In July of last year, I asked the question of whether housing was really recovering or not? There has been much hoped placed on the "housing recovery story" over the last few years as it relates to the economy and I thought it was time to update the data to see how far we have progressed. With each passing month, all eyes have been glued to television screens, and headlines, as the latest estimations of housing starts, completions, new and existing home sales, etc. are trumpeted as a sign of a renewed housing cycle. This is no trivial matter as real estate is seen as a bedrock to economic strength as much as it is the sign of achievement of the "American Dream."

It is true that in past housing was a large contributor to the strength of economic growth in the U.S. Just recently Chris Puplava wrote:

"While residential investment represents a small portion of gross domestic product (GDP), housing is perhaps one of the most cyclical sectors of the economy and tends to lead economic swings by months to years. As such, keeping a close eye on housing provides a valuable insight into future economic trends. While housing represented a major headwind to the economy after the housing bubble burst, as I show below, it is now providing a major tailwind instead."

While Chris is correct in his assumptions, the question is really how sustainable is the current recovery in housing. More importantly, what really drives long term economic growth is not residential investment as much as "household formation" where a couple buys a home, raises a family and continues the consumption cycle that supports economic growth.

At The Margin

The problem with most of the analysis each month is that it is based on the transactional side of housing which only represents what is happening at the "margin." The economic importance of housing is much more than just the relatively few number of individuals, as compared to the total population, that are actively seeking to buy, rent or sell a home each month. In order to understand what is happening in terms of "housing" we must analyze the "housing market" as a whole rather than what is just happening at the fringes. For this analysis, we can use the data published by the U.S. Census Bureau which can be found here.

Total Housing Units

In an economy that is roughly 70% driven by consumption it is grossly important that the working age population is, well, working. More importantly, as discussed in "Obama's Economic Report Card:"

"Full-time, benefit providing, employment is the only type of employment that matters for the average American. Full-time employment allows for an increasing standard of living, household formation, and higher personal savings rates."

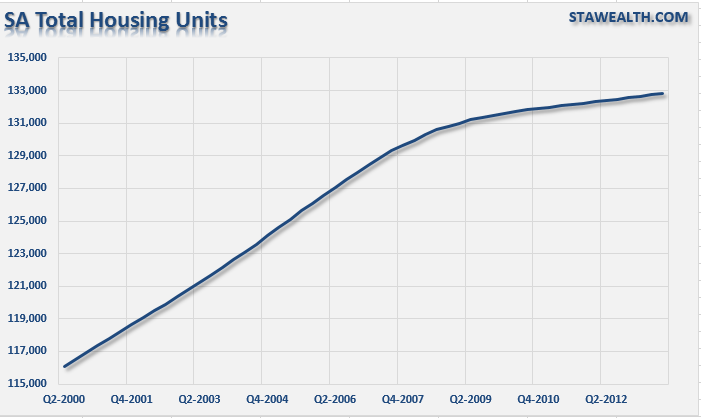

To present some context for the following analysis we must first have some basis from which to work from. Our baseline for this analysis will be the number of total housing units which, as of Q3-2013, was 132,845,000 units. The chart below shows the historical progression of the seasonally adjusted number of housing units in the United States.

As an example, the most recent report of "existing home sales" showed that 4,900,000 homes were sold on an annualized basis in November, 2013 (the last reported month). Since this is an annualized number, we must divide it by 12 months to see the estimated seasonally adjusted number of sales in November was actually just 408,333 homes. This number of existing home sales represents just 0.3% of the total number of homes available. This is what I mean by "activity at the margin." When put into this context the "existing home sales" report doesn't seem nearly as exciting.

What about new homes? New home sales were 421.000 on an annualized basis this past November (the last reported month) which equates to 35,023 new homes per month. This makes up an even smaller percentage of the total homes available at just 0.02%.

