The U.S. dollar traded at over a 3 month low against the yen as tensions escalated in the Ukraine over the weekend, when government forces and insurgents engaged in violent exchanges, leaving several people dead. Appetite turned risk adverse in the Forex as news broke that China was sending several ships to evacuate Chinese citizens out of Vietnam where anti-China protestors turned up the heat, prompting the situation to escalate into violence. The two nations remain at odds over the ownership of territories in the South China Sea. And if this wasn’t enough to affect market sentiment and raise demand for safety, sources said that the crisis in The Ukraine took a turn for the worse after armed men took over Parliament on Sunday. Many have called this the “worst violence” seen in this country since 2011. The greenback was also low as a result of Friday’s economic releases which surprised the markets with lackluster Consumer Sentiment data, but denoted a recovery for Housing Starts. Gold Prices rose on news that India’s incoming Finance Minister, Narendra Modi, who won the country’s largest electorate mandate in three decades, stated that he may ease the limits on gold imports. Futures for June delivery climbed 0.7 percent and reached $1,302.20 a troy ounce on the New York Mercantile Exchange. The hike was also fueled by geopolitical tensions which increased demand for safety in the markets.

The euro inched higher against the greenback and rebounded from its previous low, though the gains were capped as investors still believe that the european Central Bank may take the necessary steps to strengthen the region’s economic recovery. The euro lost as much as 1 percent against the greenback on speculation that the central bank will increases stimulus when policy makers meet in June, given that Inflation posted at 0.7 percent for April, unchanged from the previous month. The euro was also lower against the yen.

The yen rallied against the euro and the U.S. dollar as tensions in the Ukraine and Vietnam weighed on sentiment, and it remained high after Japan announced that Core Machinery Orders climbed. The report is a major indicator on consumer spending.

Lastly, in the South Pacific, the Australian dollar traded lower against the greenback as the slump in steel shipments to China caused the value of iron ore to decline. Iron ore is a major Aussie export and drop in demand has weighed on the commodity. Furthermore, reports showed that support for Australian Prime Minister, Tony Abbott, has dwindled, especially since the budget issued last week indicated the possibility there could be job losses if the government implements more expenditure cuts. New Zealand’s dollar fluctuated slightly against the U.S. monetary unit after releases issued on Monday pointed to a surge in Producer Price Inflation Input and Output.

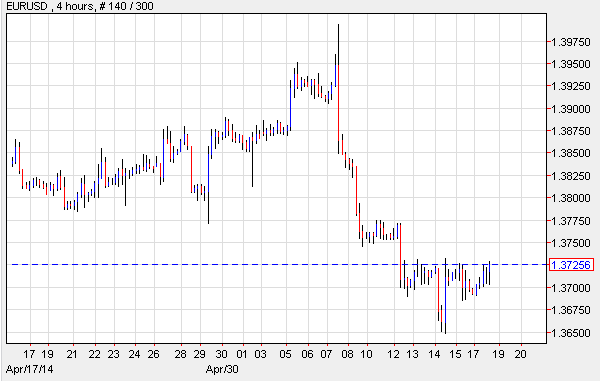

EUR/USD: Speculators Look Ahead To June

The EUR/USD rebounded on Monday after trading at the lowest rate in two months. However, analysts don’t expect the euro to continue its rally as market traders speculated on whether the european Central Bank would finally take action to improve the economy’s outlook. The euro dropped over the past two weeks after coming close to the $1.4000 level, on the possibility that the monetary authorities will implement new stimulus measures to ensure the region remains on track to recovery. The most recent announcement denoted that the E.U. sustained economic growth, though at a slower pace. Several economists stated that twelve months after ECB President Mario Draghi pledged to do whatever is needed to ensure the region’s recovery, he currently faces tougher challenges due to what was labeled “mediocre” growth.

