By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

It’s Election Day here in the U.S. and in a few hours we’ll know who becomes the 45th President of the United States. Based on the strength of the U.S. dollar and the rally in U.S. stocks, investors are banking on a Clinton victory. This has been one of the most dramatic U.S. presidential battles in recent history and if we are lucky, it will be over by Wednesday. A winner is typically declared by 11pm NY Time, but if Clinton crosses the 270 threshold in the 9 o’clock hour, it could be an early evening for all of us. We’re sure that all of our readers -- Americans and foreigners -- will be glued to their television screens tonight but we’ll be live trading the event in what will surely be an exciting and active session. History will be made in one form or another -- either Hillary Clinton will become the first female president of the United States or we’ll see another 5% drop in S&P 500 accompanied by a steep decline in the U.S. dollar. U.S. elections don’t normally elicit major market volatility but the problem in 2016 is that for the better part of this year, market participants did not consider a Trump victory realistic. And now that the election is too close to call, they're bailing out of U.S. assets and rushing to protect their portfolios. Regardless of your political leanings, it is hard to ignore the fact that investors fear a Trump presidency. His foreign policy, trade ideas and plan to overhaul the Federal Reserve scares domestic and foreign investors alike and the general lack of specificity could mean a long period of uncertainty. Beyond the immediate impact, investors also worry that if markets sell-off and the U.S. economy slows, the Fed could forgo a rate hike in December, which would exacerbate the dollar's slide into year's end.

In light of this, we’re republishing our 3 central scenarios for today’s election:

3 Potential Election Outcomes

- Scenario #1: Trump becomes President, Clinton accepts defeat.

The greatest market impact would be a Trump victory and a willing Clinton defeat. In this scenario, the U.S. will have a man with untested political skills and unknown policies in office. In this case, the biggest winners will be the euro, Swiss franc and Japanese yen while the biggest losers would be the U.S. dollar and Mexican peso. The Canadian dollar should also fall but its moves could be tempered by a weakening U.S. dollar.

- Scenario #2: Clinton becomes President, Trump accepts defeat

The greatest relief for foreign investors would be if Clinton becomes President and Trump willingly accepts defeat. She’s not without her own problems (and there are many) but the transparency of her policies and the continuity of stability would send the U.S. dollar sharply higher. In this scenario, the dollar and peso would rise against all of the major currencies with the biggest losers being the Japanese yen, Swiss franc and to some degree the euro. However she would need to win by an uncontestably wide margin and Trump would need to accept defeat, which he has suggested he will not do.

- Scenario #3: Trump/Clinton becomes President by narrow margin. Loser refuses to accept defeat.

The third scenario is the most likely. If Trump or Clinton becomes president by a very narrow margin and the loser refuses to accept defeat, the ongoing uncertainty would be extremely negative for the U.S. dollar, especially in the hours after the election. On a percentage basis, the greatest market volatility in financial assets (currencies, equities and commodities) will be in scenarios 1 and 2.

A third of the Senate and the entire House of Representatives are also up for election and these contests will be important to watch because the President’s ability to provide fiscal stimulus depends on whether his or her party controls the Senate.

Both the euro and British pound traded lower against the U.S. dollar Tuesday on the back of weaker data. German industrial production plunged 1.8% in September, 3 times worse than expected. This completely overshadowed the improvement in the trade balance, partly because exports and imports declined. For the second month in a row, industrial production in the U.K. fell 0.4%, against expectations for steady activity. Although manufacturing production rose more than expected, these numbers show limited support from a weaker sterling. U.K. trade numbers are scheduled for release Wednesday, but the report will certainly take a backseat to U.S. dollar flows. Meanwhile, the U.K. Supreme Court has accepted an appeal against the High Court ruling. The hearing is set for December 5 and will last for four days. A ruling is expected sometime in 2017.

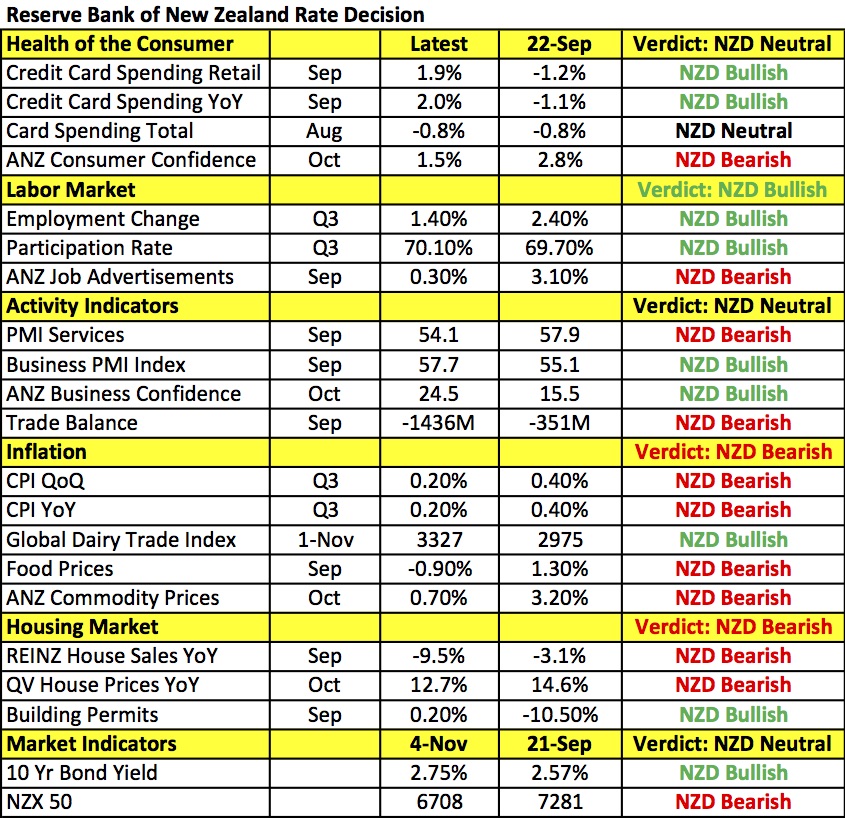

In contrast to the euro, sterling and Swiss franc, all three of the commodity currencies traded higher against the greenback. These moves were driven primarily by positive risk flows because the U.S. dollar is strong and commodity prices are slightly lower. China’s trade balance fell more than expected posting $49.06b vs. a $51.07b forecast. Chinese exports took a larger than expected hit with a decrease of 7.3% when only -6.0% was expected. Imports for the country also declined by 1.4%, missing the expected -1.0% figure. NAB Business Conditions printed a reading of 6 down from 8 the previous period. Business Confidence for Australia dropped to 4 vs. 6. Interestingly, the Canadian dollar was able to shake off disappointing data and post gains against the greenback. Housing starts rose by 192.9k falling short of the 195k forecast while building permits dropped -7%. The Reserve Bank of New Zealand meets Wednesday afternoon and a rate cut is expected. According to the table below, there have been as much improvements as deterioration in New Zealand’s economy. Employment growth was strong, dairy prices increased and business confidence is up but the central bank’s main concerns are inflation and trade -- both of which have been falling. Cooler housing activity could give them the breathing room to cut rates. The RBNZ rate decision is after the U.S. election so the market’s reaction could affect their decision. It’s a close call and even if the Reserve Bank keeps policy unchanged, they will repeat that rates are coming down.