Understanding "sales" represent only a very small fraction of the housing market we must look at what is happening within the total housing market to get the real story. In this regard, we can use the Census Bureau data to see how many homes are just sitting vacant, owner occupied or being rented. From this data we can get a much better picture of the real strength of the economy, and how much of a potential "tailwind" there may be.

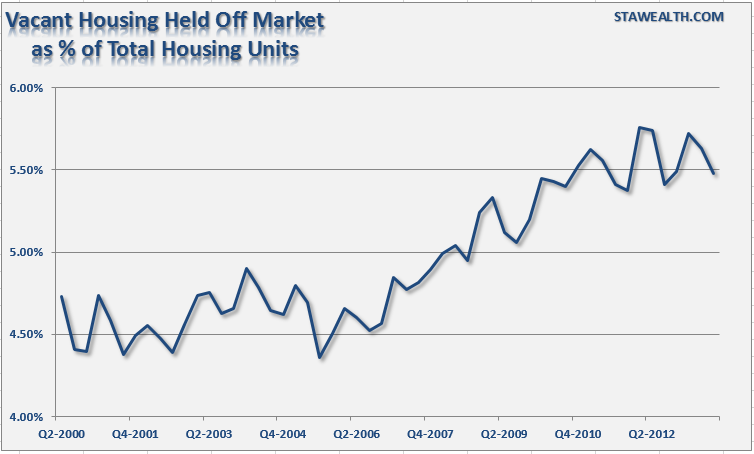

Vacancy Rate

Out of the total number of housing units some are vacant for a variety of reasons. They are second homes for some people that are only used occasionally. They are being held off market for one reason or another (foreclosure, short sell, etc.), or they are for sale or rent. The chart below shows the total number of homes, as a percentage of the total number of housing units which are currently vacant.

If a real housing recovery was underway, the vacancy rate would be falling sharply rather than hovering only 0.5% below it's all-time peak levels.

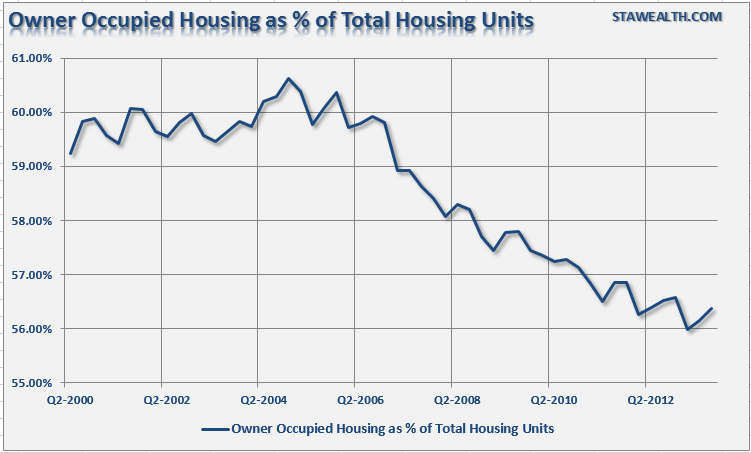

Owner Occupied Housing

Another sign that a "real" housing recovery was underway would be an increase in actual home ownership. The chart below shows the number of owner occupied houses as a percentage of the total number of housing units available.

Despite the Federal Reserve flooding the system with liquidity, suppressing interest rates and the current Administration's efforts to bailout banks and homeowners, owner occupied housing remains near its lows.