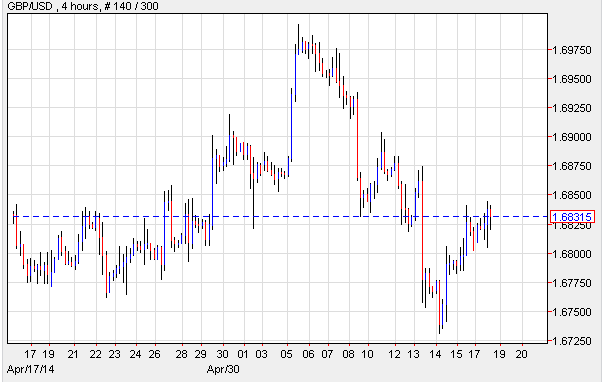

GBP/USD: London Real Estate Prices Rally

The GBP/USD traded little changed as market investors treaded with caution ahead of the release of the FOMC’s minutes, and on signs that a big scale merger between AstraZeneca and Pfizer would likely fail. The pair was also weighed down by comments from the Bank of England’s governor, Mark Carney, who said that the dramatic climb in housing prices could pose a threat to the U.K.’s economy. According to Rightmove Plc, property values in England and Wales surged 3.6 percent, which was the most in twelve years. Mr. Carney suggested that the bank should take steps to control mortgage lending and place limits on the types of loans it offers. Rightmove also revealed that properties in London are currently priced at an average of 592,763 pounds.

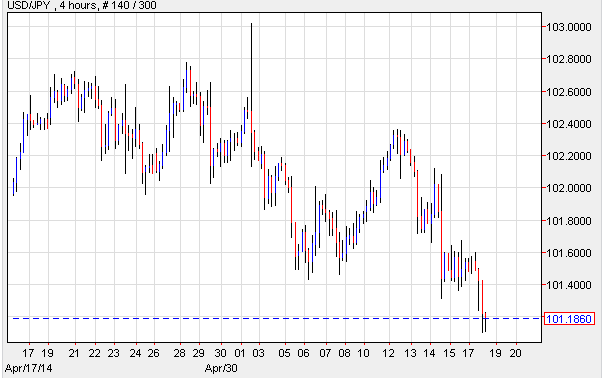

USD/JPY: Yen Fueled By Risk Aversion

Shifts in risk appetite prompted the USD/JPY to decline to the lowest level in three months. Worries over the upcoming general elections in the Ukraine, together with events that took place in Vietnam this weekend, caused investors to opt for safe havens. Disputes over land in the South China Sea between Vietnam and China prompted violent anti-China protests, causing China to take action and send five ships to ensure its citizens are able to leave Vietnam safely. On the data front, Japan announced that Core Machinery Orders climbed 19.1 percent in March, rather than the expected 6.0 percent. Analysts believe that business investors placed more orders before a sales tax hike from 5 to 8 percent went into effect.

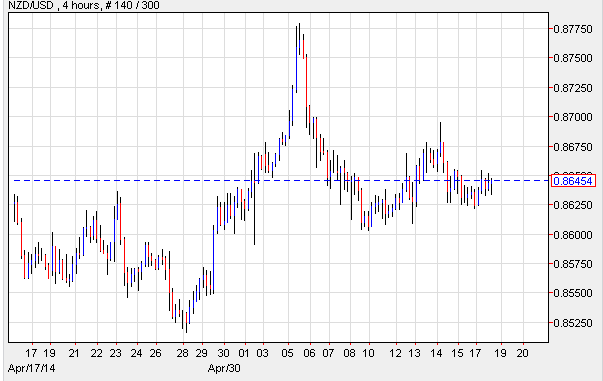

NZD/USD: Little Change During Subdued Trading

Despite subdued trading seen in the market on Monday, the NZD/USD rate made little change. The South Pacific nation reported a higher than anticipated Producer Price Inflation while the appeal for the greenback remained low ahead of the publication of the FOMC minutes. According to the official announcements, Producer Price Inflation Input climbed 1 percent in the first three months of the year, beating forecasts for a hike of 0.4 percent, and subsequent to a decline of 0.7 percent in the final quarter of 2013. PPI Output also increased. The reports showed a 0.9 percent jump, surpassing predictions for a 0.7 percent advance.

Daily Outlook: Today’s economic calendar shows that Japan will report on All Industries Activity, Adjusted Trade Balance and Trade Balance. The U.K. will release CPI and Core CPI, the House Price Index, PPI Input and Output as well as RPI. The U.S. will publish the Redbook. And Australia will announce Westpac Consumer Sentiment and Wage Price Index.