Will Apple (NASDAQ:AAPL) acceptance spark a (Bitcoin) rally?

After touching the $490 level on Friday, Bitcoin’s price has entered into a sustained downward trend, declining to $462.98 at present. A breakthrough of the important $460 level could see the downward trend extended to $454.37, an important Fibonacci support. The volumes traded on the Bitstamp exchange have been relatively moderate today as compared to the past few weeks and a close below $460 would strengthen the downward trend.

The formation of a strengthening downward trend comes amidst expectations of Apple’s announcement of a mobile payments network. This could dissuade some people from adopting Bitcoin, seeing Apple’s mobile payment network as a replacement or substitute for Bitcoin. Although in the short-term this may slow the adoption of Bitcoin, in the longer-term it could strengthen Bitcoin as people will realize the security and utility of Bitcoin and its superiority. The recent hack of Apple’s iCloud service also highlights security issues for the firm and its services.

Scottish Coin?

The prospect of an independent Scotland could potentially see Bitcoin adopted as a national currency for the first time. The First Minister for Scotland, Alex Salmond, has said in the past that Bitcoin is a possible option should the Scots vote for independence on September 18. Scotland experimented with a competitive currency market back in the 18th and 19th centuries and severing the tie with England means that the link to the British Pound may also be severed. The Adam Smith Institute has previously said that Bitcoin could be used alongside Gold, dollars and pounds as reserves, so that Scottish banks could issue their own money. The exciting prospect of Scotland adopting Bitcoin would leapfrog its financial system ahead of other developed nations and increase the credibility and adoption rate of Bitcoin.

The falling price over the past few days could be attributed to slow merchant adoption and merchants instantly exchanging Bitcoin for fiat money. Also, extreme centralization of mining activities in large farms are weighing on investors and traders sentiment, as this increases the possibility of a so-called 51% attack on the Bitcoin ecosystem. It seems that the low posted today was influenced by a single ‘whale’ trader posting a huge short position in Bitcoin. It seems that the $460 support level is holding up and we could see a reversal towards the $480 level today.

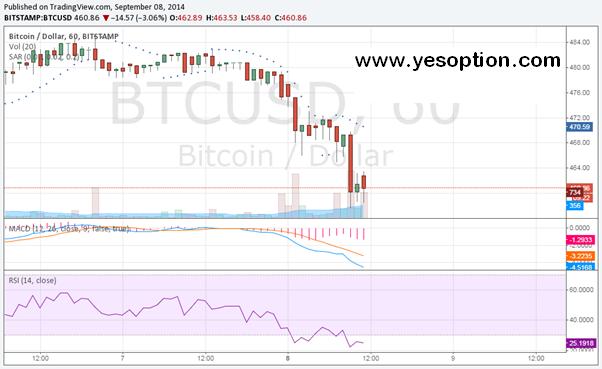

The chart below shows the hourly chart on the Bitstamp exchange. Both the MACD and the relative strength index are indicating oversold conditions in the markets. The faster moving average in the MACD is pulling away from the slower moving average, suggesting an upward correction is imminent. Also, the relative strength index is below 30, indicating that conditions in the market are oversold and an upward correction should be due. However, the parabolic stop and reversal has not yet indicated the end of the current downward trend.

Looking at the 4 hour chart with the Ichimoku cloud, we see that the cloud will act as resistance at around the $480 for the next few days declining to $473 by the end of the week. This confirms the bearish tone for the BTC-USD rate. The momentum is bullish as the conversion line crossed the base line in the downward direction recently and has continued to move below the base line.

Also, looking at the Bollinger Bands, we see the Bollinger squeeze materializing in the downward direction. This indicates a huge downward swing and normally the Bollinger squeeze adds or loses roughly $60 over the course of several days. That implies that a low of $410 could be posted in the upcoming week. Daily Fibonacci support lies at $446.31 and $407.32.