Stock prices didn’t do much yesterday as the S&P 500 index closed flat vs. its Tuesday’s closing price. However, the market managed to retrace losses after a lower open, resulting in a relatively positive outcome for the day.

On Friday, April 19, the index hit a new medium-term low of 4,953.56. This marked its lowest level since late February, with a decline of over 311 points or 5.9% from the record high of 5,264.85 on February 28. However, stock prices rebounded as Middle East tensions eased, shifting investor focus to quarterly earnings releases.

This morning, the S&P 500 futures contract is trading 0.1% lower, indicating a neutral open for the index. The market may see some more short-term consolidation following recent gains.

Last Wednesday, in my Stock Price Forecast for May, I noted

“The question arises: Is this merely a correction or the beginning of a more significant downtrend? It's difficult to determine at this point. Last month, hopes for a Fed pivot were dashed as new data reignited inflation fears, and geopolitical tensions added further uncertainty. However, as of today, it appears the market is only correcting a rally that began in November.”

The investor sentiment has clearly improved, as indicated by yesterday’s AAII Investor Sentiment Survey, which showed that 40.8% of individual investors are bullish, while only 23.8% of them are bearish, down from 32.5% last week. The AAII sentiment is a contrary indicator in the sense that highly bullish readings may suggest excessive complacency and a lack of fear in the market. Conversely, bearish readings are favorable for market upturns.

The S&P 500 approached a potential resistance level marked by its trading range from March and April, as we can see on the daily chart.

Nasdaq 100 Remains Above 18,000 Level

On Monday, the technology-focused Nasdaq 100 index accelerated higher, but on Tuesday and yesterday, it was trading sideways after reaching a local high of around 18,150 on Tuesday. The market is likely to fluctuate or retrace some of its recent advances; for now, it looks like a pause within an uptrend.

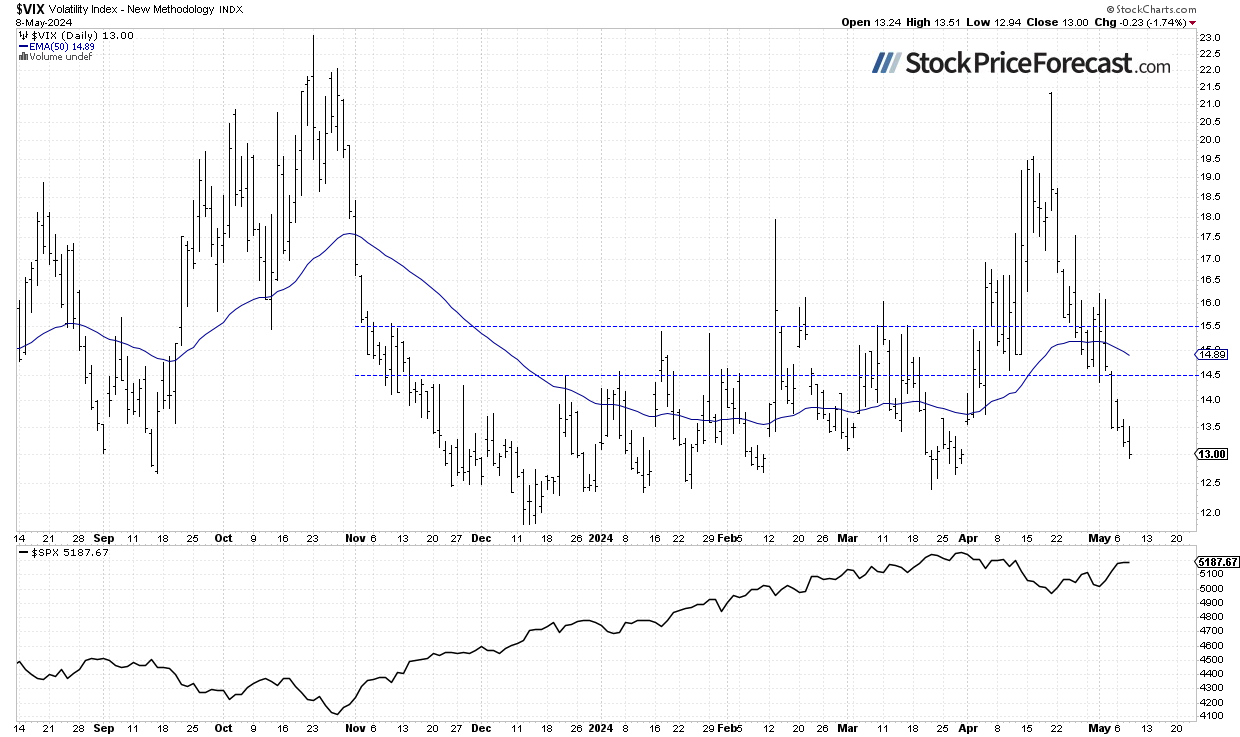

VIX – Even Lower, at 13

The VIX index, also known as the fear gauge, is derived from option prices. In late March, it was trading around the 13 level. However, market volatility has led to an increase in the VIX, and on previous Friday, it reached a high of 21.4 - the highest since late October, signaling fear in the market. Recently it went lower again, and yesterday, it was as low as 12.94, showing a growing complacency in the market.

Historically, a dropping VIX indicates less fear in the market, and rising VIX accompanies stock market downturns. However, the lower the VIX, the higher the probability of the market’s downward reversal.

Futures Contract Fluctuating Along 5,200

Let’s take a look at the hourly chart of the S&P 500 futures contract. This morning, it is trading very close to the 5,200 level, extending a short-term consolidation. It looks like a pause within an uptrend. The nearest resistance level remains at 5,220, and the support level is at 5,160, among others.

Conclusion

The S&P 500 is likely to extend a short-term consolidation this morning, as indicated by the futures contract trading near the 5,200 level. On Tuesday, I wrote

“the market may pause or even retrace some gains. With most of the earnings season over (there is only one very important release left - NVDA on May 22) and the FOMC Rate Decision release behind us, expect a period of uncertainty.”

In the first half of April, the S&P 500 was continuing a correction from the March 28 record high of 5,264.85 on Middle East tensions, strong US dollar. Recently, it sold off below the important 5,000 level, and last week, it kept retracing the declines as earnings and economic data lifted the sentiment again.

In my Stock Price Forecast for May, I noted

“Where will the market go in May? There's a popular saying: 'Sell in May and go away,' but statistics don't consistently support such clear seasonal patterns or cycles. The safe bet for May is likely sideways trading, with investors digesting recent data suggesting that inflation may not be transitory, and the Fed could maintain its relatively tight monetary policy. However, economic data isn't entirely negative, and strong earnings from companies may continue to fuel the bull market.”

For now, my short-term outlook remains neutral.

Here’s the breakdown:

- The S&P 500 is expected to continue its short-term consolidation this morning, likely just a pause within an uptrend.

- On Friday, April 19, stock prices were the lowest since February, indicating a correction of the medium-term advance. Recently, the S&P 500 retraced almost all of its mid-April sell-off.

In my opinion, the short-term outlook is neutral.