The market has had a bumpy ride so far in 2014, with February turning in the best performance, rising over 4%, after January’s -3.6% pullback. Cap this off with a less than 1% gain for the S&P 500 in March, and you’ve got an unimpressive 1.3% gain for the first quarter:

With this kind of up and down ride, you’d want to find some dividend stocks which offer defense, in addition to income. With the pullback in many biotech stocks, the Healthcare sector no longer leads,(although it’s still up nearly 5%), but has given way to the Utilities sector, which is up over 10% year-to-date.

Here’s a look at the chart for the Utilities ETF, SPDR Select Sector - Utilities (XLU):

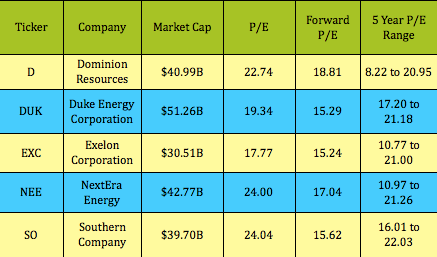

We looked further into XLU’s top holdings, and came up with these top 5 utility stocks, all of which are large cap dividend paying stocks. Another common feature is that they all have somewhat lower forward P/E’s, meaning that their earnings should improve in their next fiscal year. Duke Energy Corporation (NYSE:DUK) and Southern Company (NYSE:SO) have the lowest P/E’s, relative to their 5-year P/E ranges:

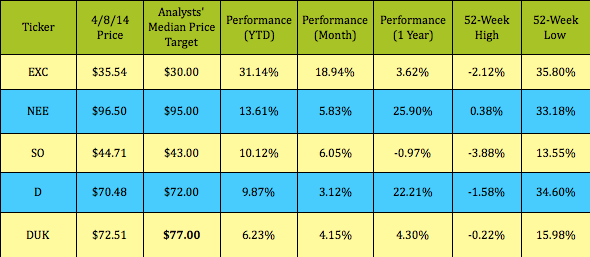

This is how they’ve performed year-to-date, and over the past month, and over the past 52 weeks. Nuclear-based Exelon Corporation (NYSE:EXC) has outperformed the pack year-to-date and over the past month, but is still up only 3.62% over the past year. Contrasting with that performance is more steady NextEra Energy Inc. (NYSE:NEE), which has made over half of its 1-year 25.90% gains, by rising 13.61% in 2014:

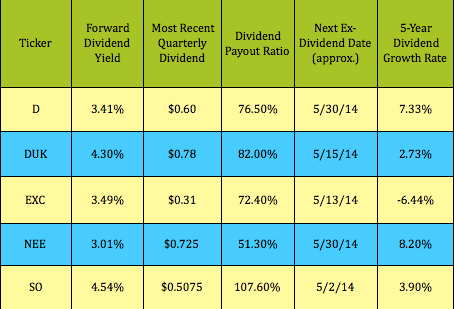

Dividends: With their 4%-plus dividend yields, Southern CO. and DUK, are both listed in the Utilities section of our High Dividend Stocks By Sector Tables. Although their yields are lower, Dominion Resources Inc. (NYSE:D) and NextEra Energy Inc. (NYSE:NEE) have the best 5-year dividend growth rates:

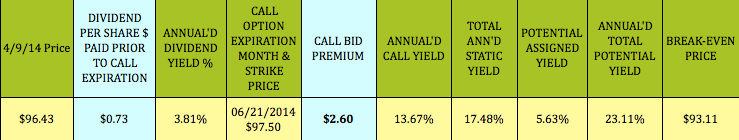

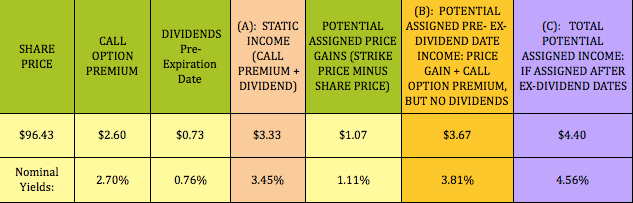

Options: If you want to add more downside protection to these stocks, selling covered calls offers you more immediate income, and a lower breakeven. NEE has the most attractive call options of the group. This June $97.50 call pays $2.60, over 3 times NEE’s next quarterly dividend. (Our free Covered Calls Table has more info on this and over 30 other trades.)

Here are the major income scenarios for this trade. The $97.50 strike price is $1.07 above NEE’s price/share, which amply rewards you if your shares get assigned prior to the ex-dividend date for the $.73 dividend:

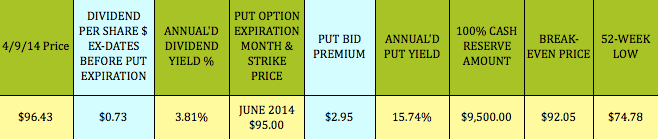

Selling cash secured put options is another way to profit from these defensive stocks. In fact, if you sell puts below the stock’s share price, you’ll get an even lower breakeven, and improve upon their defensive nature. This is another June trade, but this put has a $95.00 strike price, and a $92.05 breakeven, which is 4.5% below NEE’s price/share. You won’t receive any dividends, but, just like selling calls, you’ll be paid your option premium within 3 days of the trade, often sooner. You can find more info about this and over 30 other trades in our Cash Secured Puts Table.

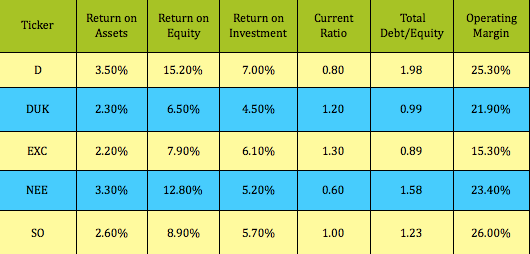

Financials: It’s a mixed bag, Dominion and NextEra have an edge over the rest of the group for some of these metrics, but they do carry more debt:

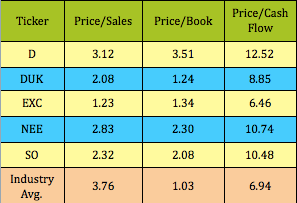

Valuations: Excelon has the lowest valuations for these metrics:

Disclosure: Author was long shares of Southern, SO, at the time of this writing.

Disclaimer: This article was written for informational purposes only. Author not responsible for any errors, omissions, or actions taken by third parties as a result of reading this article.