China Denies GDP Inflated

Chinese GDP came in at 7% beating estimates (not that anyone really believes it, and I sure don't), but the good news stops there.

CNBC reports Shanghai Composite Widens Losses After China GDP.

Asian equities were mixed on Wednesday, with Shanghai stocks deepening losses despite better-than-expected Chinese gross domestic product data.The world's second-largest economy grew 7 percent on year in the April-June period, unchanged from the previous quarter but slightly better than Reuters estimates for a 6.9 percent rise. A spokesperson for the country's statistics bureau insisted that the figure was accurate, denying accusations that it was inflated, Reuters reported. Other data released on Wednesday showed June industrial output and retail sales also beating forecast

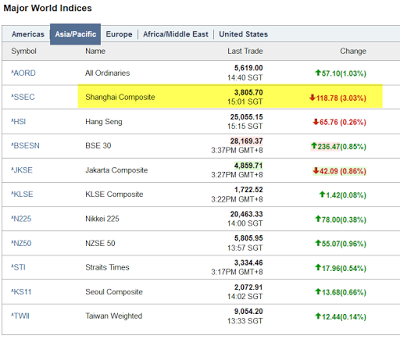

Chinese Stocks Resume Plunge With 3% Slide

The above image captured approximately 2:45AM central.

China Business Outlook Index Drops to Record Low

Markit reports China Business Outlook Index Drops to Record Low in June.

- Optimism towards business activity, new business and employment falls to record low.

- Business revenues and profits forecast to rise at slower rates.

- Inflationary pressures set to ease.

The latest Markit Business Outlook Survey indicated that confidence among Chinese companies declined to a record-low this summer. A net balance of +23 percent of firms expect activity levels to rise over the next year, down from +30 percent in February and the lowest reading in nearly six years of data collection.Optimism Towards New Work Hits Fresh Low

In line with the trend for activity, optimism towards new business also fell in June. A net balance of +21 percent of Chinese companies expect new workloads to increase over the coming year, down from +28 percent in February and the lowest reading seen since the survey began in late-2009.

Business Revenues Expectations Revised Down

Reduced optimism towards activity and new business growth led companies to temper their expectations for business revenue s growth for the year ahead. June data indicated that a net balance of +20 percent of firms expect business revenues to increase over the next year, down from +27 percent in February and a new series low. As a result, confidence towards profits growth also declined to a record low in June, as highlighted by a net balance of +14 percent in the latest survey period.

When does China adopt the Fed's line ... "It's all transitory"?