Deutsche Grundstuecksauktionen (DE:DGRG) (DGA) posted robust H119 results (albeit somewhat below the strong H118 levels), despite lower transaction volumes in the broader German real estate market. We believe that buoyant investment demand, fuelled by the persistent low interest rate environment, which limits the selection of attractive investment alternatives, should support future performance. DGA continues with its generous dividend policy and recently paid a dividend of €1.00 per share.

High comparative base

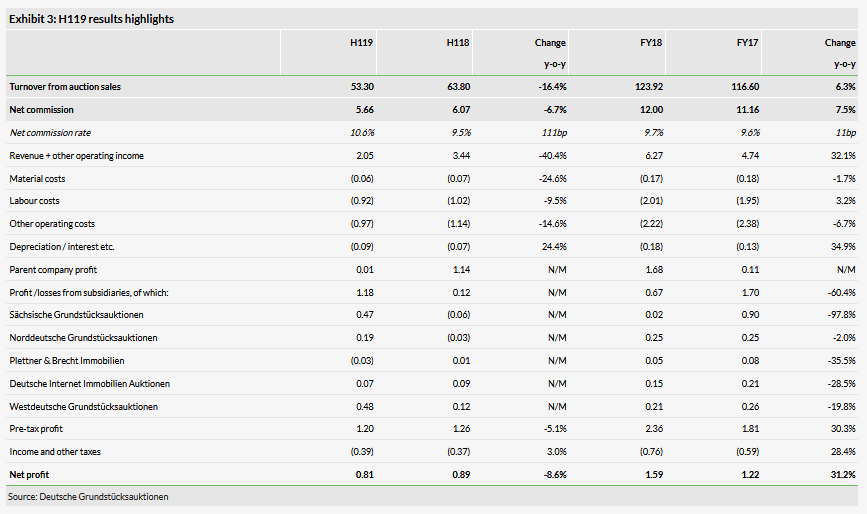

DGA’s net commission income declined 6.7% y-o-y to €5.66m in H119 on the back of the lower value of sold properties (down by 16.4% y-o-y to €53.3m). However, this is mainly due to a large transaction of €15.2m completed in Q118. In Q219 alone, the company’s net commission income improved 17% y-o-y to c €3.1m. We acknowledge the solid net commission rate of 10.6% in H119, which is ahead of H118 at 9.5% and DGA’s five-year average of 10.1%. As a result of a slightly higher tax charge, DGA reported a decline in net income of €8.6% y-o-y to €0.81m (or c €0.51 per share).

Guidance confirmed despite lower new admissions

DGA’s management reiterated its FY19 guidance with respect to the turnover of sold properties of €109m, in line with its five-year average. This is despite the expected drop in orders from the Institute for Federal Real Estate and Bodenverwertungs- und verwaltungs (BVVG) in H219. The acquired admission volume across the DGA group for Q319 is €23.7m, which is some 10% below last year. However, management still believes that it may be able to achieve Q318 results, partially on the back of a stronger brokerage business. Moreover, DGA expects that the Institute for Federal Real Estate and BVVG are likely to launch a new tender offer covering 2020 and beyond.

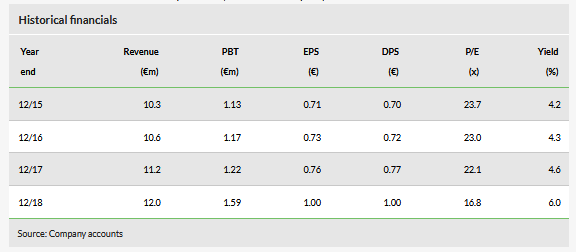

Valuation: An interesting dividend play

Based on FY18 EPS of €1.00, DGA’s shares currently trade on a P/E ratio of 16.8x. DGA has been a regular dividend payer over the last 20 years, with its last payout of €1.00 per share representing a dividend yield of c 6.0%. This is well ahead of the German small-cap market (no direct listed peer).

Edison Investment Research provides qualitative research coverage on companies in the Deutsche Börse Scale segment in accordance with section 36 subsection 3 of the General Terms and Conditions of Deutsche Börse AG for the Regulated Unofficial Market (Freiverkehr) on Frankfurter Wertpapierbörse (as of 1 March 2017). Two to three research reports will be produced per year. Research reports do not contain Edison analyst financial forecasts.

