Brent crude oil is trading near its record lows, however yesterday it grew slightly. Some support to the price of oil came from falling USD, as its index fell by 0.2%.

Anyway, short-term prospects for oil remain negative as there are many factors suggesting that. Amongst them, the nearing interest rates hike in the US, poor macroeconomic indicators in China, and the expectations about resuming Iranian exports that are going to reach already oversupplied world markets soon.

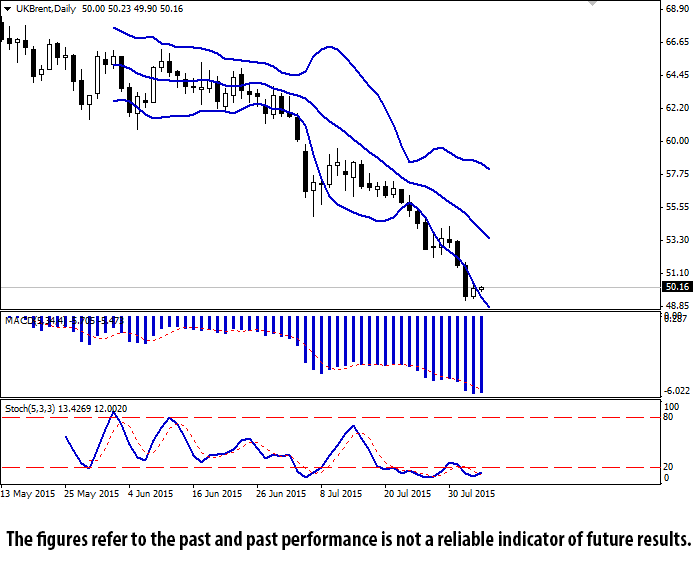

Bollinger Bands® on the daily chart continues downward movement, but is giving a buy signal as the price left the bottom border of the price range. MACD histogram turned to growth though the indicator is still giving a sell signal. The indicator points out to the likeliness of a correction. Stochastic remains in the oversold zone but the indicator line is approaching its border.

The indicators recommend to limit short positions or fix the profits, and to consider opening short-term long positions.

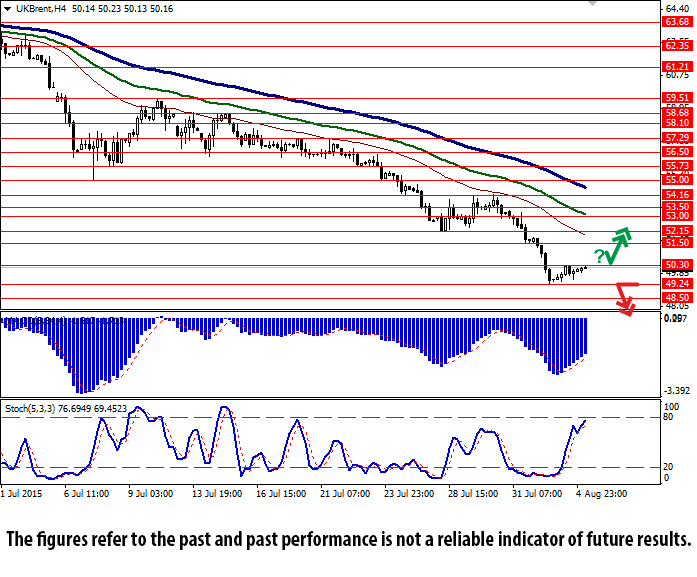

Support levels: 49.24 (local low), 49.00 (psychologically important level), 48.50 (a short-term bear target).

Resistance levels: 50.30 (4 August high), 51.50, 52.15, 53.00, 53.50, 54.16 (29 July high), 55.00.