There has been a lot of discussion in the past year about the strength of technology stocks and the return to “Nasdaq 5000.” Of course, such lofty heights also bring out the arguments over various valuation metrics and whether or not this is the next dot-com bubble.

Yes, for sure, “this time is different” from 2000 as many of the companies leading the technology charge actually do make money. However, while making money is important, it does not nullify the aspects of exuberant price movements and momentum chasing.

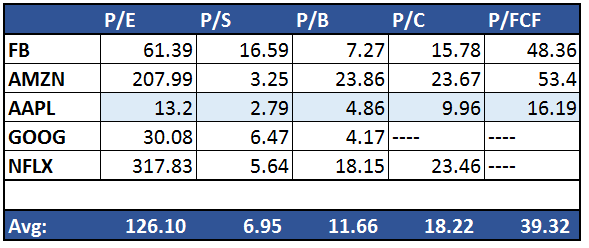

First, let’s take a look at the current valuations of the big-5 technology stocks: Alphabet, Apple, Netflix, Facebook and Amazon.

(Note: In order for a company to maintain a Price / Sales ratio of 2.0 it must grow sales at roughly 20% every year indefinitely to maintain that ratio with a respective price increase. In other words, it is very difficult for a company to consistently grow sales at that pace.)

With the exception of AAPL, there is little argument that technology overall is pushing the upper limits of valuations. But, for the sake of argument, let’s set aside the fundamental arguments for a moment and focus on the technical backdrop.

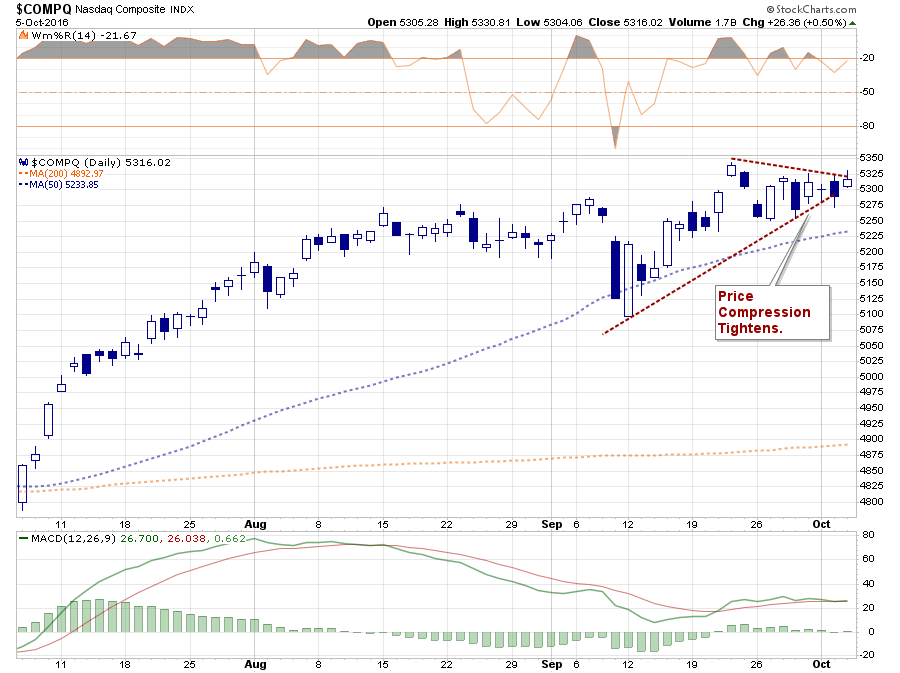

First, as shown below, the current price consolidation, as I discussed with respect to the S&P 500 on Tuesday, is quickly reaching a decision point. A break to the upside should see a rather sharp advance into the end of the year while a break to the downside would produce a relative decline.

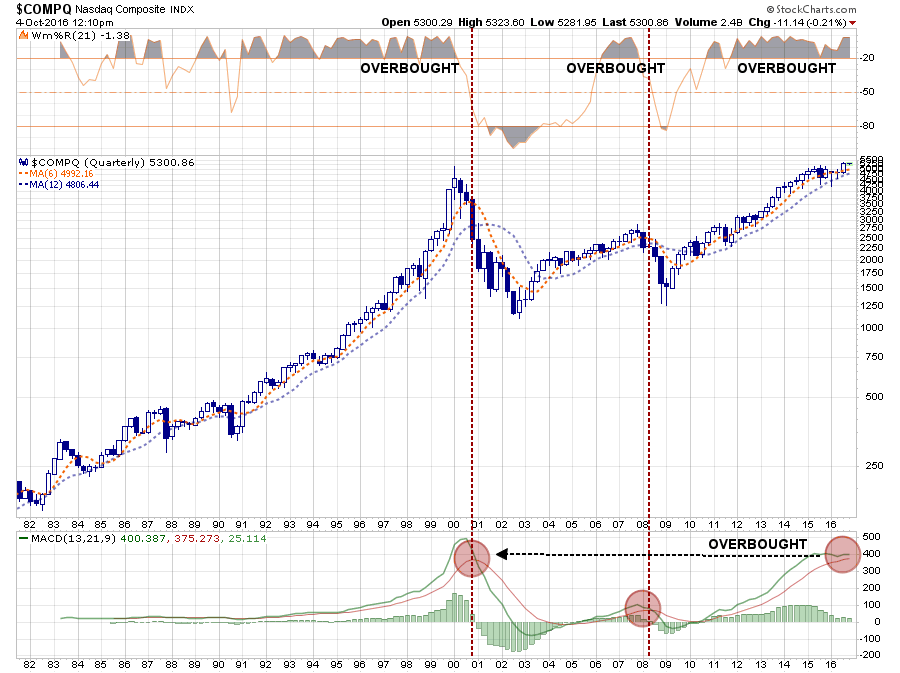

Secondly, it is the long-term monthly chart that is most interesting. While market participants are once again chasing technology stocks with reckless abandon because “this time is different”, the reality is that it probably is not that different.

Given the current extreme overbought conditions of the market on a monthly basis, combined with a potential “sell signal” from similarly high levels, the previous declines have been devastating.

While I am NOT suggesting that you should run out and sell all of your technology holdings tomorrow, the belief that somehow this time will be different than the last is likely misguided.

As always, when the eventual selling begins, it will be indiscriminate. Given the massive rise in all asset prices over the last eight years, the extensions well above historical norms and valuations that are hard to rationally justify, the unwinding will likely be just as brutal as the last.

Just some things I am thinking about.