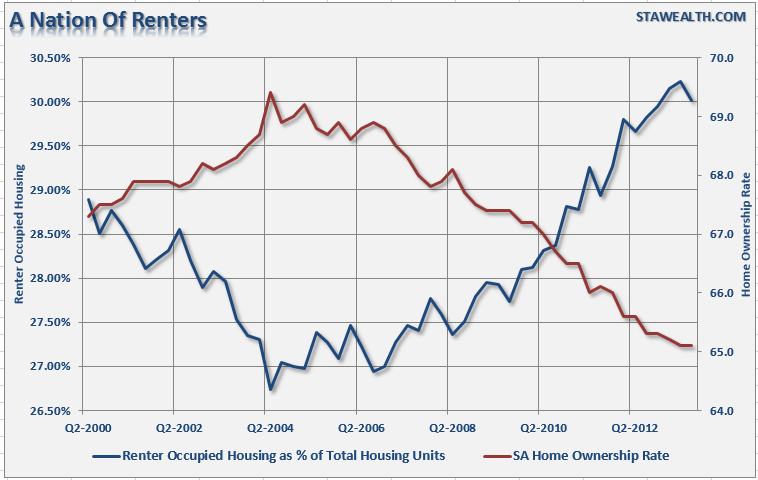

Home Ownership

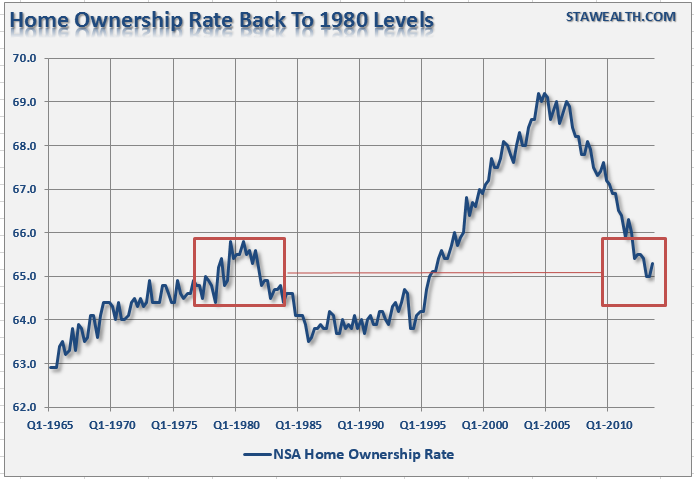

The simple reality is that there has really been very little actual recovery in housing. With five years of economic recovery now in the rear view mirror, it is clear that the average American is really not recovering as evidenced by the lowest level of home ownership since 1980.

At 65.3%, the current level of home ownership shows the lack of household formation which is a detraction from longer term economic growth. The weak economic growth rates and widening wealth gap certainly explain the fall in homeownership rates and the lowest level of birthrates on record.

However, the recent reports of sales, starts, permits, and completions have all certainly improved in recent months. Those transactions must be showing up somewhere, right?

REO To Rent

While the Federal Reserve, along with the current Administration, have tried a litany of programs to jump start the housing market nothing has worked as well as the "REO to Rent" program. With Fannie Mae/Freddie Mac, and the banks loaded with delinquent and vacant properties, the idea was to sell huge blocks of properties to institutional investors to be put out as rentals. This has worked very well.

The chart below shows the number of homes that are renter occupied versus the seasonally adjusted homeownership rate.

Do you see the potential problem here? Speculators have flooded the market with a majority of the properties being paid for in cash and then turned into rentals. This activity drives the prices of homes higher, reduces inventory and increases rental rates which prices "first time homebuyers" out of the market. The problem is that when the herd of speculative buyers turn into mass sellers - there will not be a large enough pool of qualified buyers to absorb the inventory which will lead to a sharp reversion in prices.

Maybe this is why the Federal Reserve, and the FDIC, are looking to relax the regulation put in place after the last housing bubble which required banks to have "skin in the game." By removing that restriction banks can now go back to providing mortgages to unqualified buyers, pool them and sell them off to unwitting investors. Haven't we watched this movie before?

