A week ago, gold rose towards key resistance. The resistance is defined by the 2013 price point of $1320 and the 2015 price point of $1307. It reached about $1306. As it did, I called the market a “profit booker’s delight”.

Gold price enthusiasts should not take my statements as a “top call”, and I just booked profit on a tranche of short positions. Traders can rebuy now, in hopes of a new price surge to above the $1300 area.

This is the four-hour bars chart of gold.It’s possible that the next rally is delayed a bit, and gold drifts a bit lower, towards the apex of the large blue triangle I’ve annotated on the chart.

That’s because the Bank of Japan is apparently trying to scare the market that it will sell the yen against the dollar.

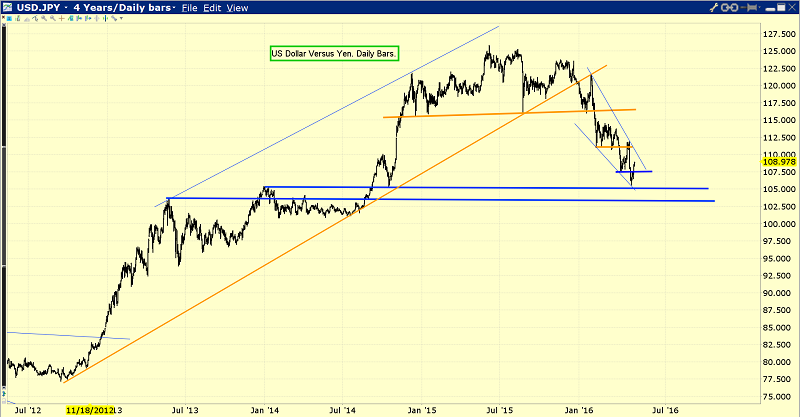

This is the key dollar-yen daily chart. The dollar has declined substantially in 2016 against the yen, and a rally of some size is to be expected after such a decline.

A dollar-yen rally can put some additional pressure on gold in the short term, but the interventionists may find that their plan to rally the dollar backfires, or doesn’t even get off the ground.

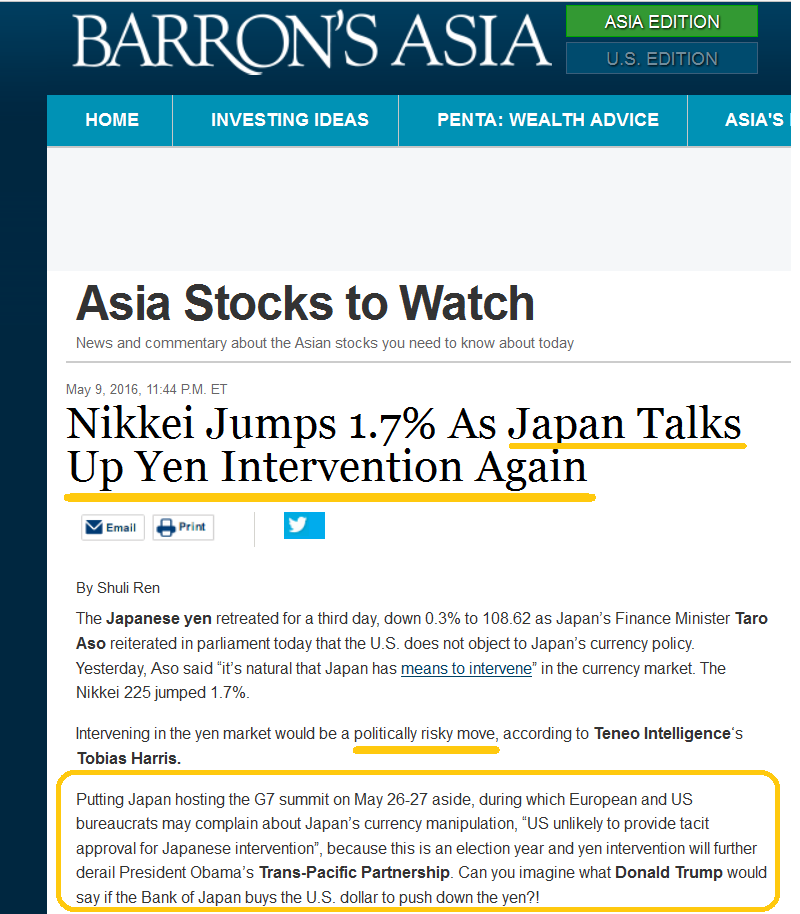

An attempt by the Bank of Japan to buy dollars now could provoke a huge outcry from politicians in America.

