For the 24 hours to 23:00 GMT, the EUR rose 0.30% against the USD and closed at 1.3589. The greenback came under pressure after the Fed slashed its growth estimates on the world’s largest economy by projecting the US economy to register growth between 2.1% to 2.3% this year, down from its earlier forecast of economic growth to be between 2.8% to 3.0%. Separately, the Fed Chief, Janet Yellen, at a press conference, following the central bank’s decision to taper its QE package by another $10 billion, hinted that the US Fed did not foresee the need for raising its short-term interest rates from record lows anytime soon. However, at the same time, she also highlighted the possibility for the central bank to opt for an aggressive pace of interest rate increase in the next year while indicating that policymakers saw good reasons for a faster economic growth in 2015 and 2016.

Meanwhile, in the Euro-zone, data showed that construction output in the region expanded 0.8% (MoM) in April following a 0.6% contraction in the preceding month.

In a noteworthy event, media reports projected the IMF to urge the ECB to undertake additional stimulus measures, including “large-scale” purchases of sovereign bonds, to boost growth and ward off the deflation-risk in the region.

In the Asian session, at GMT0300, the pair is trading at 1.3592, with the EUR trading a tad higher from yesterday’s close.

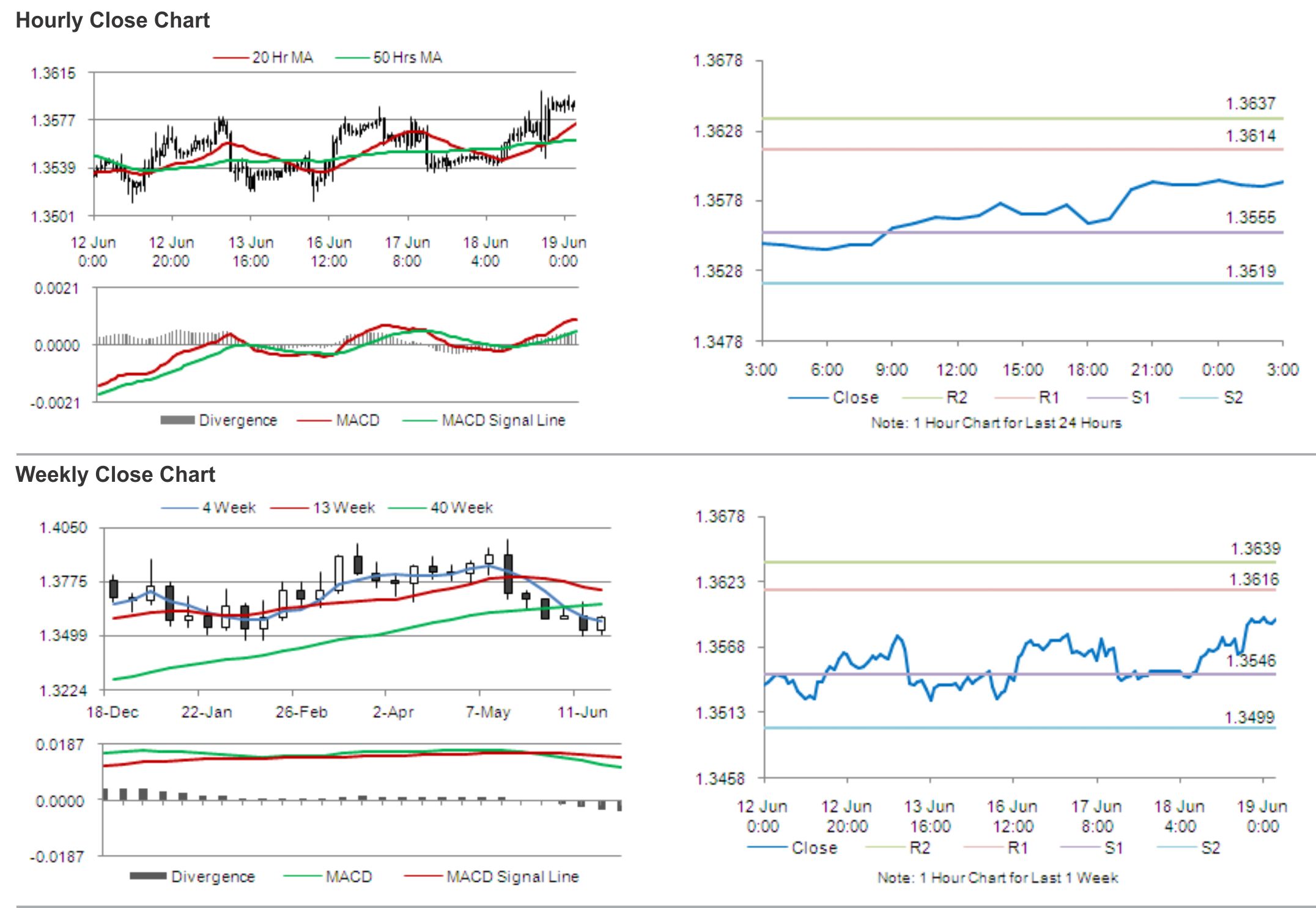

The pair is expected to find support at 1.3555, and a fall through could take it to the next support level of 1.3519. The pair is expected to find its first resistance at 1.3614, and a rise through could take it to the next resistance level of 1.3637.

Amid a lack of major economic releases in the Euro-zone, traders would keep a close tab on global economic news and the US weekly jobless claims data, for further cues in the currency pair.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.