Japanese finance minister Akira Amari sounded warnings this week that the dramatic fall of the Yen had gone far enough.

Yet the fundamentals of Japan's economy are so dire that further falls in the currency are highly likely.

Long-Term Potential

The verbal intervention stabilised USD/JPY just above the psychologically key 100 level. However, it looks like 110 is still in the cross-hairs as the US Federal Reserve is stepping up the rhetoric on slowing and eventually ending its quantitative easing program. But over the longer term, there is potential for USD/JPY to go a lot lower as Japan faces a looming fiscal crisis.

Japan's fiscal position is unsustainable with around 46% of government expenditure funded by borrowing adding to a debt to GDP ratio of some 240% against a backdrop of falling domestic savings rates. Around a quarter of government revenue goes on servicing interest on debt and that's despite extremely low interest rates.

Abe's Plan

The solution put forward by the new government of Prime Minister Shinzo Abe is a combination of aggressive quantitative easing and fiscal stimulus to spur growth and to end persistent deflation.

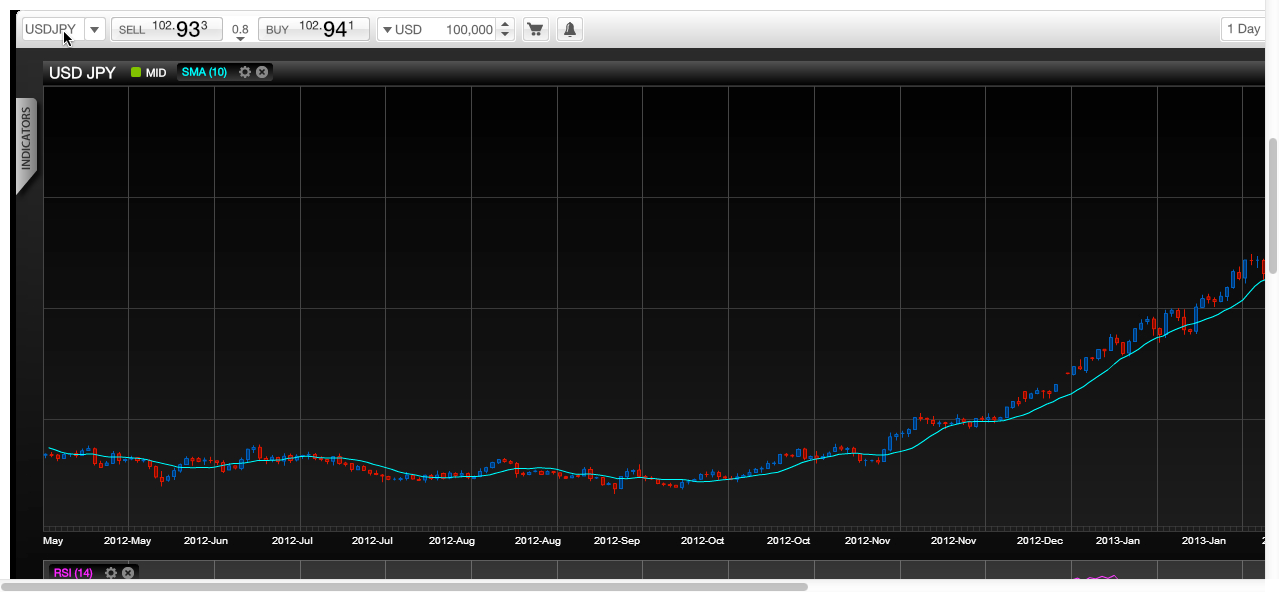

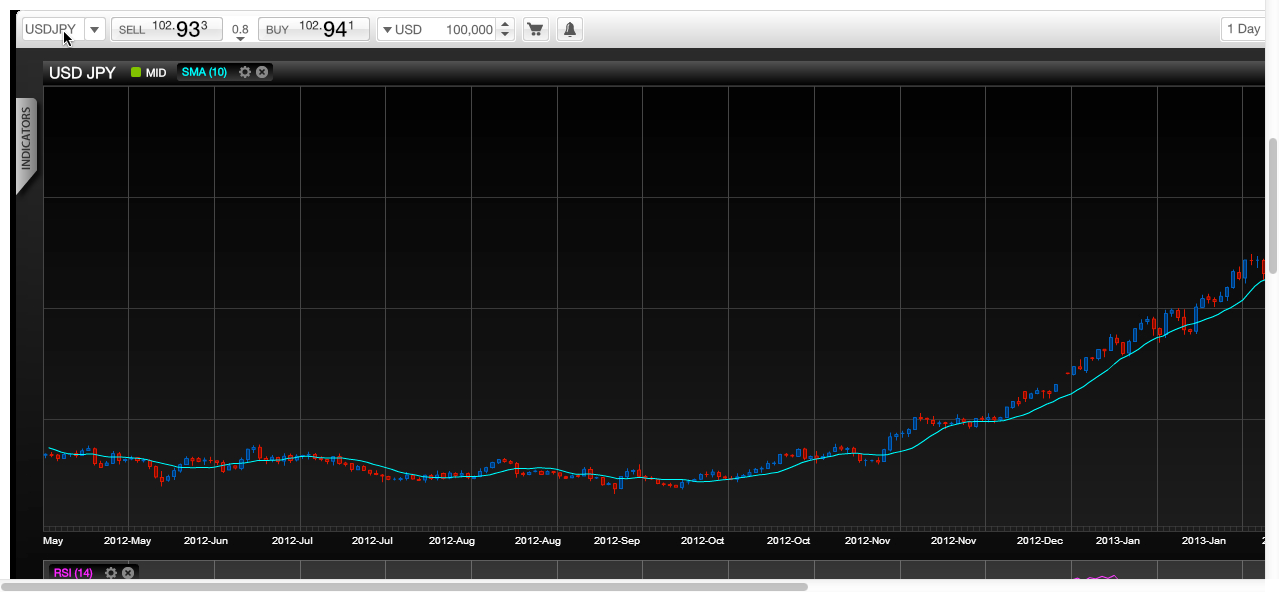

USD/JPY?" width="1279" height="592" />

USD/JPY?" width="1279" height="592" />

Seen That Before

But Japan has tried fiscal stimulus and quantitative easing before and it didn't reverse two lost decades of growth. Repeating the exercise on a grander scale is unlikely to create little more than a temporary up-tick in GDP growth, which is what is starting to happen.

Japan can't grow sustainably any more. The country's population isn't just ageing, but actually set to shrink dramatically and these two trends are well entrenched. Nearly a quarter of Japan's 128 million population is over the age of 65. By 2060 that is forecast to rise to 40% with the population declining to 87 million. Household consumption makes up around 60% of Japan's GDP and that key segment is shrinking and so therefore the economy will to.

Fast Forwarding The Crisis

A succession of weak governments looking to keep voters on side did not prepare the country for this outcome and an inevitable fiscal crisis looms as expenditure soars while tax revenues shrink.

A financial crisis is almost certainly on the cards for Japan and it is just a question of timing and unfortunately the government may have fast forwarded that date.

The risk of actually stimulating inflation is that it will erode consumer spending power. That's certainly been the experience of the UK where GBP has been pushed lower on a tidal wave of QE leading to imported inflation. Higher inflation could lead to higher interest rates, not withstanding the concerted bond buying efforts by the Bank of Japan. A rise in interest rates would add to the government's burdens.

Growing Debt

The other problem is that when it becomes apparent that these stimulus efforts haven't worked – that will probably take a few years – Japan's debt pile will be even bigger. What will follow is another round of credit downgrades from the main credit rating agencies, a crisis of confidence in Japan's financial position possibly leaving the Bank of Japan as the only buyer of JGBs.

The Japanese government will eventually default on its debts and many of its social obligations. It's just a case of whether it does it via inflation or by ceasing to pay interest and by not redeeming some of its paper. The long-term outlook for JPY is therefore extremely bearish.

