Summary

- Low demand creating currency devaluations.

- Currencies will continue to implode.

- Gold and Silver will surface as “currency”.

The biggest problem in the world economy is that there isn’t enough demand out there, and there is more supply. The lack of demand has triggered a series of competitive currency devaluations, which the United States started. The devaluations, started all sorts of carry trades and capital flows from the United States to other countries, which is hurting exporters, reversing globalization, and will lead to deflation and the eventual end to fiat currencies.

The world under the Gold Standard with fixed exchange rates was different. A government could just declare overnight that their currency has devalued against the price of gold 20%. Today, however, a government can’t just declare its currency devalued. They have to print money to devalue their currency, which is what has been going on.

A world of currency devaluations has led to problems for exporting economies.

With China’s economy slowing after a huge investment and credit boom, China can react by deflating their own economy, which would lead to all sorts of social problems, or devalue their currency, which will flood the world economy with their goods. Most governments choose to devalue their currency, which is what the Chinese are doing, making it far more difficult for other exporting nations to maintain their export levels without devaluing their own currencies.

The Chinese renminbi will continue to decline by 10% or 20% over the new few years. with major repercussions for all [China's] competitors in the world, especially the emerging world with more and more deflationary pressure…[which] may be good for China, but bad for virtually everyone else.

In late 2012, Japan devalued the Yen by 30%, which triggered all sorts of problems in Asian emerging countries. China is Japan by a factor of 10, probably, in terms of effect. China has far more of an effect on the global economy than Japan

In terms of the CPI, it will not go up. As China devalues, import costs elsewhere will fall, which will lead to deflation, even with all the money being printed around the world.

Unlike many other nations, the Chinese government has encouraged its citizens to put part of their savings in gold. They know that the renminbi will lose value over time. Even so, so far, gold has declined due to the powerful deflationary pressure in the world economy. I’ve been lukewarm to bullish on gold for a while.

As other analysts have pointed out, Gold is money and it’s true money….It doesn’t have any debt. It is a real asset. Paper money is different…Gold has survived all paper currencies. All fiat currency systems have collapsed…We have had one since 1971. Gold is historically recommended as a way to “store your savings and assets in a better way than in paper currencies.” Stocks of good companies can also serve that function. The end of fiat currency system could lead to either a deflationary collapse and currency reform or an inflationary collapse and currency reform, which would cut out a lot of debt, as well as a lot of assets and wealth. That will be the ultimate point where gold is the most important asset to hold.

While China is slowing down economically, the United States, which is far less export dependent, is doing “relatively well” with a natural growth rate of about 2.5%. Therefore the US is in much better shape than the rest of the world, which relies on exports. Germany, for example, and China have to competitively devalue their currencies to regain their positions.

At the end game, capital controls already have been implemented in Russia, Argentina, Brazil, and Portugal. A reversal in the 60 year tide toward globalization and a return to regionalization. Globalization, created prosperity by producing cheaper and cheaper goods. The current lack of demand is very difficult to solve. I don’t know any way out, other than to reduce government and make far more room for free enterprise and business.

The global economy is flooded with cheap money. The banks have to do something with all the cash, so they go into the carry trade, which still does not create demand. So eventually, this will turn out to be very good for gold, very bad for paper currencies, very bad for bonds, and in the long run stocks are also a place to store some value, but you have to be prepared to lose 60% before they go up again.

Past, Present and Future

The gold and Silver markets remain in a secondary corrective mode, even though it has fulfilled the intermediate downside expectations for spikes below 1280 for June gold and 19.00 for July silver as published in my last report. Gold was able to reverse its daily trend to up inviting a 1 to 3 day reaction lower. No monthly confirmation so far from either metal turning its long – term trend up.

According to the VC Price Momentum Indicator, the 1 to 3 day reaction lower for gold and silver project a low during this time frame. Silver testing the weekly support and the April 30 close reinforces the inertia at current levels.

The Equity Management Academy has been preparing its subscribers to buy this correction and enter long – term positions in gold and silver at current levels. This is a very exciting period when we have a combination of cycles (short, intermediate and long-term) clustering its synergy during the current time and price structure.

If we can get silver to reverse higher from here next week, we could see a surge of energy unfold towards the weekly resistance levels of 20.60 to 20.80 by the second half of May. The weekly low and support level of 18.68 should be used as a protective stop for long – term traders and investors.

