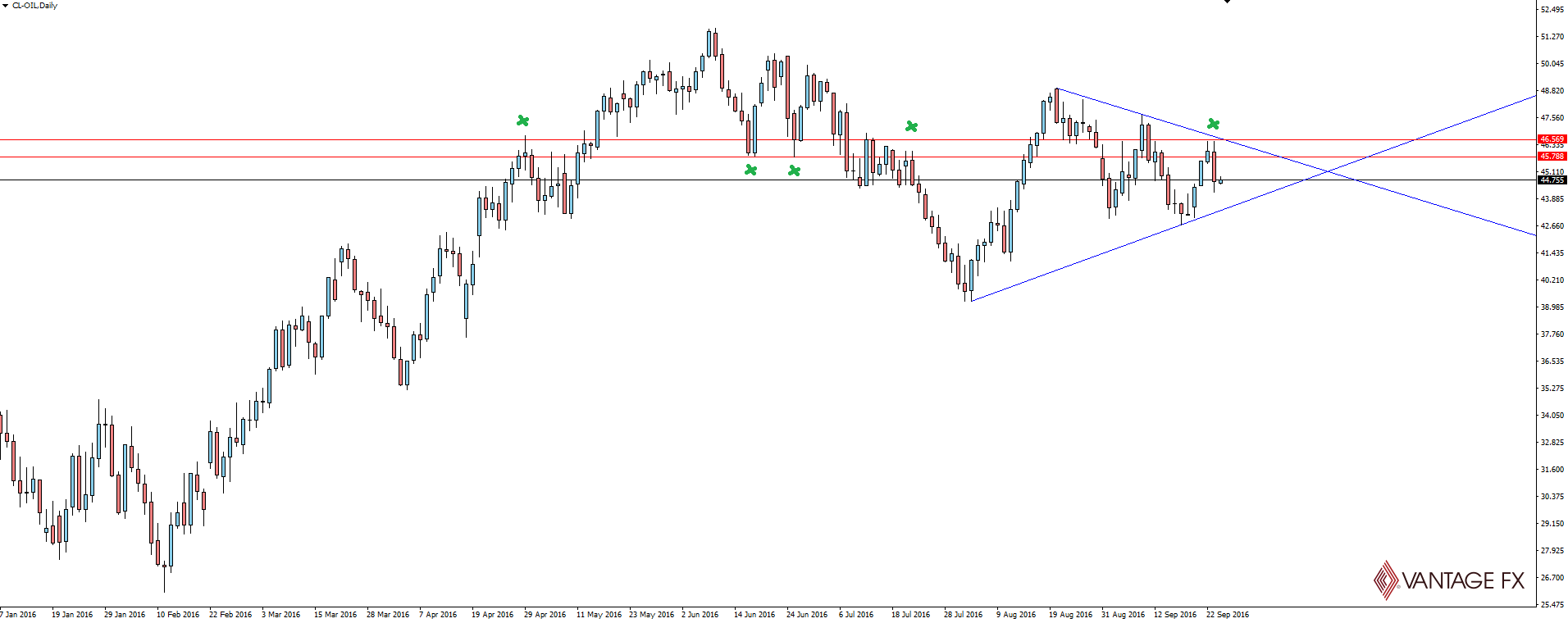

This week sees the conclusion of the OPEC meeting in Algeria, putting oil front and centre as this week’s in play chart.

We had spoken about Iran joining the Algiers meeting as bullish, but the lead up has seen price just chop about as skeptically as the analysts reporting on the meeting.

If you look at the daily chart, you can see that prices initially rose and made a push at swing highs. The initial optimism of oil traders always amazes me. Fading the optimism of oil traders is the gift that just keeps giving, and this time seems no different to any other.

Price has started to roll over out of the following technical level.

Now in saying this, analyst reports are starting to suggest some sort of production cap deal not being far away, as the bigger producers close in on maximum output and may consider a price ceiling to have little downside.

But this is OPEC, so just remember that even the word ‘deal’ is just a cat and mouse game and has no certainty to be bullish for overly long.

