Strategy is delivering

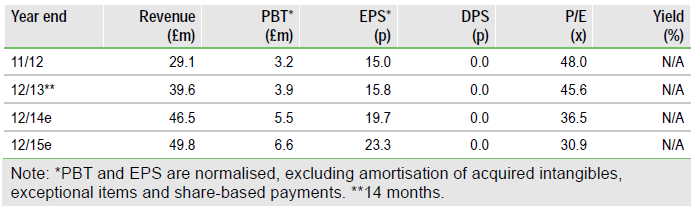

Accesso Technology Group PLC (ACSO.LSE) has released broadly in-line results for the 14 months to December. Over the last 15 months, the group has evolved into a much more substantial supplier of technology to the global leisure industry following the acquisitions of accesso LLC and Siriusware. Cross-selling the acquired products to customers outside the US is a key objective and the group has now announced its first ticketing deals in Europe. While accesso’s valuation appears pricey at c 31x our FY15 EPS, there is a range of compelling growth drivers and plenty of momentum in the business.

Investment case: Leader in the leisure tech space

Following recent advances in technology, including in mobile and RFID, there are increasing pressures on leisure and attractions businesses to invest in IT to improve both internal efficiencies and customer experience. We note that Disney has recently launched MyMagic+, its new high-tech wristband-based ticketing system, which cost c $1.5bn to develop. This increases the stakes for other operators, which typically cannot afford anything near this level of investment and need to outsource their IT. accesso is well positioned to be the leading technology provider in this space, having assembled a portfolio of products, including industry leading solutions in ticketing and point-of-sale and patented solutions in queue line management. The group now has the infrastructure in place to push ticketing to customers in Europe and its first Qsmart deal has been announced in Asia.

Final results: Slight beat in revenues and cash flow

Results for the 12 months to 3 November 2013 were broadly in line. The group has changed its year-end date to December and hence has also reported results for the 14 months to December 2013. These show revenues slightly ahead of our forecasts at £39.6m (we forecasted £39.3m), with normalised PBT in line at £3.9m and net debt lower than we forecasted at £1.2m (£2.4m). We note that November and December are quiet months for the group, as the bulk of revenues are generated over the northern hemisphere summer months. Siriusware was acquired in December for £4.1m cash (net) and 473k new shares.

To Read the Entire Report Please Click on the pdf File Below

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.