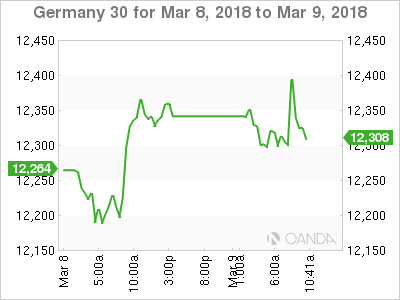

The DAX index has posted slight losses in the Friday session, after sharp gains on Thursday. Currently, the DAX is trading at 12,320.00, down 0.29% since the Thursday close. On the release front, German industrial data continues to disappoint. Industrial Production declined 0.1%, missing the estimate of 0.6%. This marked the fourth decline in the past five months. In the US, the focus is on employment reports. Wage growth is expected to tick lower to 0.2%, while Nonfarm Payrolls are forecast to improve to 205 thousand.

The ECB didn’t change the benchmark interest rate, which remained pegged at 0.00%. Still, the Thursday meeting had plenty of drama, as policymakers removed a long-standing clause known as ‘easing bias’, which stated that monthly asset purchases could be increased if economic conditions were to worsen. The removal of easing bias can be seen as a small step towards winding up the asset program, which is scheduled to end in September. However, Mario Drahgi dampened the party, saying that that eurozone inflation could remain subdued, so the Bank’s monetary policy would remain ‘reactive’. Investors took the comments as a sign that the ECB is no rush to tighten monetary policy, which boosted the German stock markets, while sending the euro sharply downwards.

US President Trump may have said that trade wars are a “good thing”, but his enthusiasm for upheaval in global markets is certainly not shared by investors. On Thursday, US President Trump made good on his threat, and signed an order imposing 25% tariffs on steel imports. EU policymakers have threatened to retaliate with tariffs on US goods, and European Commission President Jean-Claude Juncker was particularly blunt, saying “we can also do stupid”. Fears of an all-out global trade war are weighing on the US dollar and the stock markets, and the resignation of Gary Cohn, a senior economist in the White House who opposed the tariffs, will only dampen investor risk appetite. The ball is now in the EU court, and if the Europeans retaliate and Trump responds with further tariffs, we could see some sharp movement in the stock markets.

Economic Calendar

Friday (March 9)

- 2:00 German Industrial Production. Estimate +0.6%. Actual -0.1%

- 2:00 German Trade Balance. Estimate 21.2B. Actual 21.3B

- 8:30 US Average Hourly Earnings. Estimate 0.2%

- 8:30 US Nonfarm Employment Change. Estimate 205K

*All release times are EST

*Key events are in bold

DAX, Friday, March 9 at 7:25 EDT

Prev. Close: 12,245.36 Open: 12,235.00 High: 12,267.50 Low: 12,176.63 Close: 12,205.00