Recent actions and rhetoric from Commonwealth Prime Ministers, and their respective policy makers, have put their commodity sensitive currencies under pressure.

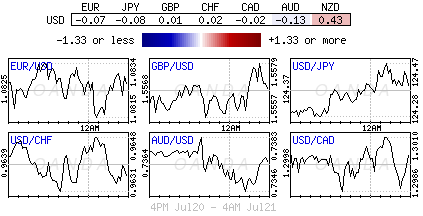

In Australasia, the kiwi ($0.6592) and Aussie dollar ($0.7370) both linger within striking distance of their six-year lows. In North America, the loonie has fared no better, straddling its own six-year low, while under attack from last week’s Bank of Canada (BoC) rate cut to +0.5%. For now, dealers and investors are willing to trade as if they do not expect any short-term market reprieve for any of these commodity and interest sensitive currencies.

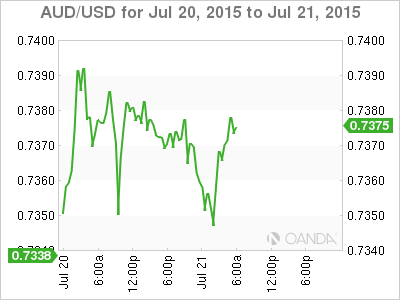

There are a number of key events this week that’s expected to seal the short-term fate for a couple of the currency pairings. Tomorrow down-under, Aussie Q2 inflation numbers and a speech by Governor Stevens from the RBA is expected to have a material impact on the AUD.

Thus far, the recent ‘big’ dollar sentiment and softer global commodity prices, in particular gold and iron ore, have being undermining the AUD. Overnight, the Reserve Bank of Australia (RBA) had the opportunity to adjust its rhetoric on the job market when it published its MPC meeting minutes.

Reserve Bank of Australia (RBA) July Minutes

In the overnight session, the RBA released the minutes of its July meeting. The report revealed that Aussie policy makers continue to “straddle the fence,” which is likely to keep short-term rate expectations further in check. Or will it?

The RBA warned that the strength in Q1 GDP has not managed to carry over into Q2, despite the Aussie unemployment rate nudging towards +6% which is further away from the banks initial forecast of a rise to +6.5%. The market will be looking for clues from the Governor on whether he will be changing the bank’s tune on the labor situation. From any Aussie policy makers perspective it would be rather difficult, especially with recent data continuing to show a soft economy that continues to grow well below trend. However, the central bank did note that “significant labor demand” should succeed in further lowering Australia’s jobless rate. The minutes also reiterated that inflationary pressures are well contained and called for further AUD decline to assist economic recovery.

On Wednesday, the RBA is expected to ignore the headline inflation print and focus on the core (+0.6%e q/q), which is expected to remain benign. This would continue to reflect ongoing weak wage growth and further support a “sub-par” performing economy. If consistent with expectations, the inflation data is unlikely to be low enough to justify any immediate rate cut (+2%). The market will be looking to Governor Stevens’ speech later in the day on economic policy matters for further clues as the minutes reveal a moderately dovish spin on recent economic developments.

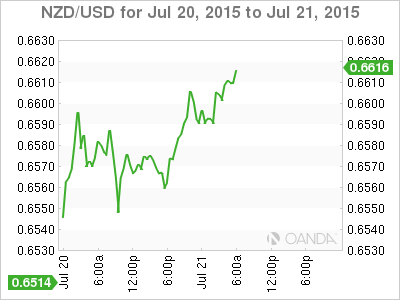

Kiwi Takes Temporary Flight

Not unlike its Australasian partner, the AUD, the Kkwi’s value ($0.6590) has been undermined by the ‘big’ dollars rate appeal and soft global commodity prices.

To date, the market-selling interest outright has been fuelled by sharply lower dairy prices and weak inflation numbers. But since Monday, the NZD has managed to tick higher, benefiting from comments made by New Zealand’s Prime Minister, John Key, who said that the NZD has “fallen faster than expected.”

With the market being heavily short for a very long time, it’s not surprising to see the NZD rally, as some investors book profits while others take out insurance policies ahead of Thursday’s Reserve Bank of New Zealand (RBNZ) monetary policy meeting.

The market has fully priced a rate cut and is expecting a very “dovish” statement. If the RBNZ fails to deliver, there would a massive short squeeze to the topside, hence, the “pre-squeeze.” If the central bank does deliver, technical analysts expect that NZD$0.6499 is at risk in the short-term and if breached, exposes NZD$0.6200 assuming that the RBNZ cuts cash rates even further over the coming quarters. Currently, traders are pricing in a -25bps cut to +3%, but a small percentage of traders are looking for a -50bps ease.

A -50bps cut may be too much, too soon. Cutting -50bps would suggest that the RBNZ is caught behind the curve and that’s not necessarily the case, despite the challenges facing the Kiwi economy. Nevertheless, money market traders are pricing cuts to a record low of +2% by year-end. The obvious danger for the crowded short NZD trade is if Governor Wheeler from the RBNZ does not deliver.

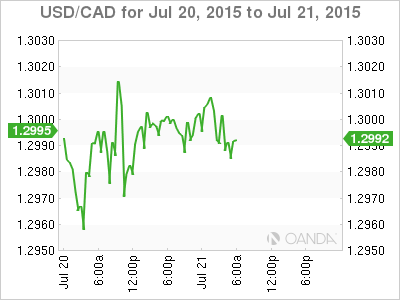

Poloz Goes It Alone

The Bank of Canada’s (BoC) Governor Poloz could not rely on the Fed to do work for him. Higher U.S rates would weaken the loonie and support the Canadian export market, which has been obliterated by weak commodity prices. However, the fixed income market is finding it difficult to fully price in a Fed rate hike by year-end.

Last week, the BoC went alone and cut overnight rates by -25bps to +0.5%. Canada’s lower growth profile, from a disappointing H1 of this year, sealed the BoC’s positive actions. In its quarterly monetary policy report, the BoC forecasted that Canada would enter a recession in Q2. Governor Poloz now sees Q2 growth shrinking by -0.5%, down significantly from the +1.8% growth that it previously forecasted.

This would be the second consecutive decline of quarterly growth. “Real GDP in Canada is now estimated to have contracted modestly in H1 of 2015, resulting in a marked increase in excess capacity and additional downward pressure on inflation.” The cut, and ‘wait and see’, telegraphed a message from the Governor that Canada is expected to show growth to pick up in Q3. This is the second time that the BoC has cut rates this year, and at +0.5% there still is room for the Canadian policy makers to do more, if need be. The OIS market is currently pricing in a 50% chance that the BoC will cut rates again at its September meeting, and a 33% chance that the Bank will cut in again in October.

However, any ‘wait and see’ approach could leave USD/CAD with a small ‘dovish’ bias, potentially capping the loonie’s fall within striking distance of its multi-year lows (CAD$1.3035). Despite the USD in demand on pullbacks, loonie bulls will be looking to crude oil prices for some support.