Weekly CFTC Commitment of Traders Crude Oil Report

CFTC COT data shows speculator’s oil bets rose last week

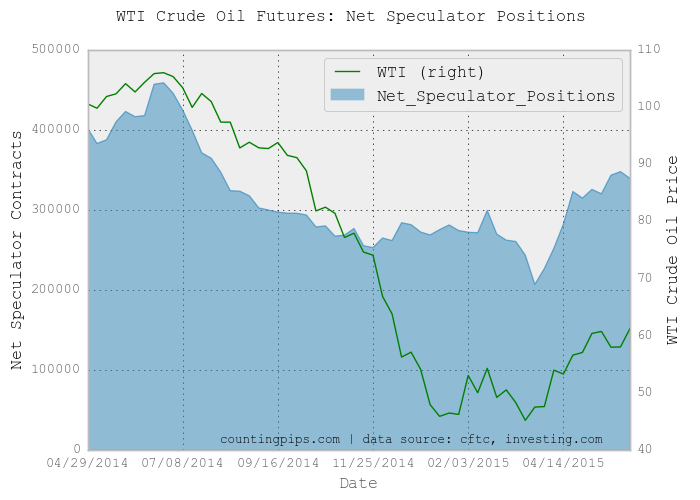

WTI Crude Oil Non-Commercial Positions:

Futures market traders and large oil speculators reduced their overall bullish bets in WTI oil futures last week for the first time in three weeks, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial contracts of crude oil futures, traded by large speculators, traders and hedge funds, totaled a net position of +339,518 contracts in the data reported for June 2nd. This was a change of -8,473 contracts from the previous week’s total of +347,991 net contracts for the data reported through May 26th.

For the week, the standing non-commercial long positions in oil futures decreased by -7,551 contracts and combined with the short positions that rose by +922 contracts to total the overall weekly net change of -8,473 contracts.

Over the same weekly reporting time-frame, from Tuesday May 26th to Tuesday June 2nd, the WTI crude oil price advanced from $58.03 to $61.26 per barrel, according to Nymex futures price data from investing.com. Brent crude prices, meanwhile, traded higher for the week from $63.72 to $65.49 per barrel from Tuesday May 26th to Tuesday June 2nd, according to price data from investing.com.

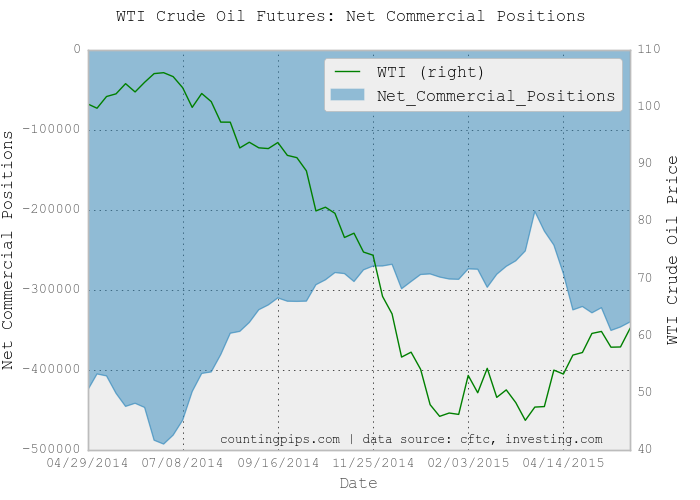

WTI Crude Oil Commercial Positions:

In the commercial positions for oil on the week, the commercials (hedgers or traders engaged in buying and selling for business purposes) decreased their existing bearish positions for a 2nd week to a net total position of -339,955 contracts through June 2nd. This is a weekly change of +6,263 contracts from the total net amount of -346,218 contracts on May 26th.

Last 6 Weeks of Trader Positions

| Date | Open Interest | Specs Long | Specs Short | Com Long | Com Short | Net Com | Com Chg | Net Specs | Specs Chg |

| 04/28/2015 | 1717417 | 521704 | 206860 | 574587 | 895204 | -320617 | 4227 | 314844 | -8248 |

| 05/05/2015 | 1750082 | 530764 | 205058 | 597211 | 925721 | -328510 | -7893 | 325706 | 10862 |

| 05/12/2015 | 1731678 | 512443 | 192231 | 604581 | 926687 | -322106 | 6404 | 320212 | -5494 |

| 05/19/2015 | 1621198 | 504615 | 161184 | 542015 | 892555 | -350540 | -28434 | 343431 | 23219 |

| 05/26/2015 | 1614397 | 502001 | 154010 | 534528 | 880746 | -346218 | 4322 | 347991 | 4560 |

| 06/02/2015 | 1651499 | 494450 | 154932 | 541163 | 881118 | -339955 | 6263 | 339518 | -8473 |

*COT Report: The weekly commitment of traders report summarizes the total trader positions for open contracts in the futures trading markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators)