European economic updates return today after the Easter holiday, including new Eurozone data via the Sentix Investor Confidence Index and industrial producer prices. Later, the monthly estimate of job openings in the US is published.

Eurozone: Sentix Investor Confidence Index (08:30 GMT) Recent economic updates continue to show an improving macro trend for Europe. The revival is still weak, but for the moment the numbers continue to move in the right direction. The latest example: official estimates for the French economy anticipate a moderately stronger growth rate in the first and second quarters of this year relative to previous forecasts.

The national statistics bureau last week raised its outlook slightly, projecting that GDP for Europe’s second-largest economy will tick up to a 0.4% rise in this year’s first quarter. The source of the improvement is partly due to “a one-off rebound in energy production after the mild autumn, and then progress in Q2 by 0.3%” on a quarter-over-quarter basis, Insee reported. By comparison, France’s GDP in last year’s Q4 increased by only 0.1%.

Meanwhile, Now-casting.com’s latest estimate for Eurozone GDP continues to reflect moderately higher estimates for Q1 and Q2. This year’s first quarter growth is on track for a 0.4% quarter-over-quarter rise, according to last week’s update. Meanwhile, Q2’s nowcast has been revised up in recent weeks, reaching a 0.6% quarter-over-quarter advance for the euro-area countries - a solid advance relative to recent European standards.

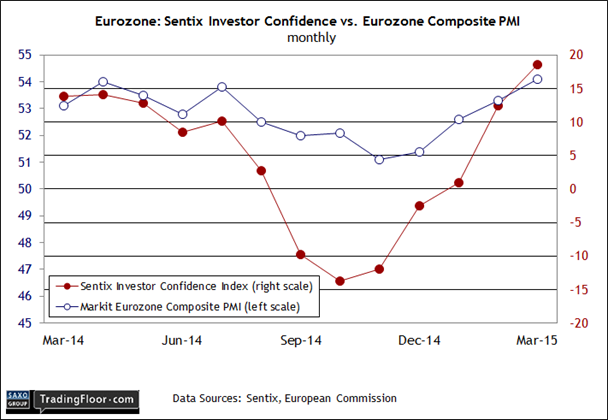

Various sentiment indicators have been anticipating as much, including the Sentix Investor Confidence Index. In the March update, this benchmark climbed to its highest reading since May 2014 and reflected “the continued strong improvement of investors’ six-month expectations which show their highest reading since February 2006”, Sentix noted. With economic forecasters still projecting stronger numbers for Europe these days, today’s update on the mood among investors will likely offer another encouraging round of support for arguing that there’s a modest recovery underway.

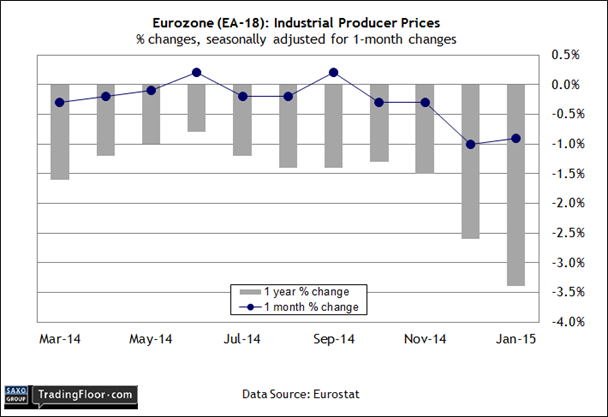

Eurozone: Producer Price Index (09:00 GMT) Deflation fears eased a bit in the March estimate of consumer prices for the countries that share the euro. The European Union’s statistics division advised last week that the consumer price index in March fell 0.1% against the level a year earlier. That's mild compared with a negative 0.3% fall in February and January’s steep 0.6% slide. Deflation is still a real and present danger, but its grip appears to be loosening. The recent updates that point to a return of economic growth strengthen the view that the deflation risk is fading.

Today’s release on producer prices will reflect another test for measuring the positive momentum in the Eurozone. Deflation has been especially potent and persistent in the industrial sector and so the data du jour will be widely read for deciding what comes next. Producer prices slumped a hefty 3.4% on a year-over-year basis in January—quite a bit deeper against the previous month’s 2.6% annual tumble. If the macro profile has turned a corner for the better, there’s no sign of it in industrial prices.

Will today’s February update tell us otherwise? A mix of other economic numbers in recent weeks imply that we’ll see a softer degree of deflation in today’s report. That’s the narrative via consumer prices. A bit of corroboration via the industrial sector would provide another clue in favour of the optimists.

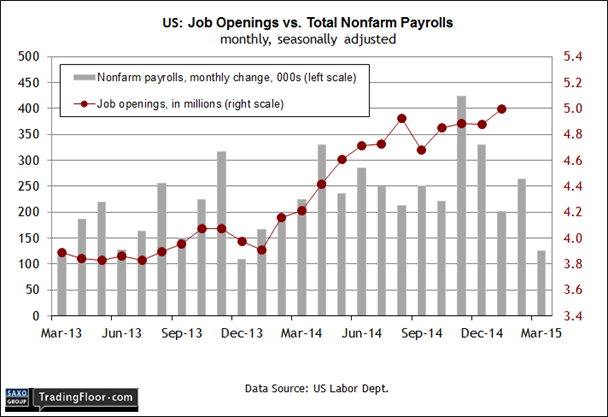

US: Job Openings and Turnover Survey (14:00 GMT) Yesterday’s macro updates for the US offered a mixed message in the wake of Friday’s disappointing news that payrolls in March increased at the slowest pace in more than a year.

The Federal Reserve’s March update of its Labor Market Conditions Index (LMCI) confirmed that last month was a rough ride for payrolls. LMCI, which measures 19 labour market indicators, dropped to its first negative reading in March in 33 months. Meanwhile, the Conference Board (CB) yesterday reported that its Employment Trends Index (ETI) fell slightly last month. “The combination of the disappointing March employment report and the recent weakness in the ETI suggests that the likelihood of a slowdown in employment has increased,” an analyst at CB said. “Even so, it is unlikely that job growth in the second quarter would fall much below the trend of 200,000 jobs per month.”

The outlook for employment looks a bit brighter within the services sector, which accounts for the majority of US economic activity. In the yesterday’s March report of the ISM Non-Manufacturing Index, the headline benchmark ticked down slightly but remains at a level that indicates solid growth overall. Meantime, the employment component for this index increased slightly to a level that’s near a post-recession high. The services sector, in other words, is still minting new jobs at a robust pace.

Today’s update on job openings will help the crowd decide if there’s still a strong degree of momentum bubbling in the labour market generally. That was the message in the last release for January, when the number of job openings jumped to a 13-year high of 4.998 million. Given what we’ve seen in other data sets for the labour market recently, it wouldn’t be surprising to see the pace of openings retreat. But short of a dramatic tumble, new openings that stick close to the five-million mark will provide fresh support for thinking that sluggish numbers for payrolls of late will soon give way to stronger comparisons in the months ahead.

Disclosure: Originally published at Saxo Bank TradingFloor.com