It has been a quiet week for the euro, and that trend has continued today, as EUR/USD is unchanged at 1.0718.

All eyes on ECB

The ECB is poised to end its accommodative policy at today’s meeting, but there is plenty of uncertainty and anticipation ahead of the announcement. The central bank has signalled that it plans to tighten policy but has been short on details. ECB President Lagarde has stated that rates will lift off after its asset purchase programme ends. With a rate hike widely expected at the July meeting, that adds up to QE winding up at the end of June. That still leaves plenty of variables in play. Will the ECB hike by a moderate 25bp or a massive 50bp? What will be the pace of the rate-hike cycle?

As for today’s meeting, a rate hike is unlikely but cannot be ruled out, with inflation continuing to accelerate. If the ECB doesn’t raise rates today and suffices with terminating QE, the driver for euro movement in today’s session will be Lagarde’s press conference. A hawkish tone could give the euro a lift, while if Lagarde sounds more dovish than the markets were expecting, the euro could lose ground.

Key to the size of the rate hike in July will be today’s updated inflation and GDP forecasts. The war in Ukraine and supply bottlenecks make it likely that inflation will be revised upwards and growth downwards. If the inflation report is worse than expected, there will be more pressure on the ECB to consider a 50bp hike in July.

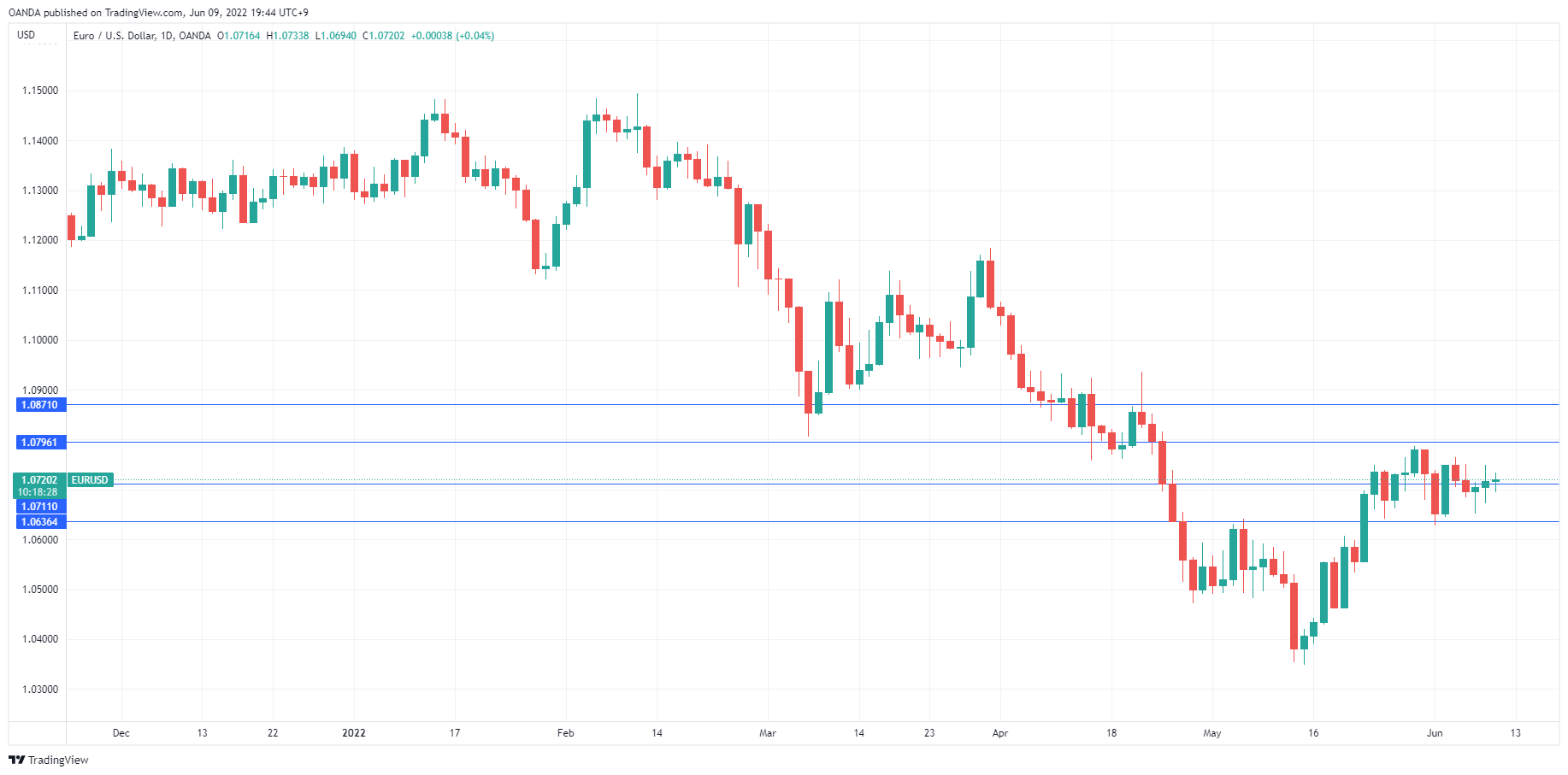

EUR/USD Technical

- EUR/USD faces resistance at 1.0796 and 1.0871

- There is weak support at 1.0711, followed by support at 1.0636