Yesterday was quite volatile for GBP/USD. The pound depreciated against the US dollar dropping to 1.4603 on weak statistics for UK inflation. The consumer price index for the last month rose by 0.2% and thus was below expectations of 0.3% growth. The index remains at the minimum level of 0,0% year-on-year. The core consumer price index that does not consider prices of food and energy resources dropped to 1,0% against a previous value of 1,2%.

However, the pound rebounded promptly to a level of 1.4801 on dismal macroeconomic statistics for the USA. US retail sales in March rose by as little as 0.2% against a forecast of 1.0%, which weakened the dollar substantially.

IMF's forecast for US GDP growth in 2015 put extra pressure on the American currency. The forecast had been downgraded from 3.3% to 3.1%. Hence most market participants expect that US interest rates will be raised later than planned. The monetary policy is expected to be changed in the fourth quarter 2015.

A few reports on US industrial production are to be published today. According to forecasts, the data for this month will be worse than the month-ago values, which may weaken the dollar more and support GBP/USD.

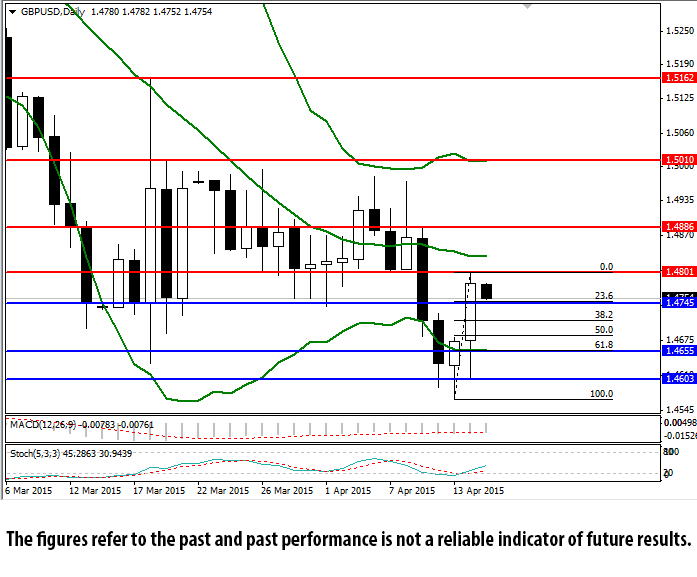

Support levels: 1.4745 (23,6% Fibonacci level), 1.4655 (lower line of Bollinger® Bands), 1.4603 (yesterday's minimum).

Resistance levels: 1.4801 (yesterday's maximum), 1.4886 (maximum on 9th April), 1.5010 (upper line of Bollinger bands).