The U.S. Dollar gained against several of the majors as investors speculated whether the U.S. Jobs reports would show an increase in hiring. Metrics issued on Wednesday revealed that New York State Manufacturing rose at the quickest pace since 2012 this month due to a hike in new orders. Separate economic releases indicated that Producer Prices climbed at the fastest pace in six months. With signs denoting economic growth, Japan’s biggest brokerage firms raised forecasts that the greenback will trade at 114 rather than the previously estimated 110 versus the Yen. The greenback pared gains on Thursday morning after releases confirmed that the Consumer Price Index rose 0.3 percent; this was the largest increase since June. And according to the Department of Labor, Claims for Unemployment fell by 2,000 to 326,000 in the week that concluded on January 11. While the numbers show a dip in claims, they still represented overall weakness for the Employment sector. Gold dipped to the downside as market traders awaited the highly anticipated Jobs reports. Gold Futures for February delivery traded at $1,235.90 a troy ounce on the Comex. The upbeat releases of Wednesday bolstered optimism the U.S. economy is recovering steadily, despite the lackluster Non-Farm Payroll announcements of last week.

The European Central Bank indicated that it has not yet reached a decision on whether to require financial institutions to maintain a capital buffer of 6 percent when undergoing a stress test. ECB President Mario Draghi stated that the bank would issue an official announcement once a consensus is reached. The central bank wants to make certain that the E.U. does not revert back to the kind of financial turmoil the region went through in 2013. The Euro surged versus the greenback as bank member Jens Weidmann suggested that deflation is no longer a problem and intimated that downside risks remain “limited.” His comments followed a release which showed that Consumer Inflation stayed below the bank’s 2 percent target. While the Euro rallied to the upside, it had a tough time inching higher as demand for the Dollar remained strong following Wednesday’s stellar economic fundamentals. The British Pound slumped to a three-week low versus the U.S. Dollar as the gauge which measures Home Prices in the U.K. showed a drop for the last month of 2013. The data fueled speculation that economic recovery in the U.K. is cooling off. The Sterling also depreciated against the Euros.

The Yen extended further losses despite positive news which confirmed that Core Machinery Orders went up in Japan as demand rose in anticipation of the upcoming April sales tax increase.

Lastly, in the South Pacific, weaker than predicted Employment figures drove the Australian Dollar down. The currency remained under pressure as the underlying details of the report were also negative, indicating a big drop in full-time employment. According to analysts, the slowdown of the Aussie economy can be attributed to China’s decision to make changes to its economic growth strategies. China stated that it will focus its efforts on domestic demand rather than on manufacturing. And with the dip of exports to China, Australia has revealed a decline in the Current Account. The Reserve Bank believes that by trimming the key cash rate it may be able to bolster growth. However, this could be a dangerous move as the housing market could benefit further from low rates, but create a bubble. New Zealand’s Dollar also edged lower against its U.S. peer as the data out of the U.S. benefitted demand for the latter.

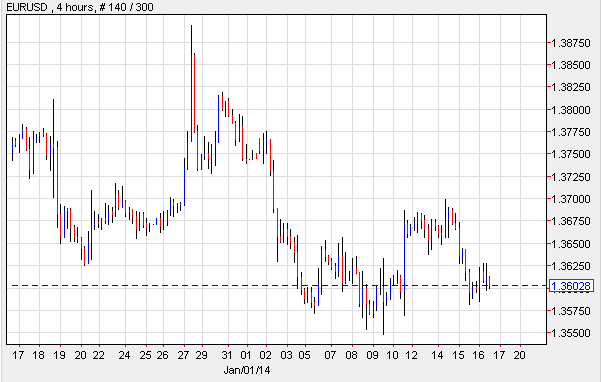

EUR/USD- Deflation Not A Concern

The Euro climbed versus the U.S. Dollar as Jens Weidmann, who heads the German Bundesbank, issued a series of comments suggesting that deflation only poses a minor risk to the region. Mr. Weidmann’s comments came after Eurostat confirmed that Consumer Price Inflation went up 0.8 percent on a YoY basis in December, remaining below the target 2 percent. Meanwhile, ECB President Draghi stated that the bank would announce more details about the stress test it will use to assess the health of the regional banking system. The bank will also unveil the type of capital thresholds it will establish, and will then issue the data along with recommendations so that banks can correct the shortfalls and avoid another financial crisis such as the one experienced in the past year.

