Are Bank Stocks Nearing Reversal Of Fortune Breakout?

The KBW Bank has been trading in a downtrend slope since early 2018.

And it has been underperforming the broad stock-market indices as well.

Is The Bad News For Bank Stocks About To End?

Stock-market bulls sure hope so, as the stock market tends to be on stronger footing when the banks provide market leadership.

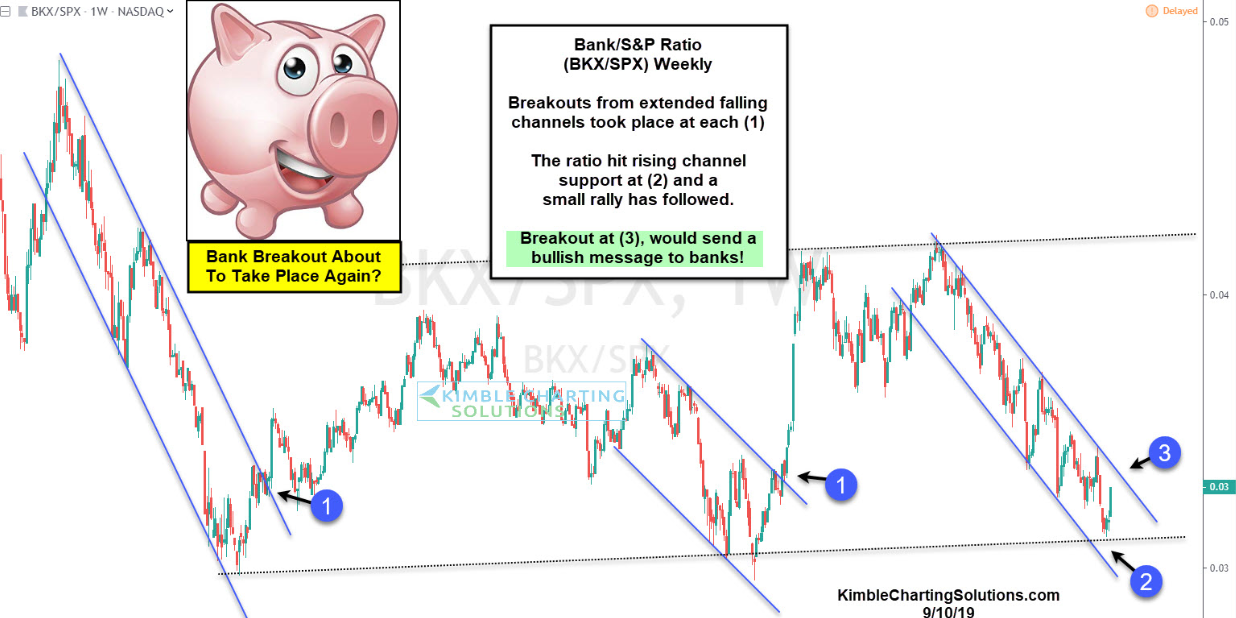

Today’s chart looks at the ratio of bank stocks to the broad market index, the S&P 500.

The BKX-to-S&P 500 price ratio recently hit 7-year channel support and a small rally has followed.

If a breakout at (3) takes place, look for relative strength from the banks again. This would also be a positive signal for the broader market.