China Information Technology Development Limited (NASDAQ:CNIT) has moved to NEUTRAL from UNDERVALUED

It has a Fundamental Analysis Score of 9 and a CapitalCube Implied Price of HKD 0.15

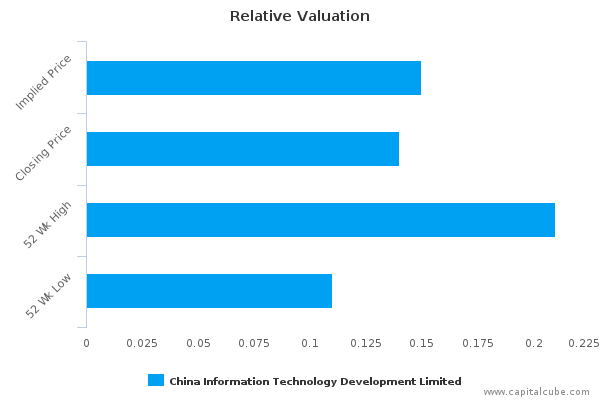

Relative Valuation

China Information Technology Development Limited is currently neutrally valued, as its previous close of HKD 0.14 lies within the CapitalCube estimate range of HKD 0.13 to HKD 0.16. Over the last 52 week period, China Information Technology Development Limited has fluctuated between HKD 0.11 and HKD 0.21.

Company Overview

- Relative underperformance over the last year is in contrast with the more recent outperformance.

- China Information Technology Development Limited's current Price/Book of 3.04 is about median in its peer group.

- 8178-HK's earnings and EBITDA are both negative which suggest that P/E or Price/EBITDA are not meaningful to make this analysis between operating advantage (ROE) and growth expectations (as suggested by P/E or P/EBITDA).

- 8178-HK's relatively low net margins and poor asset turns suggest a problematic operating strategy.

- Compared with its chosen peers, the company's annual revenues and earnings change at a slower rate, implying a lack of strategic focus and/or lack of execution success.

- 8178-HK's return on assets currently and over the past five years has trailed the peer median and suggests the company might be operationally challenged relative to its peers.

- The company's median gross margin and relatively low pre-tax margin suggest high operating costs versus peers.

- 8178-HK's earnings and EBITDA are both negative which suggest that P/E or Price/EBITDA are not meaningful for an analysis between historical growth (using annualized three-year revenue growth) and investor growth expectations (as suggested by P/E or Price/EBITDA) .

- The company's relatively low level of capital investment and below peer median returns on capital suggest that the company is in maintenance mode.

- 8178-HK's operating performance may not allow it to raise additional debt.

Investment Outlook

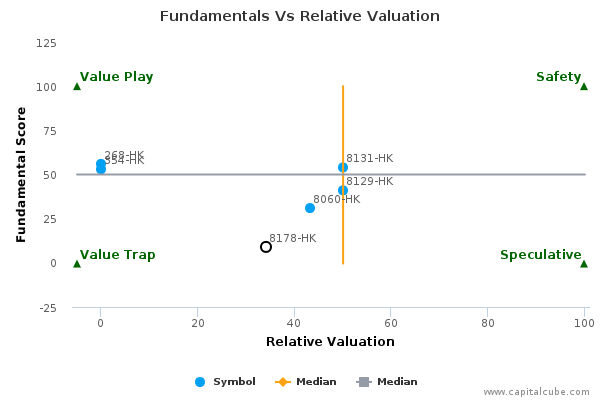

China Information Technology Development Limited has a fundamental score of 9 and has a relative valuation of NEUTRAL.

China Information Technology Development Limited lies at the bottom left quadrant of CapitalCube's Value – Price Matrix. We call this space a Value Trap. At this level, China Information Technology Development Limited is potentially undervalued, since it trades lower than its CapitalCube Implied price of 0.15. However, its fundamental analysis score is also on the lower side at 9, begging the question whether the low price is on account of the weaker fundamentals.

Drivers of Valuation

8178-HK's earnings and EBITDA are both negative.

8178-HK's earnings and EBITDA are both negative which suggest that P/E or Price/EBITDA are not meaningful to make this analysis between operating advantage (ROE) and growth expectations (as suggested by P/E or P/EBITDA).

The company's current Price/Book of 3.04 is about median in its peer group.

Peer Analysis

A complete list of valuation metrics is available on the company page.

Company Profile

China Information Technology Development Ltd. operates as an investment holding company, which engages in the development and sale of computer software and hardware. It operates through the following business segments: Software Development and System Integration & In-house Developed Products. The Software Development and System Intergration segment engages in the sale of computer hardware; provision of software development services and provision of technical support and maintenance services. The In-house Developed Products segment engages in the lease of in-house developed computer hardware. The company was founded on May 24, 2001 and is headquartered in Hong Kong.

Disclaimer: The information presented in this report has been obtained from sources deemed to be reliable, but AnalytixInsight does not make any representation about the accuracy, completeness, or timeliness of this information. This report was produced by AnalytixInsight for informational purposes only and nothing contained herein should be construed as an offer to buy or sell or as a solicitation of an offer to buy or sell any security or derivative instrument. This report is current only as of the date that it was published and the opinions, estimates, ratings and other information may change without notice or publication. Past performance is no guarantee of future results. Prior to making an investment or other financial decision, please consult with your financial, legal and tax advisors. AnalytixInsight shall not be liable for any party's use of this report.

AnalytixInsight is not a broker-dealer and does not buy, sell, maintain a position, or make a market in any security referred to herein. One of the principal tenets for us at AnalytixInsight is that the best person to handle your finances is you. By your use of our services or by reading any our reports, you're agreeing that you bear responsibility for your own investment research and investment decisions. You also agree that AnalytixInsight, its directors, its employees, and its agents will not be liable for any investment decision made or action taken by you and others based on news, information, opinion, or any other material generated by us and/or published through our services. For a complete copy of our disclaimer, please visit our website www.analytixinsight.com.