Since the Federal Reserve last month effectively paused their tightening program – markets have calmed considerably. Thus investors are back shorting volatility since they expect smoother days ahead.

In other words, investors feel confident enough to again to go back to picking up nickels and dimes in front of a steam roller. . .

That’s because – as rogue economist Hyman Minsky taught us with his Financial Instability Hypothesis (FIH) – periods of complacency are the seeds for future turbulence. (And vice versa). Therefore, this peace and quiet is one of the biggest risks in the market today. And the longer it goes on for, the more violent the whiplash will be.

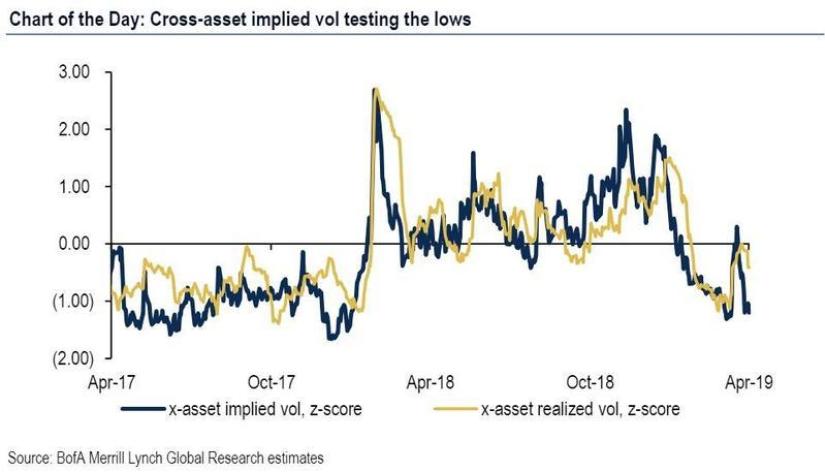

According to Bank of America Merrill Lynch (BofAML), there’s exceptionally low volatility across many assets. (Further, I wrote a piece recently highlighting the extremely low implied volatility in currency markets).

Note that we haven’t’ seen such low levels of volatility across multiple assets since before the ‘vola-pocalypse’ in February 2018. (The ‘vola-pocalypse’ was when Wall Street’s favorite trade – shorting volatility – suddenly blew up. That sent global markets into a frenzy).

It’s clear that shorting volatility has become a ‘crowded traded’ again (an asset class or investment theme that has attracted an unusually large number of market participants). And I consider that a ‘tipping point’.

Because even a minor market ‘surprise’ (aka a black swan) in any one asset could send volatility surging across many assets. (Just as the chart above shows). That’s because cross-asset correlations are extremely high today (because of algorithms and leverage).

Meaning: a sudden spike of volatility in Italian government bonds could cause a spike of volatility in U.S. equities or Chinese corporate bonds. Now, to guess where and when the black swan will show up is the million-dollar question. And one that I don’t plan on trying to answer.

Instead, I will just take what I learned from both Minsky and the former-trader-turned-philosopher, Nassim Taleb, with his concept of ‘antifragility’ (to gain from disorder). And position for positive asymmetry (low risk, high reward) while I wait for a spike in turbulence.

Thus, rather than shorting volatility (which is already at very low levels), I think betting on high volatility offers better upside with much less risk. Or put another way – I’d rather profit from coming the high-volatility instead of being killed by it. Because as we learned from Minsky’s FIH , periods of low volatility are the seeds for future high volatility. (And vice versa).

Therefore, at this time, it makes sense to take advantage of the crowd shorting low volatility. And go long assets that benefit from periods of high volatility and market turbulence. Stay tuned.