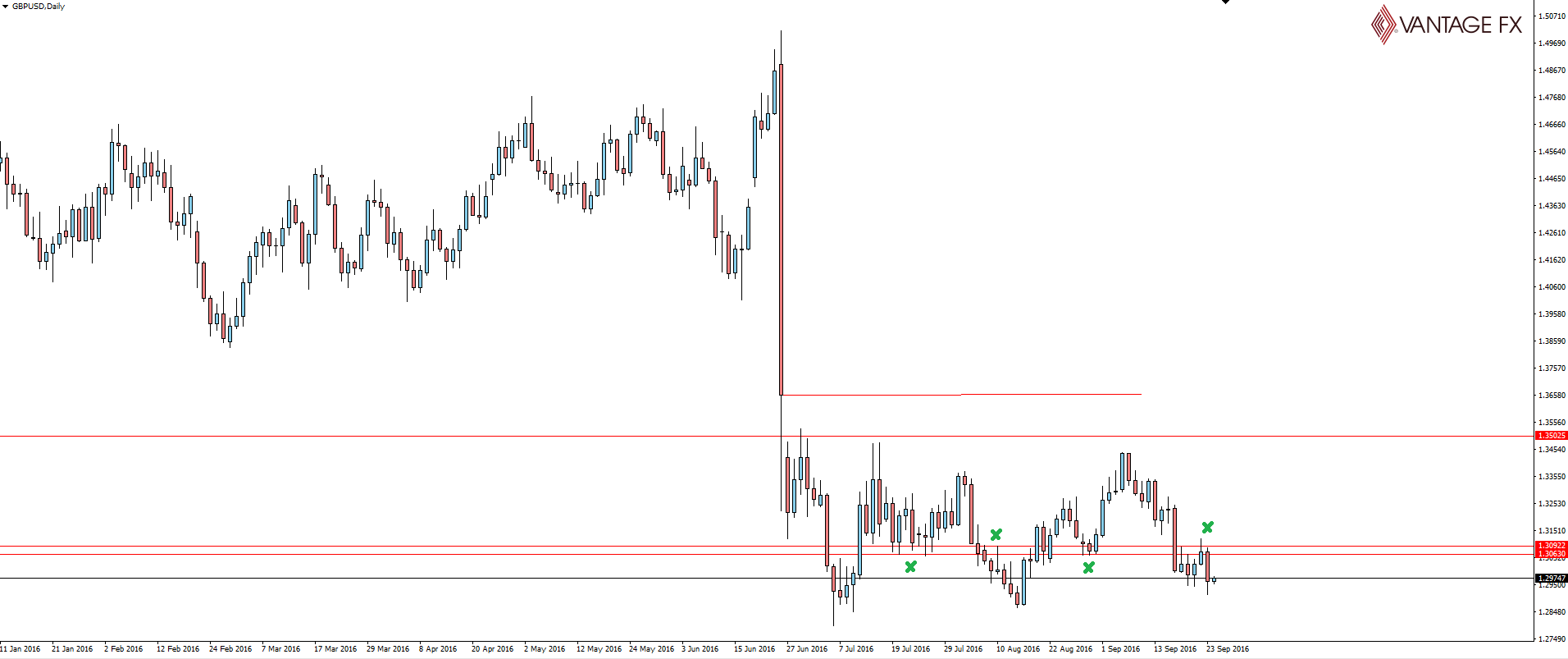

Moving onto Forex markets and today’s GBP/USD price action.

Post that kind of obvious Brexit drop that has scarred our charts, there is only one GBP/USD level that matters.

Friday’s daily candle on cable started positively, but heading to the top of our barely 30 pip support/resistance zone was too much for the pair and it rolled over heavily from there and into the close.

Keep your higher time frame levels on your charts and even if you’re a day trader, use them to base your initial bounce/hold direction for your trading.

On the Calendar Monday:

JPY BOJ Gov Kuroda Speaks

EUR German Ifo Business Climate

CHF SNB Chairman Jordan Speaks

EUR ECB President Draghi Speaks

CAD BOC Gov Poloz Speaks

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, forex news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.