Talking Points:

- The combination of US CPI and the FOMC minutes passed with a slightly more dovish view for the dollar.

- Despite a lower probability of a September Fed hike, the dollar held support while stocks still dropped.

- China market and Greek headlines were also tempting bulls, but falling short of true optimism.

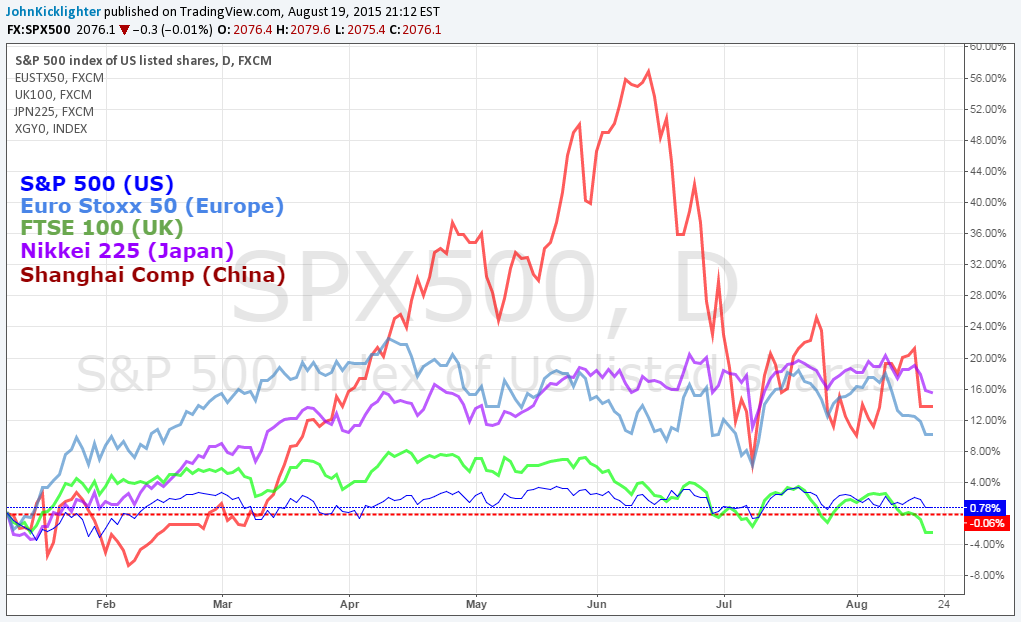

With pairs like AUD/USD and GBP/USD leaning heavily on resistance (dollar support), the FOMC minutes this past session cooled near-term hike forecasts. Despite that bearish fundamental push, neither pair made the effort to clear its technical ceiling. Despite Fed funds futures lowering the probability of a September hike from 26 to 16 percent, the change in timing seemingly hasn't upset the standings of the majors enough to override the seasonal lull that reinforces technical boundaries and encourages range. Meanwhile, China and Greece were once again making the headlines while global equities were facing some unexpected trouble. We look at how the market's have developed in today's trading video.