Figuring out the direction of the oil markets is notoriously difficult, even for the most seasoned oil traders. The difficulty stems from the fact that there are so many variables at play, from country-specific consumption factors to macroeconomic considerations to political and geopolitical issues.

Complicating things further is the game theory between OPEC (Organization of Petroleum Exporting Countries) and the rest of the world. But at the end of the day, in the long run the price of oil will always be a function of oil supply and demand, which brings us to the first component of the case for higher oil prices.

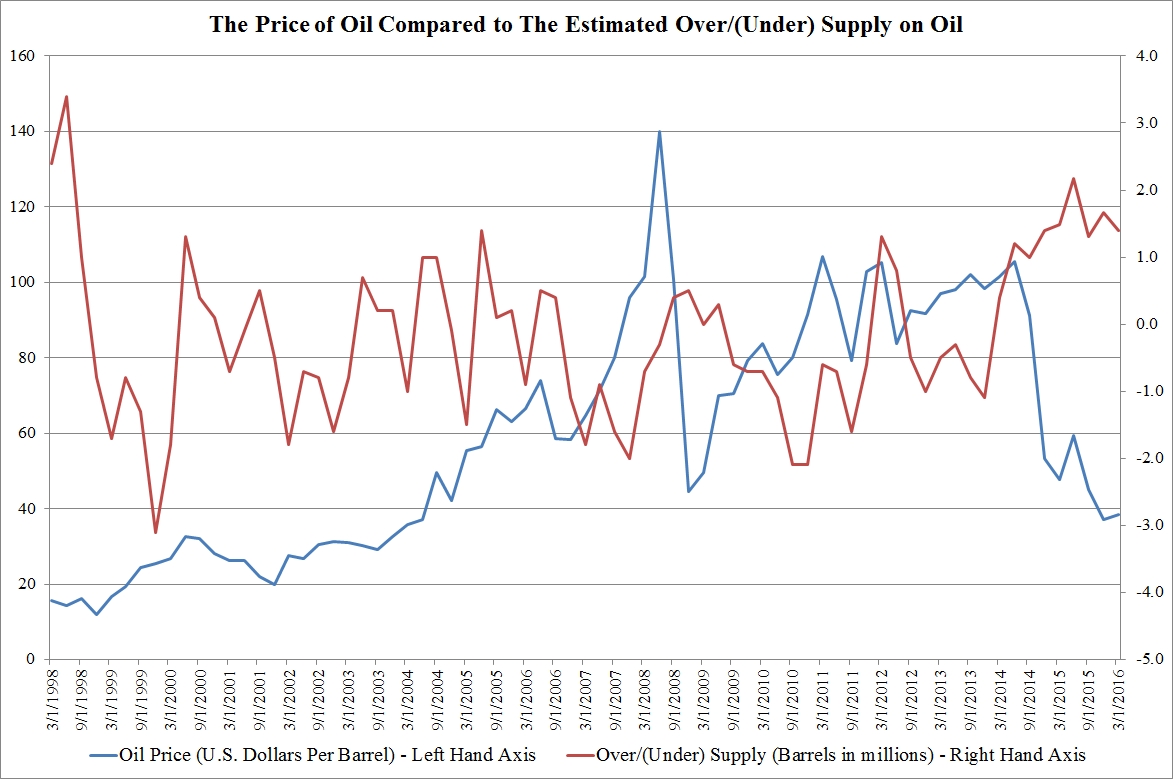

Oil prices closely follow excess oil supply

The above chart displays on the left hand axis and denoted in blue, the price of a barrel of oil over time in U.S. dollars. On the right hand axis, we have the total excess oil supply, which is the total demand for oil less the total supply, which is based on data shared monthly by the International Energy Agency.

As is pretty clear from the chart, the two lines generally move in opposite directions, which makes sense. The higher the red line goes, the more over supplied the oil market is and thus the lower the price of oil (blue line) should be.

The cratering in the price of oil which started in 2014 closely tracked the explosion in the excess supply of oil. Oil prices closely track the excess oil supply in the market. Now that we’ve established that, what’s the outlook for demand and supply?

