All gold to be sold to Zimbabwean refinery

Caledonia Mining Corporation, (CAL) announced on 28 January that its 49%-owned Blanket gold mine is now required to sell all its gold, with immediate effect, to Fidelity Printers and Refiners (Fidelity), a company controlled by the Zimbabwean authorities. Blanket’s terms of trade with Fidelity will result in Blanket receiving 98.5% of the gold price fixed in London on a Tuesday. Fidelity will then pay within a maximum of seven days. Caledonia sold gold worth US$3.8m to Fidelity yesterday, with payment expected today.

While the obvious risk to Caledonia is timely payment in full for its gold, we note that it has been delivering its gold to Fidelity for assay since re-opening Blanket in 2009. The fundamental change is that Fidelity will now be the sole refiner for all gold mined in Zimbabwe (whereas Caledonia previously used a Switzerland-based company). Over the past 12 months, we understand that most of Zimbabwe’s other gold producers have voluntarily opted to sell their gold production via Fidelity (instead of using a more cumbersome export mechanism operated by the Zimbabwe Chamber of Mines) and that the refining and payment arrangements via fidelity have operated without a hitch.

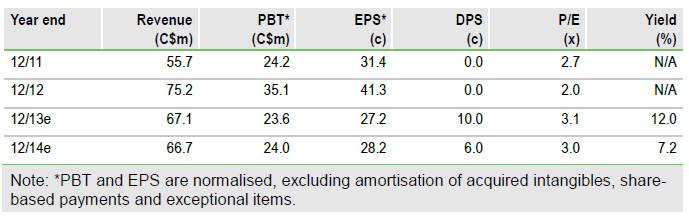

We do not consider this change in the sale process of Caledonia’s gold to Fidelity as an immediate risk to our valuation. However, we will watch for Caledonia informing the market of any changes to its situation and will monitor its quarterly accounts to assess the impact of this new arrangement on cash flows from Blanket. Caledonia has US$23.9m in net cash outside Zimbabwe, which will provide a considerable buffer pending any disturbances to payments. We also note that this change will not affect its FY14 quarterly dividend payments of 1.5c (6c aggregate).

To Read the Entire Report Please Click on the pdf File Below