |

1:30pm |

USD |

Building Permits |

1.51M |

1.52M |

|

2:15pm |

USD |

Industrial Production m/m |

0.4% |

0.1% |

|

|

6:00pm |

GBP |

BOE Gov Bailey Speaks |

|||

|

USD |

FOMC Member Barkin Speaks |

||||

|

6:15pm |

USD |

Fed Chair Powell Speaks |

|||

|

Wed Apr 17 |

7:00am |

GBP |

CPI y/y |

3.1% |

3.4% |

|

5:00pm |

GBP |

BOE Gov Bailey Speaks |

|||

|

10:30pm |

USD |

FOMC Member Mester Speaks |

|||

|

Thu Apr 18 |

1:30pm |

USD |

Unemployment Claims |

214K |

211K |

|

USD |

Philly Fed Manufacturing Index |

0.8 |

3.2 |

||

|

3:00pm |

USD |

Existing Home Sales |

4.20M |

4.38M |

|

|

Fri Apr 19 |

7:00am |

GBP |

Retail Sales m/m |

0.3% |

0.0% |

A key highlight among the data releases is the UK CPI, scheduled for publication on Wednesday, at 07:00 BST. There has been considerable speculation regarding potential rate cuts by the Bank of England, prompting the central bank to push back against what it perceives as excessively dovish market expectations.

Despite core CPI registering a 0.6% increase last month, more than double the BOE's 2% target, annual inflation rates for both CPI and core CPI are showing signs of moderation, which is encouraging. Nonetheless, it may still be premature to anticipate easing measures from the BOE in June. The upcoming CPI data would need to indicate a further weakening trend to sustain such expectations.

While a few US macroeconomic indicators are on the agenda for the upcoming week, the next major US data release is not expected until later in the month, with the Fed's preferred inflation gauge set to be published on April 26th – i.e., Core PCE index. Until then, the dollar may find support on any short-term declines, especially considering that both US interest rates and those of other major economies, such as the ECB and the Bank of Canada, have recently taken a more favourable turn for the greenback.

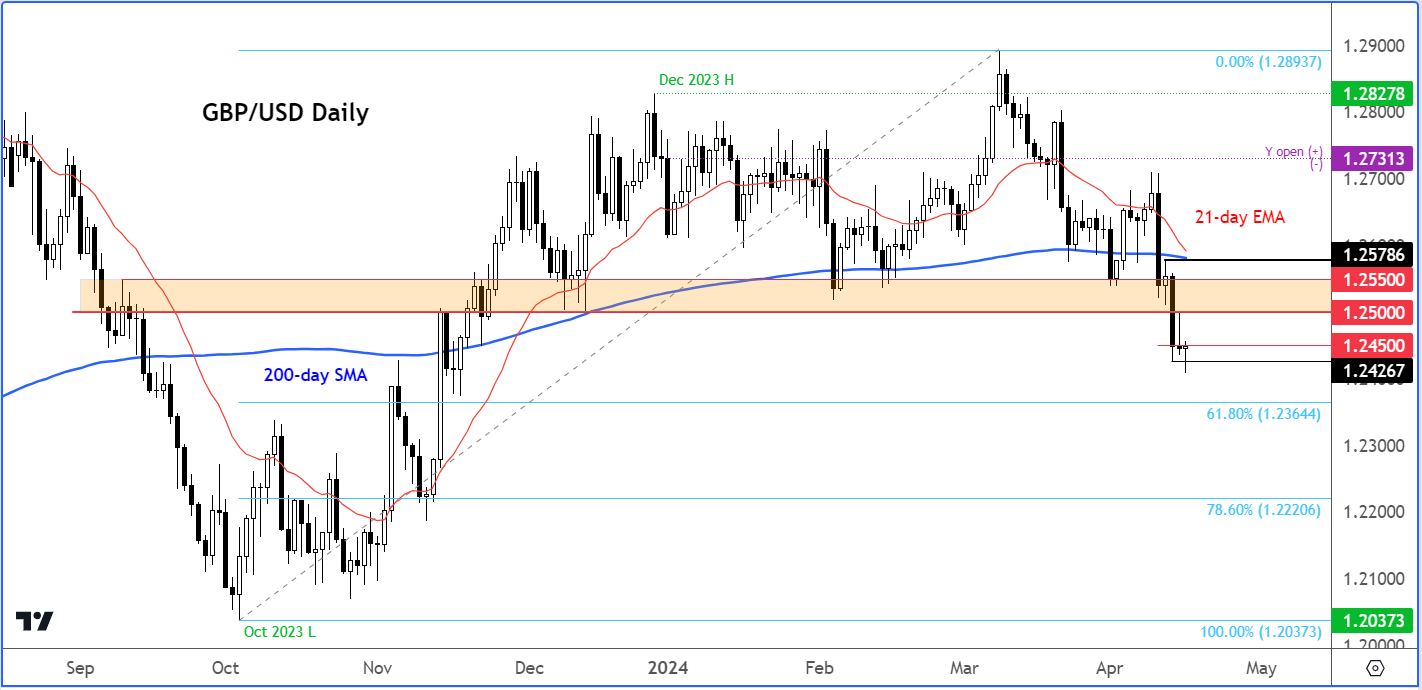

GBP/USD technical outlook and levels to watch

Source: TradingView.com

After breaking and closing below key support area around 1.2500 to 1.2550 on Friday, the GBP/USD came to within a couple of pips from testing this area from underneath on Monday before falling to a fresh multi-month low. This morning, though, stronger wages data from the UK helped it to bounce back at the time of writing on Monday.

But while it remains below the broken 1.2500-1.2550 zone, the path of least resistance would be to the downside. This area was previously supported back in December, a couple of times in February, and again in early April. Once key support, will this zone now turn into key resistance following its breakdown on Friday?

If resistance holds here, then watch out for potential continuation, initially targeting the first key round handle like 1.24, followed by 1.23 etc. An additional level to watch is the 61.8% Fibonacci extension level at 1.2365 as derived from the rally that started in October and ended and March.

However, if the GBP/USD goes back above that broken 1.2500 - 1.2550 support area then this will complicate the short-term directional bias as that could signal a possible false break scenario.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky therefore, any investment decision and the associated risk remains with the investor.