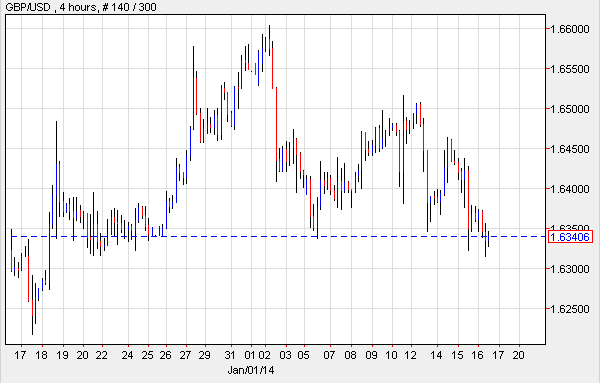

GBP/USD- Home Prices Slump

The British Pound went down against the U.S. Dollar, reaching a three-week low after the Royal Institution of Chartered Surveyors indicated that the gauge which indicates the progress of Home Prices in the U.K. dropped from 58 to 56. On a positive note, the gauge which measures how prices will fare over the upcoming three months went up to the highest level in almost 15 years. However, the Surprise Index fell to -9.1; any negative reading suggests that recent economic reports point to economy slowdown. With this in mind, Mark Carney, the central bank’s governor, suggested that the Bank of England may hold off on raising the interest rate.

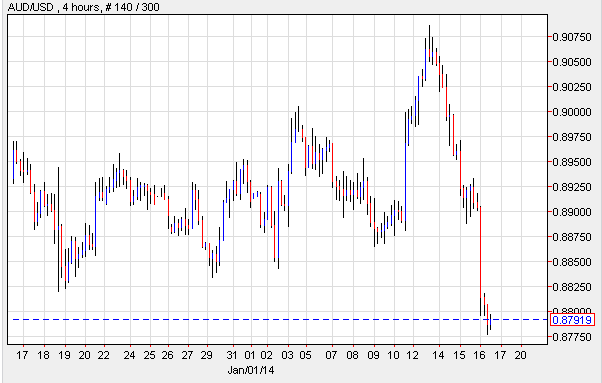

AUD/USD- Aussie Impacted By Employment

Australia’s Dollar plunged against the U.S. currency as official reports showed that Jobs fell by 22,600 in December, after posting a modified 15,400 increase one month prior. Furthermore, the rate of Unemployment continued at 5.8 percent, marking a four-year high. According to the release, full-time employment slipped by 31,600 and the overall drop in job participation prompted the rate of joblessness to remain unchanged rather than inch higher. In light of the metrics, investors anticipate that the Reserve Bank of Australia will refrain from reducing the benchmark interest rate as it could spur a real estate bubble.

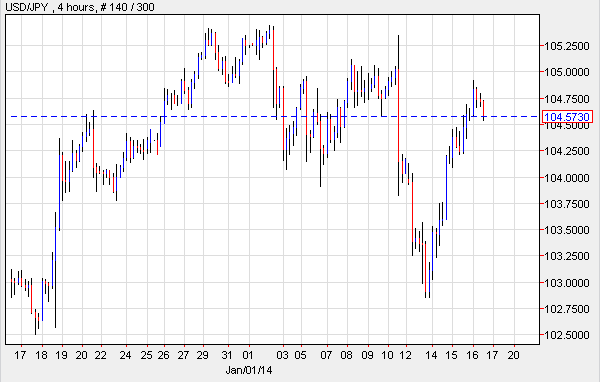

USD/JPY- Yen Expected To Depreciate

While Japan continues to offer positive economic reports, investors are predicting that the Japanese monetary unit will slump further versus the U.S. Dollar. Some speculators believe that the currency will be impacted by the sales tax increase which will go into effect in April. Meanwhile, on the data front, Japan’s Money Supply M2 rose 4.2 percent, which fell slightly short of the expected 4.5 percent hike. Furthermore, the Machine Tool Builders Association stated that orders jumped 28 percent in the year up until December 2013, up from the previously posted 15.4 hike. The announcement brought volatility to the currency exchange, though the greenback advanced versus the Yen, as demand for the American Dollar was high.

Today’s Outlook

Today’s economic calendar shows that Japan will report on Household Confidence. Switzerland will announce PPI. The U.K. will issue Retail Sales and Core Retail Sales. The U.S. will release Housing Starts, Building Permits, Industrial Production and the Michigan Consumer Sentiment. Lastly, China will publish data on House Prices.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Daily Report: EUR/USD, GBP/USD, AUD/USD And USD/JPY : January 17, 2014

Published 01/17/2014, 05:32 AM

Updated 09/16/2019, 09:25 AM

Daily Report: EUR/USD, GBP/USD, AUD/USD And USD/JPY : January 17, 2014

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.