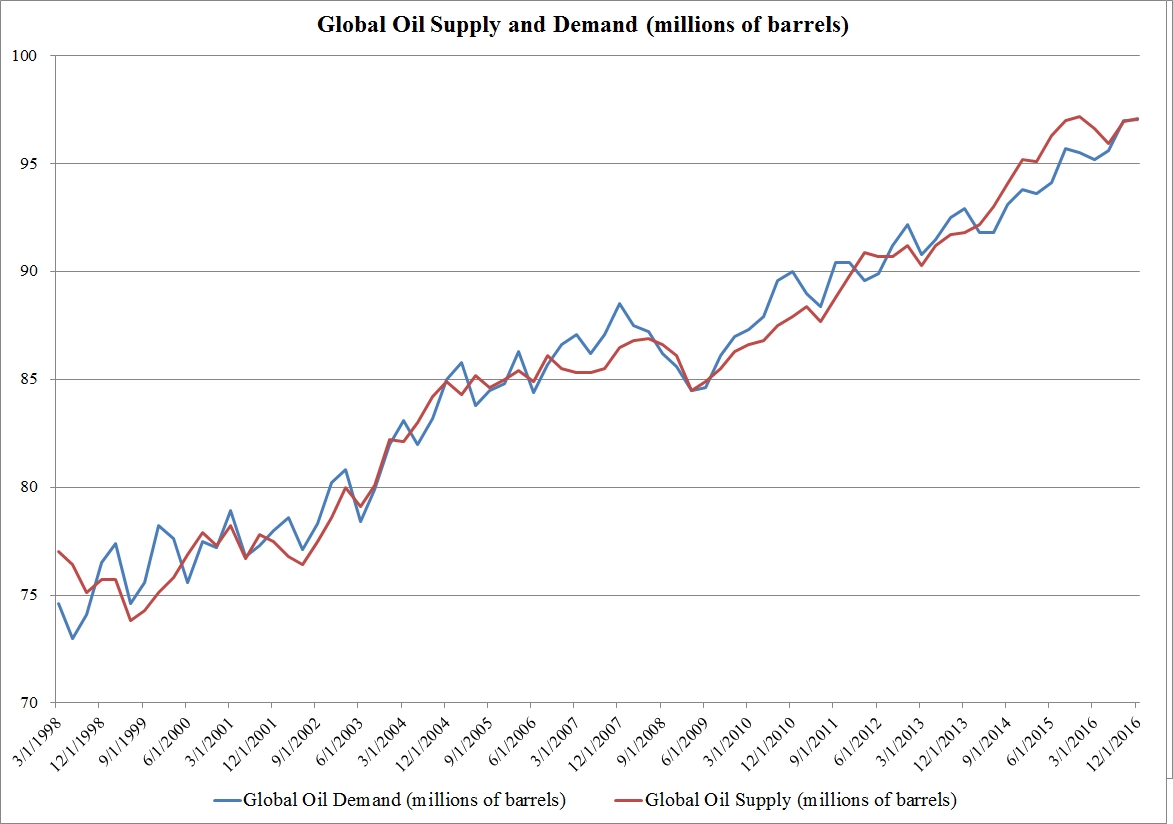

Current projections suggest a reduction in excess supply

The above chart displays the projections of the International Energy Agency for global oil demand and global oil supply through the end of 2016. The predictions suggests that by the end of the year, supply and demand will fall back into balance after being out of balance for over two years. This obviously would lead to higher oil prices from here.

The question is whether you can trust these estimates, which brings us to the last component.

An OPEC output freeze could be on the horizon

For those less familiar, OPEC is a cartel comprised of 14 countries that coordinate their levels of oil production. Collectively, OPEC represents about 1/3 of the global output of oil. OPEC can influence the price of oil by changing their levels of supply.

The recent moves in the price of oil have been on speculation that the next OPEC meeting in Algeria on September 26-28 could result in a freezing of output levels, thereby limiting supply growth. As the Wall Street Journal reported, Russia, which is also one of the largest suppliers of oil globally, plans to meet with OPEC in October.

Separately, several news outlets have reported that Iran will also be attending the September meetings. Iran has been increasing its oil output following a previous reduction in sanctions, and simply joining the discussion could be a sign that they are ready to take coordinated action and limit their output. An OPEC output freeze would significant impact supply growth and likely lead to higher oil prices.