H119 results: Holding up quite well

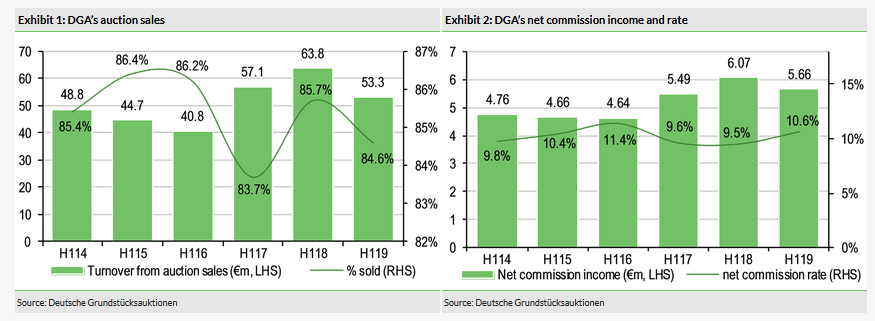

DGA and its subsidiaries were able to sell 790 properties worth €53.3m during auctions in H119, which represents a 16.4% y-o-y decline from €63.8m generated on 802 properties in H118. The decrease in value does not come as a surprise and mostly resulted from a high comparative base associated with a large one-off €15.2m transaction completed in Q118 (related to a commercial property in Berlin-Marzahn). Excluding this deal, DGA’s turnover was c 11% ahead of its five-year average (calculated on first-half results in each year). This was largely driven by the higher unit price per property, as the number of sold properties declined from a five-year average of 889 units. We believe this may be at least partially associated with the overall lower supply of properties currently available for sale in Germany. In total, the company sold 84.6% of the properties offered at its auctions in H119, slightly below the H118 level of 85.7% and a five-year average of 85.5% (see Exhibit 1).

The above transaction volume includes 106 properties worth €3.6m sold on behalf of the German Institute for Federal Real Estate (visibly below the €21.5m in H118), as well as properties valued at €1.4m sold on behalf of BVVG compared with €1.6m in H118. In total, the value of properties DGA sold on behalf of the German government and associated public institutions (referred to as institutional clients) stood at €6.8m (vs €24m in H118).

DGA’s adjusted net commission income reached €5.7m and was down only 6.7% y-o-y, as the company was able to achieve a healthy net commission rate of 10.6%, which was ahead of 9.5% in H118 and above the five-year average of 10.1% (see Exhibit 2). In Q119 alone, net commission income was down c 26% to €2.5m due to the above-mentioned large deal last year but increased 17% y-o-y in Q219 to c €3.1m. During Q219, the parent company saw a mild decline in property volumes and commission revenue, while three of its subsidiaries (responsible for Northern Germany, Western Germany and Saxony) recorded a considerable increase in the value of sold properties and in turn commission income. Plettner & Brecht Immobilien (DGA’s property broker and auction house in Berlin) saw auctions at last year’s level but experienced a decline in the brokerage business. We understand that this is at least partially associated with ongoing regulatory headwinds in Germany’s capital city (discussed below). Meanwhile, DGA’s internet auction business recorded one of its best quarters historically, both in terms of property volumes and commission revenue. Having said that, it remains a relatively small contributor to group results.

DGA’s figures may reflect the broader market trend, with a 12% y-o-y decline in transaction volumes in the German real estate market in H119 to c €32.2bn (according to JLL). However, we note that transactions concluded through auctions similar to those run by DGA represent a minor part of the overall real estate investment market in Germany. Moreover, the broader market decline is from a high comparative base, as last year was strong for the German residential investment market. Based on JLL data, we estimate that H119 volumes are still c 3% ahead of the five-year average. Furthermore, the lower transactional activity may be at least partially explained by the insufficient supply of properties for sale (with demand holding up well).

We note that DGA’s financial statements are in accordance with German accounting standards (HGB). DGA, the parent company, is influenced to a considerable extent by the results of its five fully owned subsidiaries, but is not obliged to present consolidated accounts and management reports. As a result of profit transfer agreements, the group’s total result is therefore shown in the statements of the parent company. Consequently, for the sake of clarity we show (shaded below) both gross turnover (auction sale proceeds) and net commission at group level, as these drive the transferred profits. They are also regarded by management as key indicators. However, they are, of course, only proxies for the subsidiaries’ revenue, which is not disclosed, so accurate top-line analysis is not possible.

Transaction volume guidance for FY19 maintained

Net commission income in H119 was ahead of management expectations, which bodes well for H219. Having said that, the acquired admission volume across the DGA group for Q319 stands at €23.7m and is lower by around 10% compared to last year (€26.4m). Management anticipates a decline in orders from the Institute for Federal Real Estate and BVVG in the second half of the year, but expects a new tender offer covering 2020 and beyond to be organised in 2019. However, we understand that visibility on this is limited at the moment. Nevertheless, DGA believes that the guided sales volume from institutional clients of €15m is achievable. Overall, management believes it may be able to repeat the Q318 results, partly because of expected stronger activity in the brokerage business. Hence, it has also confirmed its guidance for FY19 transaction volumes of €109m (in line with the five-year average).

Continued solid demand for German properties, a healthy letting market and the ECB’s accommodative policy suggest that a hard landing scenario in the property market is relatively unlikely, especially in the near term. That said, the attractiveness of investments in residential properties in Germany is somewhat impaired by discussions around regulatory caps on rental growth and expropriation (including for instance the current rental cap trial in Berlin).

Valuation

With no direct peers listed on the Frankfurt Stock Exchange, we look at the iShares MSCI Germany Small-Cap ETF, which seeks to track the performance of an index composed of small-cap German equities. This shows a P/E ratio of 13.2x based on the last reported financial year (DGA at 16.8x) and 12-month trailing yield of 3.12% at end-July 2019 (vs the current DGA yield of 6.0%). As noted above, the history of a sustained and attractive dividend should be supportive of the shares.