Donald Trump is an avid fan of a lower dollar, and the Democrats would not be happy to see the US trade deficit spike higher because of a dollar rally, as the US election approaches.

Tactics? Investors can buy some gold now, and more if it declines to the triangle apex zone of about $1250.

In the big picture of American gold price discovery, the potential election of Donald Trump is starting to get taken very seriously by some of the world’s most respected business publications.

They are suggesting his policies could be extremely positive for the price of gold. I find this news to be tremendously positive for the price of gold.

In a nutshell, as the world’s largest empire of debt enters its twilight years, its citizens may elect a president known as “The king of debt” to stiff all their creditors.

Clearly, influential publications like Barron’s understand the powerful link between debt and the price of gold. Thescare tactics being used by Japanese authorities will have no more than a short term negative effect on the price of gold against all fiat.

I’ve predicted that the world is on the cusp of a sea change, where American T-bonds begin a huge new leg down against gold, and the yen loses its safe-haven status.Within a few years, and perhaps sooner, the Japanese scare tactics will backfire, and create a surge into gold.

This is the spectacular Bombay Stock Exchange (BSE) index month monthly bars chart.

If US politicians really want to make America great again, they will tell their citizens to invest their savings into gold and the Indian stock market.

The bottom line is this: While the buyback-bloated US stock market struggles in technically overbought territory against a background of horrific demographics, the young business-oriented titans of India are poised to launch their stock markets into higher price mode,for decades to come.

This is the monthly bars chart of the Dow. The uptrend line has been tested, and RSI (relative strength) is disintegrating. It’s a dangerous situation.

I’ve predicted that US stocks will likely make a marginal new high, drift sideways into the nation’s election, and then implode in an inflation-oriented fireball to the 2009 lows, and break them.From a fundamental standpoint, a decision by the US government to stiff its bond market creditors would be the catalyst to make my scenario happen, in textbook fashion.

In my professional opinion, there will be no US government default on its debt. Instead, whoever gets elected will order the Fed to print trillions of dollars of new fiat paper money, and pay the T-bond creditors with it. At the same time, the US Treasury is likely to launch a program of gold revaluation that is more aggressive than the current buy programs in China and Russia.

I realize that gold stocks are the darling of the Western gold community, and yesterday’s price action may have been a bit unnerving for many investors.

This is the two hour bars GDX (NYSE:GDX) chart. After a multi-month rally, GDX has built a small head and shoulders top pattern.

Nervous investors can “stay in the game” by moving some capital from gold stocks to gold, but the overall gold market is very well supported.

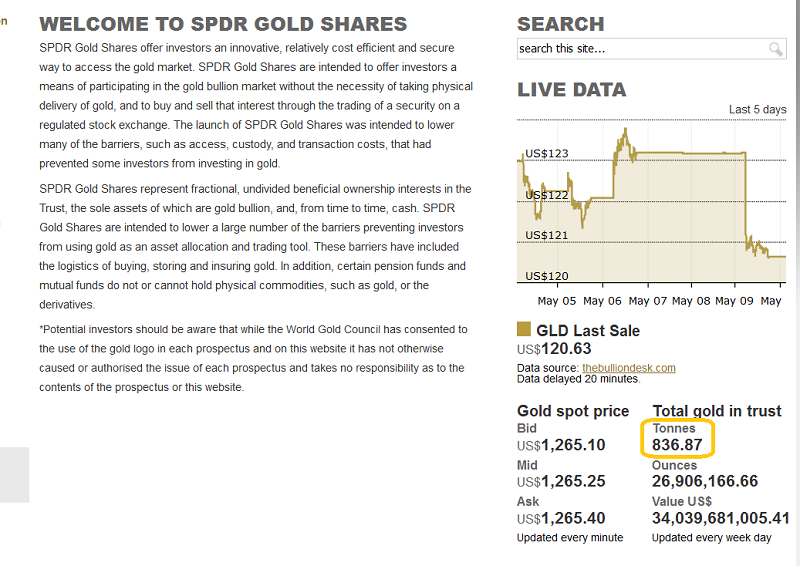

That’s a snapshot of the SPDR fund (SPDR Gold Shares (NYSE:GLD)) tonnage. Despite yesterday’s gold price swoon, value-oriented investors increased their holdings. The total tonnage just hit another multi-year high!

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?