Datron AG (DE:DARG) has accompanied news of 23% lower EBIT in H119 with a full-year profit warning. While the former was not unexpected, given a bumper comparative, previous guidance that profit would be H2-oriented may no longer be the case owing to worsening conditions (estimated industry order intake down 17% for 2019) and order delays in DATRON’s key domestic and US markets. Management now expects 2019 revenue of c €55m vs its May 2019 guidance of €60m and EBIT between €4m and €5m (originally €6m). It remains confident that, as in H119, investment-led growth, supported by strong finances, will continue to drive clear market outperformance, especially by its premier CNC milling machines.

H119: New product interest

An apparently lacklustre H119 outturn (flat revenue and EBIT down by a quarter) should be seen in context. ‘Very positive’ results (a near-doubling of adjusted EBIT and a double-digit percentage rise in sales) made H118 a hard act to follow. This was compounded by a sharp and rapid deterioration in H119 market conditions, which saw order intake fall by c 20%, according to industry association VDW. To its credit, DATRON bucked this trend with export-led new orders up 8% (domestic down just 5%), confirming the appeal of its new CNC high-speed milling (HSM) machines, DATRON neo and M8/MLCube, which all but maintained unit sales. With material and labour expenses on a tight rein (down 4%), EBIT would also have held steady but for €0.5m higher marketing and investment costs, a testament to the company’s ambitions. Finances remained sound (net cash €7.5m at period end).

Reduced full-year expectations

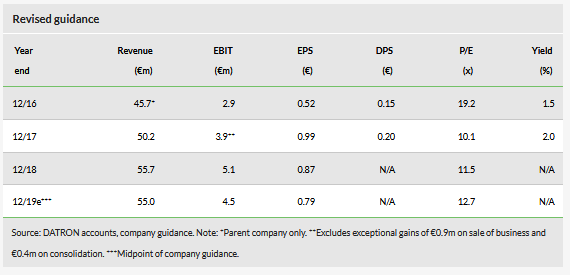

The guidance for 2019 has been revised, as described, in the light of new cautious market outlook. EBIT is now expected to be €4–5m (previous guidance €6m). This breadth of range with associated uncertainty is epitomised in Q3’s outlook, eg EBIT either to halve or rise by 50%. Also, broker forecasts have yet to be revised.

Valuation: Likely consolidation

Despite a sharp price decline post-profit warning, 2019e P/E of c 13x on midpoint revised guidance suggests a discounting of assumed strong long-term prospects, evident in continued intensive marketing and international growth ambition.

Edison Investment Research provides qualitative research coverage on companies in the Deutsche Börse Scale segment in accordance with section 36 subsection 3 of the General Terms and Conditions of Deutsche Börse AG for the Regulated Unofficial Market (Freiverkehr) on Frankfurter Wertpapierbörse (as of 1 March 2017). Two to three research reports will be produced per year. Research reports do not contain Edison analyst financial forecasts.

Review of H119 results

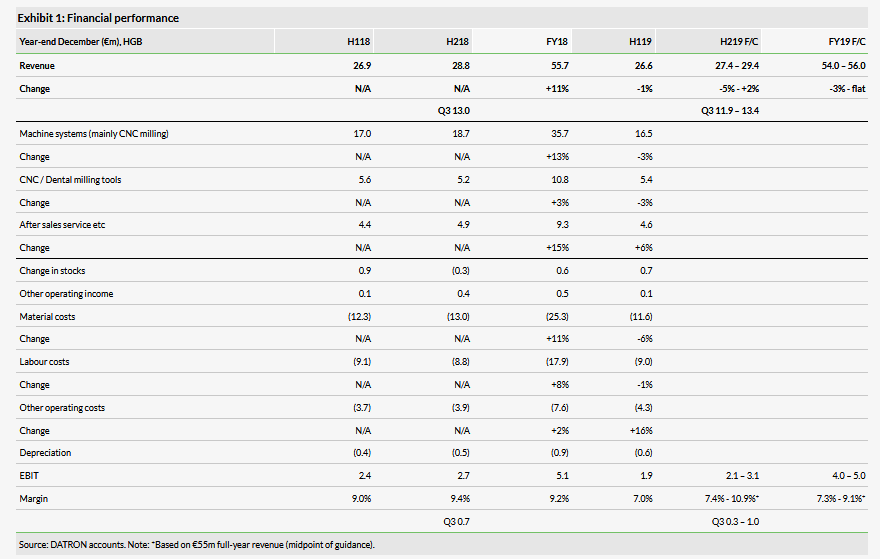

Exhibit 1 highlights a clear slowdown in total revenue (down 1% after double-digit percentage growth in the last two years). Fortunately, there was little expansion of the cost base, so the impact at the EBIT level was curbed, if still significant (down 23%). While the fall in material costs reflected a change in sales mix to higher-margin products, labour expenses were checked despite continued corporate growth, ie its Q1 Slovakia/Czech acquisition and initial full operation of the specialist tool technology business. On the other hand, other operating costs rose sharply, mainly because of participation in leading trade fairs IDS (Cologne) and EMO (Hannover) and investment in IT systems, and depreciation was boosted by DATRON Tool Technology’s new machinery.

Order inflow was up 8%, which is impressive in challenging circumstances. This increased the book/bill ratio to 1.01x vs 0.92x y-o-y.

H119 saw the expected resumption of growth in the international share of order intake (53% vs 46% y-o-y), thanks both to its own buoyancy (up by a quarter) and a subdued domestic performance (down 5%). This is in line with the company’s longstanding expansion; 2018’s skew towards Germany was rather a matter of timing, as particular domestic strength (sales up by a quarter) coincided with delays in completing certain overseas contracts. While the US, DATRON’s largest market after Germany, was unchanged, there was a notable increase in new orders in Asia, as well as growth from France and Benelux, which offset UK weakness (EU order intake up 11% in the period).

In terms of divisional analysis, previous machine segments CNC milling, dosing and dental are now shown as a single division, Machine systems (see Exhibit 1). The 3% revenue fall in H119 was driven by its main constituent, CNC milling (down 9%), which may be unsurprising, given the challenges. The tools business was also down slightly. The expanded installed base of machines (principally, CNC milling) continued to help drive higher after sales and other revenue (up 6%).

H219 caution

Given unfavourable macro factors, revised midpoint guidance is for a further 1% decline in revenue in the second half. Industry association VDW has newly forecast a market fall of 2% for the full year, with order intake down 17%. However, DATRON is at pains to point out that it sees opportunity to outperform, as was clearly the case in H1. This is due in particular to increasing market acceptance of the (r)evolutionary machine control DATRON ‘next’ and the high-performance CNC milling machine MXCube, launched in Germany this year. The company also remains positive about the Tools and After Sales divisions.

Costs, notably labour and investment, also remain an issue in H2 because of the projected development of the company.

The speed of market deterioration may explain the breadth of guidance, with H2 EBIT now expected between €2.1m and €3.1m (€2.7m in H218).