Yet the fundamentals of Japan's economy are so dire that further falls in the currency are highly likely.

Long-Term Potential

The verbal intervention stabilised USD/JPY just above the psychologically key 100 level. However, it looks like 110 is still in the cross-hairs as the US Federal Reserve is stepping up the rhetoric on slowing and eventually ending its quantitative easing program. But over the longer term, there is potential for USD/JPY to go a lot lower as Japan faces a looming fiscal crisis.

Japan's fiscal position is unsustainable with around 46% of government expenditure funded by borrowing adding to a debt to GDP ratio of some 240% against a backdrop of falling domestic savings rates. Around a quarter of government revenue goes on servicing interest on debt and that's despite extremely low interest rates.

Abe's Plan

The solution put forward by the new government of Prime Minister Shinzo Abe is a combination of aggressive quantitative easing and fiscal stimulus to spur growth and to end persistent deflation.

USD/JPY?" width="1279" height="592" />

USD/JPY?" width="1279" height="592" />Seen That Before

But Japan has tried fiscal stimulus and quantitative easing before and it didn't reverse two lost decades of growth. Repeating the exercise on a grander scale is unlikely to create little more than a temporary up-tick in GDP growth, which is what is starting to happen.

Japan can't grow sustainably any more. The country's population isn't just ageing, but actually set to shrink dramatically and these two trends are well entrenched. Nearly a quarter of Japan's 128 million population is over the age of 65. By 2060 that is forecast to rise to 40% with the population declining to 87 million. Household consumption makes up around 60% of Japan's GDP and that key segment is shrinking and so therefore the economy will to.

Fast Forwarding The Crisis

A succession of weak governments looking to keep voters on side did not prepare the country for this outcome and an inevitable fiscal crisis looms as expenditure soars while tax revenues shrink.

A financial crisis is almost certainly on the cards for Japan and it is just a question of timing and unfortunately the government may have fast forwarded that date.

The risk of actually stimulating inflation is that it will erode consumer spending power. That's certainly been the experience of the UK where GBP has been pushed lower on a tidal wave of QE leading to imported inflation. Higher inflation could lead to higher interest rates, not withstanding the concerted bond buying efforts by the Bank of Japan. A rise in interest rates would add to the government's burdens.

Growing Debt

The other problem is that when it becomes apparent that these stimulus efforts haven't worked – that will probably take a few years – Japan's debt pile will be even bigger. What will follow is another round of credit downgrades from the main credit rating agencies, a crisis of confidence in Japan's financial position possibly leaving the Bank of Japan as the only buyer of JGBs.

The Japanese government will eventually default on its debts and many of its social obligations. It's just a case of whether it does it via inflation or by ceasing to pay interest and by not redeeming some of its paper. The long-term outlook for JPY is therefore extremely bearish.