There is a new batch of weak data from China, whose economy has so far failed to respond meaningfully to government stimulus.

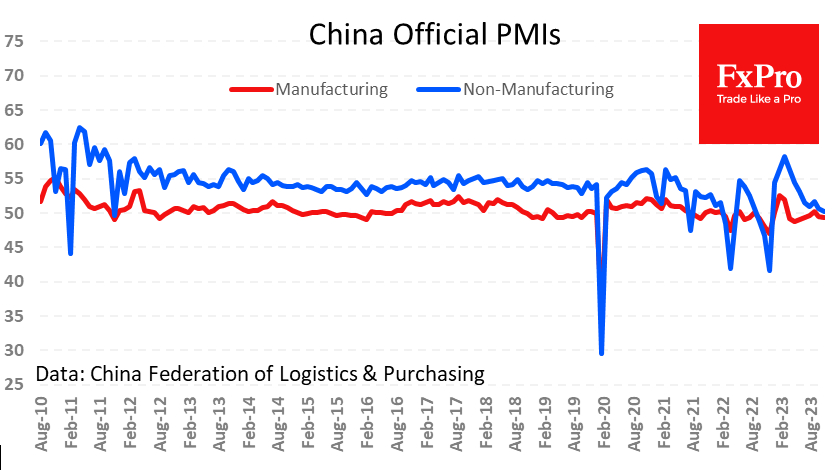

Official PMI (Purchasing Managers’ Survey) estimates noted that the manufacturing sector remained in contraction mode in November, while growth in the services sector approached zero.

The manufacturing PMI fell from 49.5 to 49.4 instead of the expected rise to 49.8. The simultaneous decline in the orders component and purchase prices is alarming. Manufacturing employment is in contractionary territory (48.1 in November and 48.0 in October).

The services PMI fell from 50.6 to 50.2 instead of forecasts of a 50.9 rise, with export sales falling from 49.1 to 46.8 and weakness in employment (46.9 vs. 46.5 previously).

It is clear from such data that the economy’s vivid upturn has not yet occurred. This is causing pressure on the markets where the need to build up support is being discussed.

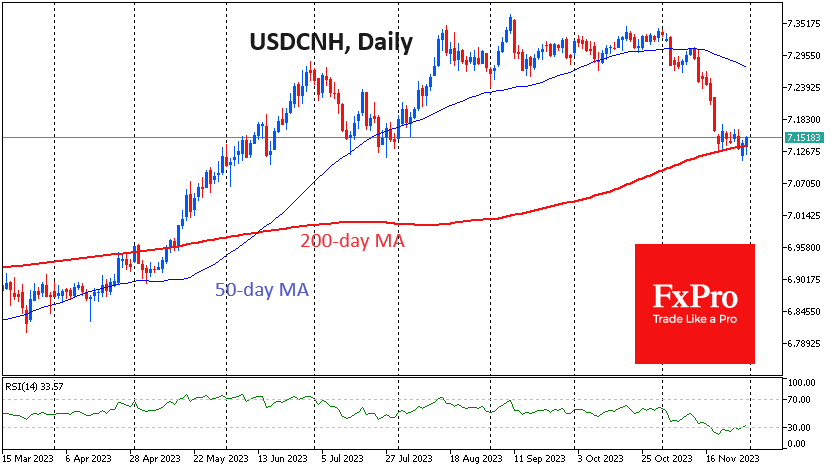

Meanwhile, the USDCNH pair has been moving around 7.1450 for more than a week. Technically, the yuan has found support on the decline towards the 200-day moving average and accumulated oversold on the RSI on the daily timeframes.

This is roughly the same area where the yuan was completing its corrective recovery in July. Therefore, it would not be surprising to see USD/CNH rise in the coming days.

Fundamentally, selling the yuan against the dollar may also make sense due to the weakness in the economy. Managed RMB weakness may be in the Politburo’s interest as a measure to support exports. In addition, China’s price growth rate is close to zero, so the authorities are not afraid of fuelling inflation through a weaker currency.

The FxPro Analyst Team