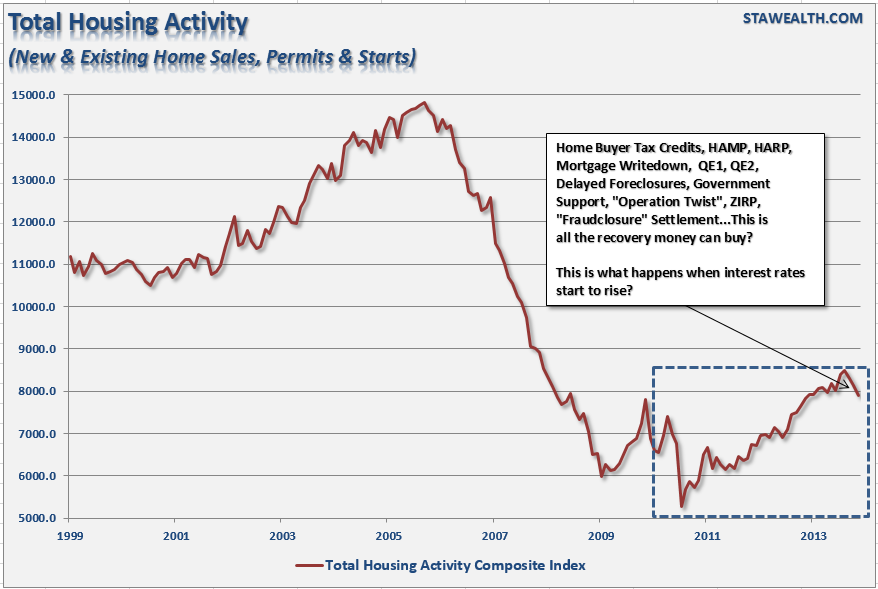

While the surge in housing activity, which still remains at historically low levels as shown in the chart below, has certainly been welcome it should not be forgotten that it has taken massive bailouts, stimulus and financial supports to induce such relatively small amounts of activity.

The mistake, however, as I addressed in "Housing Recovery, What Has Been Forgotten" is that:

"There is no argument that housing has improved from the depths of the housing crash in 2010. However, while the housing market remains at very recessionary levels, recent analysis assumes that this has been a natural, and organic, recovery. Nothing could be further from the truth as analysts have somehow forgotten the trillions of dollars, and regulatory support, infused to generate that recovery.

I recently penned an article showing the $30 trillion, and counting, that has been thrown at the economy, and financial system, to keep it afloat over the last 4 years. Of that, trillions of dollars have been directly focused at the housing markets including HAMP, HARP, mortgage write downs, delayed foreclosures, government backed settlements of 'fraud-closure' issues, debt forgiveness and direct buying of mortgage bonds by the Fed to drive refinancing and purchase rates lower. Of course, the Fed has also maintained its ZIRP (zero interest rate policy) during this same period with a pledge to keep it there until at least 2015.

The point here is that while the housing market has recovered - the media should be asking 'Is that all the recovery there is?' More importantly, why are economists, and analysts, not asking the question of 'What happens to the housing market when the various support programs end?' With 30-year mortgage rates below 4% we should be in the middle of the next housing bubble - not crawling along a bottoming process."

The housing recovery is ultimately a story of the "real" employment situation. With roughly a quarter of the home buying cohort unemployed and living at home with their parents the option to buy simply is not available. The rest of that group are employed but at the lower end of the pay scale which pushes them to rent due to budgetary considerations and an inability to qualify for a mortgage.

As I stated previously, the optimism over the housing recovery has gotten well ahead of the underlying fundamentals. While the belief was that the Government, and Fed's, interventions would ignite the housing market creating a self-perpetuating recovery in the economy - it did not turn out that way. Instead, it led to a speculative rush into buying rental properties creating a temporary, and artificial, inventory suppression.

The rising risk to the housing recovery story lies in the Fed's ability to continue to keep interest rates suppressed. It is important to remember that individuals "buy payments" rather than houses. With each tick higher in mortgage rates so goes the monthly mortgage payment. With wages remaining suppressed, 1 out of 3 Americans no longer counted as part of the work force or drawing on a Federal subsidy the pool of potential buyers remains contained.

While there are many hopes pinned on the housing recovery as a "driver" of economic growth in 2014 - the lack of recovery in the home ownership data suggests otherwise.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

An Update On The Housing Recovery

Published 01/17/2014, 02:15 AM

Updated 02/15/2024, 03:10 AM

An Update On The Housing Recovery

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.