Investing.com’s stocks of the week

As many Americans had an early celebration of the Independence Day, finally crude oil (WTI) closed below the low of May and June, around $57.50/barrel on Friday, July 3rd. Ever since the price of crude oil dropped from its highest peak at around $107.65/barrel beginning July last year, it has dropped for 7 consecutive months without any sign of recovery, thanks to OPEC, which refused to cut production in a valid argument of controlling market share.

If OPEC reduces production, then price will stabilize, but at the expense of OPEC's 12 members' market share. Countries that are non-OPEC members, like Russia and Canada, will benefit and therefore, OPEC members, with all their determination, hang on to the glide, and Iran even said they are prepared to go to $20/barrel.

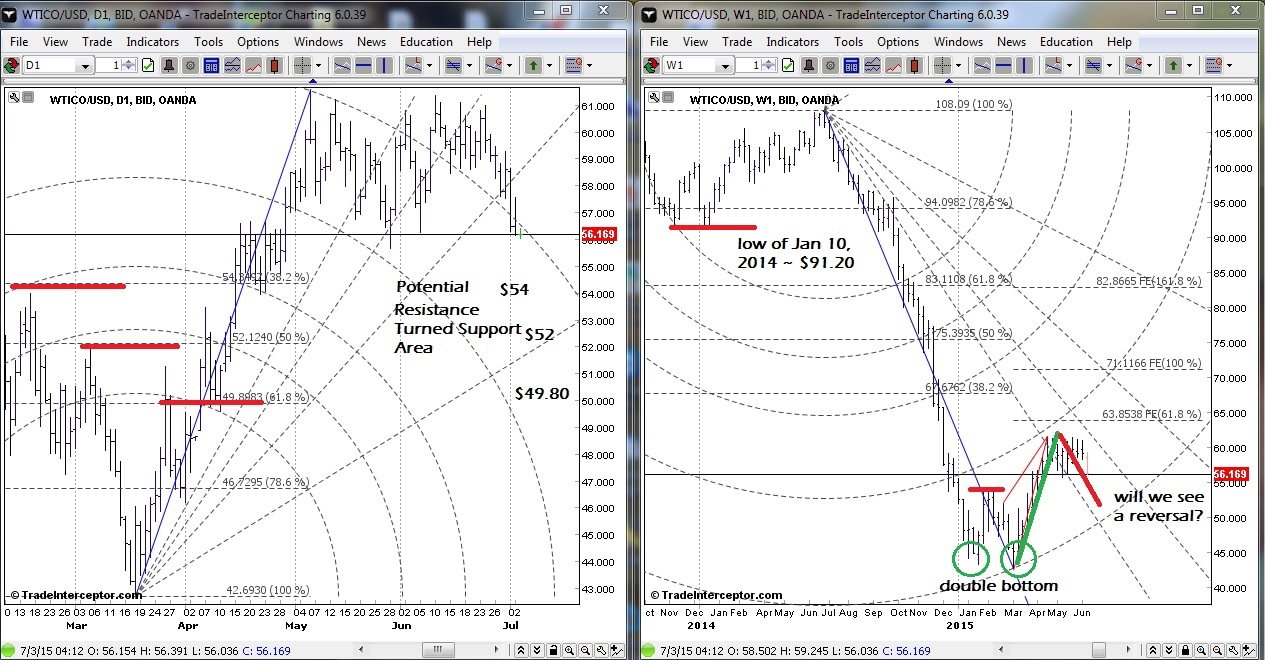

Finally, in early January to early March, sellers started to consolidate their positions, and in mid-March, fresh buyers started to come in, and the market rallied for 10 consecutive weeks, and closed April with a bullish marubozu. The crash halted and consolidation began again in May and June, as we can see on the daily chart, and created the first leg up.

From the weekly perspective, we are seeing a potential double bottom and potential reversal area around $54 to $49.80, if price ever gets there. If we see a strong reversal pattern like a hammer, morning star, or even 3 white soldiers on the weekly and/or daily timeframe, then we are keen to go long.

Fundamentally, one factor that could propel oil price back up is the coming winter and the expected "climate chaos," as jointly announced by US Secretary of State Mr. John Kerry and French Foreign Minister Mr. Laurent Fabius back in May last year, whichever comes first.