For a more detailed technical picture, let’s take a look at the gold and silver markets and see what trading/investing opportunities we can identify for next week.

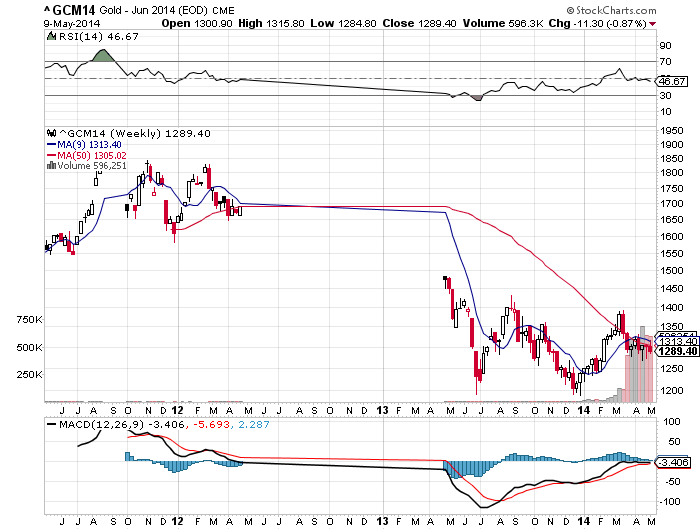

GOLD

The June gold futures contract closed at 1289. The market closing below the 9 day MA (1313) is confirmation that the trend momentum is bearish. A close above the 9 day MA would negate the weekly bearish short-term trend to neutral.

With the market closing below the The VC Weekly Price Momentum Indicator of 1297, it confirms that the price momentum is bearish. A close above the VC Weekly, it would negate the bearish signal to neutral.

Cover short on corrections at the 1277 – 1266 levels and go long on a weekly reversal stop. If long, use the 1266 level as a Stop Close Only and Good Till Cancelled order. Look to take some profits on longs, as we reach the 1308 – 1328 levels during the week.

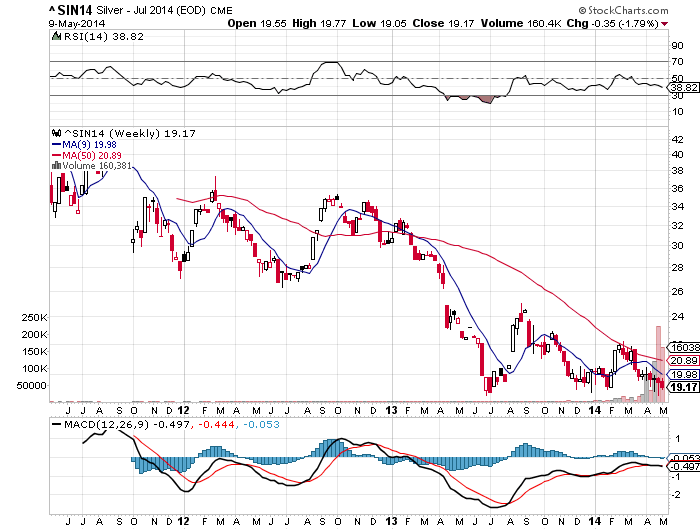

SILVER

The July Silver futures contract closed at 19.17. The market closing below the 9 day MA (19.98) is confirmation that the trend momentum is bearish. A close above the 9 day MA would negate the weekly bearish short-term trend to neutral.

With the market closing below The VC Weekly Price Momentum Indicator of 19.33, it confirms that the price momentum is bearish. A close above the VC Weekly, it would negate the bearish signal to neutral.

Cover short on corrections at the 18.89 to 18.61 levels and go long on a weekly reversal stop. If long, use the 18.61 level as a Stop Close Only and Good Till Cancelled order. Look to take some profits on longs, as we reach the 19.61 – 20.05 levels during the week.

Disclaimer: The information in the Market Commentaries was obtained from sources believed to be reliable, but we do not guarantee its accuracy. Neither the information nor any opinion expressed herein constitutes a solicitation of the purchase or sale of any futures or options contracts.Trading derivatives financial instruments and precious metals involves significant risk of loss and is not suitable for everyone. Past performance is not necessarily indicative of future results.