While most of the world’s attention has been on the China market meltdown and the Greek debt showdown, closed-end bond funds have quietly been priced to deliver solid total returns over the next 12-18 months. To take advantage of this pricing, I have carved out an 8%-10% allocation to closed-end bond funds in my Dividend Growth Portfolio.

With the Fed’s looming rate hike casting a shadow over the bond market, many high-quality closed-end bond funds are trading at their deepest discounts to NAV since the 2013 “taper tantrum,” and some are approaching levels last seen during the 2008 meltdown. Starting at these levels, I expect a portfolio of closed-end bond funds to deliver total returns (income + capital gains) of 15%-20% over the next 12-18 months.

With any closed-end mutual fund, you have only three potential drivers of returns:

- Current income: Closed-end bond funds generally pay monthly distributions earned from bond interest and stock dividends.

- Capital appreciation of portfolio: As with any mutual fund or ETF, the underlying portfolio value will rise or fall with market conditions.

- Change in discount/premium to NAV: Unlike mutual funds or ETFs, the market price of a closed-end fund will trade at a discount or premium to its underlying net asset value (“NAV”).

In today’s market, I expect all three of these drivers to work to our benefit.

I’ll start with current income. At current prices, many closed-end funds are delivering current yields well in excess of 7% without dipping too heavily into lower-quality junk. These outsized yields are made possible by the discounts to NAV and by the modest amount of leverage the funds use.

Capital appreciation of the portfolio is going to depend on the bond market cooperating. Right now, investors are dumping bonds out of fear of the pending “liftoff” of the Fed funds rate. But with inflation still very low and with lower bond yields overseas acting as an anchor, I don’t expect bond yields to rise much from current levels. In fact, I think it’s very likely that bond yields drift modestly lower from here, which would be a boon to closed-end fund pricing.

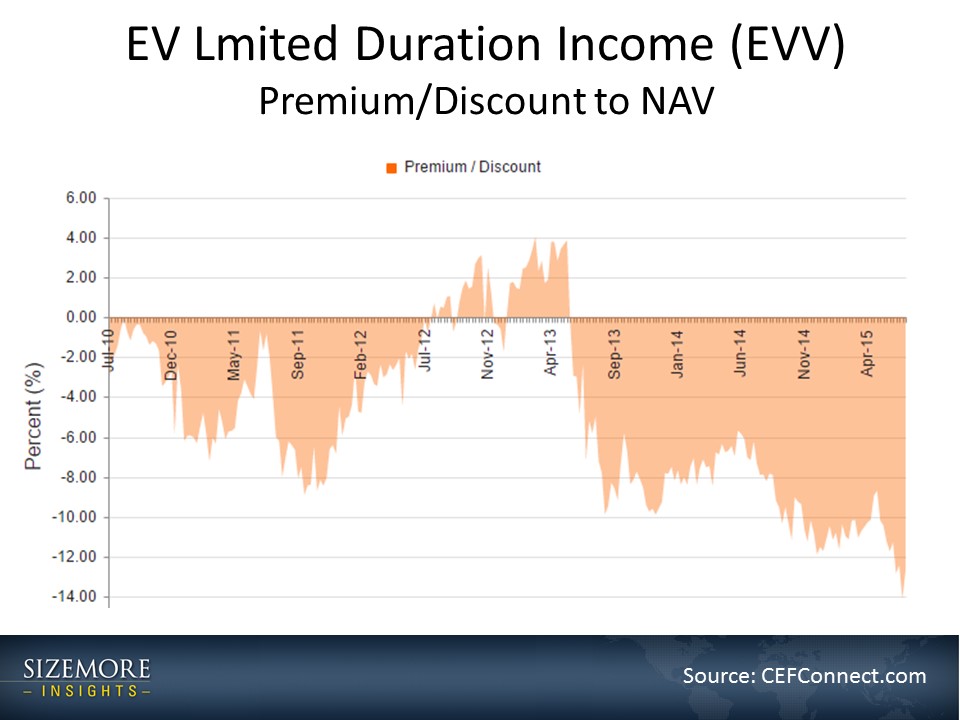

And finally, we get to the discount/premium to NAV. It’s normal for these funds to trade at modest discounts to their NAV. It’s when that discount gets wider (or smaller) than usual that you need to stand up and take note. And today, the discounts are near their widest points in years.

To better explain what I’m talking about, let’s look at an example. I’ve been buying shares of the Eaton Vance Limited Duration Income Fund (NYSE:EVV) in recent weeks. EVV owns a portfolio of bonds and bank loans and yields a very respectable 8.9%. Its portfolio has lost value this year as bond yields have crept higher, yet its market price has fallen much faster than its NAV. As a result, EVV is now trading at its deepest discount to NAV in five years: 12.7%. As recently as two years ago, EVV was trading at a 4% premium to NAV.

What kind of returns should we expect here? Let’s do a little back-of-the-envelope math.

We have the current yield of 8.9%. Assuming no improvement in NAV but that the fund’s discount improves from the current 12.7% to a more reasonable 7%, you’d tack on another 5%-6%. That gets us to just shy of 15% total returns. And if the underlying NAV rallies — and I expect it will — we can get to total returns of 20% pretty quickly.

Are those amazing returns to write home about? No. But are they a lot better than what I expect the broader market to deliver over the next 12-18 months? Absolutely.

Disclosure: Long EVV